How to implement a new accounting system in 8 steps: Your migration checklist and guide

Switching accounting software can make a huge difference to the way your business works. Up-to-date systems can speed up your finance processes and increase efficiency. A new accounting system can also deliver better reporting, more timely information and drive value through insight.

If you’re ready to bring your finance function up to date, how do you kick off the accounting system migration? And what things do you need to do to prepare for a smooth transition?

When rolling out new accounting software, it’s important to take the following steps to ensure you and your team are fully prepared for the move, have complete buy-in from the business, and all the right tools and expertise to hand to support a seamless transition.

As you follow the 8 tips below, you can use the accounting system implementation checklist to tick off as you go along.

1. Build a strong business case for implementing a new accounting system

Before you even start with your project you are probably going to have to make the case for spending time and money implementing a new accounting system.

Your company may have a proforma that you need to complete, or in smaller businesses, you may just need to make your case to the board or the CEO.

Hints for what to include in your business case for a new accounting system:

- You can do more with less - more efficient accounting software means that you can either reduce your headcount or won’t need to recruit as quickly when the business grows

- You can give your customers (internal and external) better service - better accounting software means better information and better data analysis capabilities

- You can provide better insight into the business - insight rather than numbers. You’ll have more time to become a finance partner to the business

2. Be prepared to communicate updates throughout the accounting system implementation

The key to a successful project and to having new accounting software positively adopted is to have great communication.

Rumours can be terrible things and if someone gets wind of a change that is happening then you may find that all sorts of different stories do the rounds.

Start by identifying your key stakeholders which could include; finance users, wider business users, suppliers, customers, directors and senior managers.

All the way through the aim is to make sure your stakeholders fully understand what is going on and how it will affect them.

Make sure that you have a good communications plan with regular updates and pay attention to your important stakeholders. Also, have a way that people can provide feedback.

3. Chunk up the accounting system implementation project

Don’t be tempted to try and do everything all at the same time because that is a recipe for disaster.

Instead, break your project up into manageable chunks and deal with each in turn, that way you and your team won’t get dispirited before you even start.

Split your project down into large blocks to start with, then fill in smaller blocks within the larger ones. Consider the wider business picture. What things do you need to put into the ‘quick wins’ box and what things can be done later? Make sure also that you talk to the business about the vision for the future.

It can be useful to use a spreadsheet to manage your chunking up or commercial planning tools like odoo can help.

4. Do a data cleanse before the accounting system implementation

Clean data is good data so make sure that you are only importing data that is accurate. This means that you may need to take time to go through things like your balance sheet accounts and get rid of odd balances that have been there since the dawn of time.

A good example here would be to only bring across customers who have bought in say the last two years rather than every record of every customer who has ever bought from you!

So before you carry out any data migration you need to do a full data cleanse. Again, remember to chunk it up and start with something easy like your supplier list.

5. Implement what you need, not what you already have

Don’t be tempted to try and simply replicate how your current systems and processes work because you may just be trying to build in inefficiency.

Instead, have a fundamental review and ask yourself why you are doing things in a particular way. If it doesn’t make sense then bin it.

Discuss your finance challenges with your potential software suppliers, and see how their solution can help empower your finance team.

6. Test everything

With the best will in the world, no software developer can possibly hope to get a new accounting system that will work for every company in every sector right out of the box.

So make sure you set aside time for proper testing. This is also helpful because it gives you a chance to use the system, get used to it and see if there is any functionality that can help you do things better.

Your testing may be split down into beta and user acceptance testing (UAT) phases.

Beta testing will be done by the project team and will check basic functionality following configuration.

UAT testing is the gold standard for your organisation. This is designed to make sure that ordinary users can work the system, find the functionality that they need, and that the system is delivering the results that they expect. This is also where you are checking that data is imported correctly and workflows etc., act as you expect.

7. Train your people on the new accounting system

Setting up a new accounting system would not be possible without training to help your teams get up to speed on the software.

A good training programme will help people to understand how to do their roles, find features in the system that they may need and introduce new functionality that their old system may not have had.

8. Continue to modernise and improve your accounting systems

Once your system is in place and you are happy with it then it is tempting to let sleeping dogs lie but this is a big mistake.

There is so much more than modern accounting systems can do that you really need to make sure you push your new software to add even more value.

Accounting and auditing with artificial intelligence-Odoo 17

Is your accounting team still spending hours on tedious data entry tasks? Are you wondering how financial professionals can predict cash flows, detect fraud, and ensure regulatory compliance in real-time? In a world where numbers rule, the accounting and auditing industry is experiencing an innovative transformation powered by Artificial Intelligence (AI).

An accounting system is how businesses organize and track their financial information. It can be used to create reports about that data. A sound accounting system can save you hours of administration nightmares.

Why your small business needs an accounting system

Every business benefits from establishing an accounting system. Having an accurate and full record of financial transactions for your business will help you to understand how your business is performing.

Your accounting system keeps your business financial transactions organized. This will allow you to see the financial health of your small business more easily and then do strategic planning for the future.

Being able to generate financial statements is important for communication with various stakeholders. When applying for small business loans or obtaining lines of credit, you often need these documents to show your financial status.

If your business is ever audited by the IRS, having a complete and systemic accounting system is helpful to generate the records you need.

What is a general ledger?

In a double-entry accounting system, the general ledger is the primary record in a business’s accounting system, and it is helpful for small businesses to establish early on in the life of a business. Although your ledger may not be a traditional paper book ledger, the operations are the same, whether electronic or paper-based.

A general ledger has four elements:

- Chart of accounts: This is a list of all the accounts you use to record your financial transactions. You use it to organize your transactions and provide an overview of your business’s operations. It is made up of five main account types and various accounts within those types. The specific accounts will depend on the type of business.

- Financial transactions: These are exchanges between a buyer and seller related to the transfer of goods or services. This can also include lenders who have loaned your business money.

- Accounting balances: This is a running total after transactions are recorded.

- Accounting periods: This is the time frame used for your business financial reporting. These can vary but are often a year, quarterly or monthly.

Features of a chart of accounts

As the map of your accounting system, your chart of accounts can be tailored to the needs of your business. It is best to speak with an accounting professional to ensure you establish a system that matches your business needs.

5 primary account types

The chart of accounts is divided into five account types. Back when books were kept on paper, each of these types generally had its own ledger and this was where all financial transactions were recorded using a double-entry system. While most people now use financial software or a spreadsheet instead of a physical, handwritten ledger, the organization of the financial data can be done in a similar way:

- Asset accounts: This is where you record items that your business owns. For example, property, plants, and vehicles.

- Liability accounts: This is where the debts of your business are recorded. For example, loans, accounts payable and taxes owed.

- Revenue accounts: This is where you record any income earned by your business. For example, sales and interest from investments.

- Equity accounts: This is where you keep track of investments into the business, dividends or distributions from the business, and cumulative earnings or losses.

- Expense accounts: This is where you record costs for your business to operate. For example, utilities, cost of goods sold and salaries.

General ledger sub-accounts

Back when people kept their books with pen and paper, they would have a main account with separate subledgers, such as accounts receivable or inventory. This allowed financial reporting to be broken down further. These days, you can do a similar system when doing computerized accounting. You can tailor these accounts to your needs. If set up well, they can provide you with an overview of your business so that you can identify every area of your business that earns or spends money.

Some common accounts include:

· Asset accounts: petty cash, checking, savings, accounts receivable, and inventory.

· Liability accounts: sales tax, accounts payable, payroll tax liabilities.

· Revenue accounts: sales of goods, services revenue.

· Equity accounts: owner’s equity, retained earnings, stock.

· Expense accounts: cost-of-goods-sold, rent, insurance, supplies, equipment.

Details included on a general ledger

Although your accountant or accounting software keeps your books, it is important to know what information is in your general ledger. This can help you better understand your financial reports and the information contained in them. If you are starting out and establishing your own general ledger, create a template to standardize your ledger and accounting system.

· Account name: The name of the account.

· Account number: Not all accounting systems use account numbers. But when they are used, each account is assigned a unique number to assist with locating and identifying accounts. .

· Date: The date allows you to find transactions and track them more easily and is required for tax and most reporting purposes.

· Opening balance: The starting balance for the account. Some accounts start at $0, and some will carry over from a previous financial period.

· Customer/vendor: Name of the customer or vendor for the transaction.

· Description: This column provides space for the details about each transaction.

· Debit and credit columns: Debits will increase your assets and expenses and decrease your liabilities, revenue and equity accounts. Credits will decrease your assets and business expenses and increase your liabilities, revenue and equity accounts.

· Closing balance: The closing balance for an account at the end of the financial period.

Steps for developing your accounting system

Even if you use an accountant or accounting software to set up your system, you still have important decisions to make. You should be involved in the decision-making process, as it is essential to understand how your accounting system works, as this is where all of your financial documents will come from to aid your future financial planning and discussions with key stakeholders.

1. Create a bank account

Setting up a business bank account is important for small businesses. You need clear separation from your personal bank account. Having a business bank account will help you organize your finances and more easily identify your transactions, as well as make filing your taxes easier and do cash forecasting. It can also give you access to a credit card and a savings account.

2. Choose your accounting method

You will need to choose which accounting method will work best for your business. There are two main options. Discuss this with a professional to decide which one to choose for you:

· Cash accounting: This system is when you record transactions once the money has been received or paid. It doesn’t focus on the dates of invoices or when goods are shipped.

· Accrual accounting: Financial transactions are recorded when they occur, regardless if payment has been completed.

Some businesses use a combination of both of these methods.

3. Choose your tracking method

You will need to choose an appropriate system to track your business transactions. There are three ways to do this.

· Accounting software such as odoo.

· Use a CPA or accountant to handle it for you.

· Use an Excel template. Some small businesses may start off doing this until they are established.

4. Establish your chart of accounts

When you establish your chart of accounts, you will need to set up the accounts for your general ledger. This system is based on double-entry bookkeeping, so every transaction has a debit and credit entry.

5. Organize your records

You will need to decide how you want to keep your documents, such as receipts for transactions. Decide if you will keep soft copies or hard copies of them and then how you will organize them. However you decide to do your recordkeeping, you should be consistent, organize by type of transaction and in chronological order.

Become an Odoo Consultant Odoo Sales Machine [V17 / 2024]

Perfect Odoo Consultant Business Plan is a complete guide that explains the process of business goals.

The topic of artificial intelligence (AI) is everywhere these days and it will forever change how businesses operate. This is especially true for the sales world. Selling in today’s dynamic landscape is difficult — it requires a wealth of knowledge, skills, agility, and perseverance.

Advantages of using accounting software

Using small business accounting software can make your bookkeeping much easier and a great time-saver for busy business owners.

You can generate your financial statements, such as a balance sheet or income statement at the touch of a button. These are key for meetings with stakeholders, such as lenders and investors. Your statements will look professional.

Your accounting software can be set to sync your financial data from your bank and keep it up-to-date. Automating everything and being cloud-based means you can work from anywhere and have access to your important business information. Most accounting software companies also have an app for mobile access as well.

If you have employees, you may be able to add payroll apps or modules that will simplify your payroll and automatically deal with paying employees, payroll taxes, and tax obligations.

Accurate records are essential for tracking your business’s financial transactions. It will streamline your income tax filing during tax season because all the information you need is easily available, including details about tax deductions.

When small business owners do their financial planning and forecasting, they will have access to summary reports to inform them of trends to give a clear picture of the business finances and where money is coming from and where it is being spent. This makes it easier to get a clear overall picture of your business’s performance.

Account Ledger

An account or record that can handle bookkeeping entries for balance sheet and income statement transactions, like opening and closing balance in debit or credit, is known as a ledger. This sort of book or digital record includes detailed transaction information and bookkeeping entries, such as bank or cash transactions, stock value, customer billing, vendor invoice records, salary expenses, and many more. The ledgers provide all the necessary data needed to create financial statements.

Every transaction has a reference number that will help them understand the justifications and steps involved in carrying out that particular transaction.

The following are the many account ledgers available in Odoo 16:

1. Income account

2. Expense account

3. Stock input account

4. Stock output account

5. Stock valuation account

6. Price difference account

7. Account Receivable

8. Account Payable

9. Fixed Asset Account

10. Depreciation Account

11. Revenue Account

12. Deferred revenue account

13. Expense account

14. Deferred Expense Account

15. Bank Suspense Account

16. Outstanding Receipts Account

17. Outstanding Payments Account

18. Internal Transfer Accounts

19. Cash Discount Loss Account

20. Cash Discount Gain Account

21. Foreign Exchange Gain Account

22. Foreign Exchange Loss Account

Journals

Journals are key and essential records containing important data and information about a business's transactions according to the date on which the transaction was completed. Account Names, Date, Amount, and even whether the transaction is recorded as a debit or credit are all shown in great detail.

You may see pre-configured journals that are appropriate for practically all sectors using Odoo16 Accounting. Additionally, if necessary, the platform lets you define new journals. Five different types of journals are available on the Odoo16 platform to display similar types of transactions in a single journal. The five journal types in Odoo16 can be listed as follows when we list them.

● Sales

● Purchase

● Bank

● Cash

● Miscellaneous.

1. Sales Journal

Every single sales-related transaction is documented in the sales journal type. You can set up various sales journals according to your needs using the Odoo platform. You can record transaction details for sales from wholesale and retail separately, for instance, if that is what is necessary. The customer invoices will be recorded here.

2. Purchase Journal

To compile all transactions related to purchases, use the Purchase journal record. Different buy journals can be made to post received vendor bills, just like with sales journals.

3. Bank Journal

The Bank Journal keeps detailed records of every bank transaction. You may successfully track customer bank payments, vendor bank payments, and any other transaction recorded by your associated bank account by posting your bank statements.

4. Cash Journal

Now, we can document all cash transactions in a cash journal. This type of journal can record daily cash transactions and petty cash transactions, and it can also keep track of information about cash payments from customers.

5. Miscellaneous Journal

The final form of the journal is a Miscellaneous journal, which is excellent for recording transactions that are not covered by the four journals we previously discussed (Sales, Purchase, Bank, and Cash). The journal type can take into account many other entries that don't fit into the other four journal types, such as inventory value, inventory changes, exchange difference, opening balance, and many others. Even for a salary or all of your corrections, posting a journal type entry is quite convenient. There are no advanced settings available in the Miscellaneous journals.

These five journal kinds can each have a sequence number set up on the Odoo17 platform for convenience

Journals

Journals are key and essential records containing important data and information about a business's transactions according to the date on which the transaction was completed. Account Names, Date, Amount, and even whether the transaction is recorded as a debit or credit are all shown in great detail.

You may see pre-configured journals that are appropriate for practically all sectors using Odoo16 Accounting. Additionally, if necessary, the platform lets you define new journals. Five different types of journals are available on the Odoo16 platform to display similar types of transactions in a single journal. The five journal types in Odoo16 can be listed as follows when we list them.

● Sales

● Purchase

● Bank

● Cash

● Miscellaneous.

1. Sales Journal

Every single sales-related transaction is documented in the sales journal type. You can set up various sales journals according to your needs using the Odoo platform. You can record transaction details for sales from wholesale and retail separately, for instance, if that is what is necessary. The customer invoices will be recorded here.

2. Purchase Journal

To compile all transactions related to purchases, use the Purchase journal record. Different buy journals can be made to post received vendor bills, just like with sales journals.

3. Bank Journal

The Bank Journal keeps detailed records of every bank transaction. You may successfully track customer bank payments, vendor bank payments, and any other transaction recorded by your associated bank account by posting your bank statements.

4. Cash Journal

Now, we can document all cash transactions in a cash journal. This type of journal can record daily cash transactions and petty cash transactions, and it can also keep track of information about cash payments from customers.

5. Miscellaneous Journal

The final form of the journal is a Miscellaneous journal, which is excellent for recording transactions that are not covered by the four journals we previously discussed (Sales, Purchase, Bank, and Cash). The journal type can take into account many other entries that don't fit into the other four journal types, such as inventory value, inventory changes, exchange difference, opening balance, and many others. Even for a salary or all of your corrections, posting a journal type entry is quite convenient. There are no advanced settings available in the Miscellaneous journals.

These five journal kinds can each have a sequence number set up on the Odoo17 platform for convenience.

Accounting and auditing with artificial intelligence-Odoo 17

Is your accounting team still spending hours on tedious data entry tasks? Are you wondering how financial professionals can predict cash flows, detect fraud, and ensure regulatory compliance in real-time? In a world where numbers rule, the accounting and auditing industry is experiencing an innovative transformation powered by Artificial Intelligence (AI).

Types of Accounting in Odoo 17

Odoo 17 primarily concentrates on three kinds of accounting practices. Accounting can be divided into two categories: "Anglo-Saxon accounting" and "Continental Accounting."

Odoo launched Storno Accounting, which employs negative credit/debit values for reverse entries.

Continental Accounting

The Odoo system and continental accounting, which is the most widely practiced accounting, and Odoo17 strongly support these ideas. This accounting practice is available both in the Enterprise and Community edition of Odoo 17. When making a purchase, this accounting will have an influence on the expense account. As soon as a product is found in stock, the expense of that item is therefore taken into account. Continental accounting is used by the Odoo17 platform by default. The stock can also be manually or automatically validated. The stock is unaffected if it is done manually, but the information must be manually posted at the end of each month or year.

Select the "Automated" inventory valuation technique if the stock valuations must be recorded as the stock is taken in and taken out.

Numerous beneficial effects of Continental accounting's long history can be seen in your company's accounting. Consequently, we may examine how various transactions or procedures in continental accounting are impacted by the ledgers.

Transactions in Continental Accounting

The financial activity that has a direct impact on a company's financial situation and financial statements is known as an accounting transaction. Basically, we may include any kind of money exchange under this category. These transactions are handled differently by different organizations or companies. So that we can examine some of the fundamental accounting transactions.

1. Purchase Process

The financial transactions that are necessary for the business to buy the goods or services needed to generate sales are referred to as purchases. All transactions related to purchases are referred to as "purchase journals" on the Odoo17 platform. The purchase voucher contains a record of all these transactions related to purchases. It is the transaction handled by the seller of a good or service bought, and it could even be a good or service bought, as well as any other asset bought. An entire series of transactions, including purchase order, material receipt, rejection out, purchase invoice, and purchase return, are included in a purchase.

Purchase Order: An official document produced by a buyer committing to pay the seller for the sale of a specific good or service that will be provided in the future is known as a purchase order. For the required sum, a buy order can be made for any products or services from a vendor. The beginning of a purchase order does not immediately affect the ledgers for either stock or accounts.

Material Receipt: The next operation is called Material receipt, and it deals with details like product quantities and lot numbers in regard to the goods that are intended for the employees' on-site job. The inventory item must be received and added to the inventory if the supplier supplies the product. The inventory will be updated with the quantities. Therefore, only the stock accounts are impacted by Material Receipt.

The "Stock Valuation Account" and "Stock Input Account" in the Odoo17 platform are impacted when the product is received.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock valuation account | Asset | Increasing | Debit |

| Stock Input account | Liability | Increasing | Credit |

Rejection Out (Purchase Return): The organization frequently returns the products it has purchased even before making the payment. It might be for any cause. The product will be rejected if it becomes damaged. Similar to how there will be several factors involved in the rejection. The stock will consequently reverse. In this instance, only the stock will be impacted; the accounts won't change. The stock value will likewise drop as a result.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock valuation account | Asset | Decreasing | Credit |

| Stock Input account | Liability | Decreasing | Debit |

Purchase Bill Creation: The payable account and the expense account will be impacted if you create a bill for the purchase order. Due to the fact that the payable account's nature is "Liability," it will be credited. On the other hand, because the expense account is an "expense" account, it is debited.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Account Payable | Liability | Increasing | Credit |

| Expense Account | Expense | Increasing | Debit |

Registering Payment: The payable account and the outstanding receipt account are both impacted when you generate a payment. The liability will be reduced if the payment has been made. Consequently, a debit will be made from the payable account. In the bank and cash journals of Odoo 17, a temporary account called outstanding payments is used to store unreconciled inputs. The kind of outstanding payment is "Asset." Therefore, the outstanding payment account is credited as the assets decrease.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Accounts payable | Liability | Decreasing | Debit |

| Outstanding Payments | Liability | Decreasing | Credit |

Reconciling: The sum will be transferred to the bank account after it is compared or reconciled to the bank statement. As a result, the account for outstanding payments is debited, and the bank is given credit.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Outstanding Payments | Liability | Decreasing | Debit |

| Bank Account | Asset | Decreasing | Credit |

The term "purchase return" refers to when a customer returns a product to a seller for a refund, store credit, or any other reason based on the seller's duty. The occasional return of a purchase will also happen. For instance, if the buyer is dissatisfied with the product, if they purchased it in error, if the merchant sent them the incorrect product, or even if they purchased more products than they actually needed. When a purchase is returned, the stock is reduced, and the paid amount needs to be refunded because it occurs after the invoice. Therefore, both the stock accounts and the accounts will be impacted by the purchase return. Reverse journal entries that are appropriate should be created to make up for this.

The table below lists each purchase transaction's journal entries in detail.

| Operation | Accounts Affected | Debit | Credit |

|---|---|---|---|

| Purchase order | No Accounts Affected | ||

| Material Receipt | Stock Valuation Account | XX | |

| Stock Interim Account | XX | ||

| Purchase Bill | Expense Account | XX | |

| Account Payable | XX | ||

| Registering Payment | Account Payable | XX | |

| Outstanding Payments | XX | ||

| Reconciling | Outstanding Payments | XX | |

| Bank Account | XX |

2. Sales Process

Sales transactions include any sale, contract, or other transfers that include the disposal of goods, services, or other assets, both tangible and intangible. Here, we may talk about how the Odoo17 platform can help you handle sales transactions, the operations that go along with them, and how that affects the journal entries. Operations like Sales Orders, Delivery Notes, Rejection IN (Sales Return), Sales Invoices, and Invoice payment are all part of a sales transaction. We might start by examining the following operations of sales transactions.

Sales Order: A sale order is essentially a document created by the seller to gather details regarding the goods or services the customer has requested. Every detail is included in the sales order, including information on the product or service, the price, the quantity, the terms and conditions, and many other things. The selling order is, therefore, solely intended for the creation of orders since it has no effect on inventories or accounts.

Delivery Note: An element connected to the shipment or delivery of goods is a delivery note. This will include the specifics of the goods, how many there are, and how much they cost. Dispatch Note and Goods Received Note are other names for the Delivery Note. The stock value reduces as a confirmed order is fulfilled from the inventory and delivered to the customer. Two accounts, the "Stock Valuation Account" and the "Stock Output Account," are impacted by the delivery of goods to customers.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock valuation account | Asset | Decreasing | Credit |

| Stock Output account | Liability | Decreasing | Debit |

Rejection IN (Sales Return): Numerous times, buyers return products even after being billed. Adjustments are made to stock and accounts as a result of this form of sales return. They will also have reverse journal entries created for them. For keeping track of the products that customers have rejected or returned, a Rejection IN is a very helpful feature. If the goods are returned prior to billing, just the stock will be impacted; the accounts are unaffected. Additionally, the stock value rises when the product is added back to the inventory.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock valuation account | Asset | Increasing | Debit |

| Stock Output account | Liability | Increasing | Credit |

Sales Invoice Creation: A type of accounting document called a sales invoice is sent to a buyer by a vendor of products or services. Everything will be mentioned, including the service provided, the product provided, the price the buyer must pay, the mode of payment, and more. It is necessary for bigger transactions and is a legally binding agreement between the company and the customers.

Both the Receivables Account and the Income Account will be impacted in this situation. The Account Receivable is labeled as an "Asset," and the Income Account is labeled "Income" when we analyze the characteristics of these accounts. In this instance, the revenue is rising while the asset is decreasing. As a result, the Income Account is debited, and the Account Receivable is credited.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Income Account | Income | Increasing | Credit |

| Account Receivable | Asset | Increasing | Debit |

Registering Payment: On payment registration, a temporary account called Outstanding Receipts is used. Due to payment registration, a journal entry is produced with Accounts Receivable and Outstanding Receipts.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Accounts Receivable | Asset | Decreasing | Credit |

| Outstanding Receipts | Asset | Increasing | Debit |

Reconciliation: After reconciliation, the sum will be transferred to the bank account after it is compared to the bank statement. As a result, the bank is debited, and the account for outstanding receipts is credited.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Outstanding Receipts | Asset | Decreasing | Credit |

| Bank account | No Accounts affected |

You can see a breakdown of all the sales transactions' journal entries by looking at the table below.

| Operation | Accounts Affected | Debit | Credit |

|---|---|---|---|

| Sales order | No Accounts affected | ||

| Delivery Note | Stock valuation account | XX | |

| Stock valuation account | XX | ||

| Customer Invoice | Income Account | XX | |

| Account Receivable | XX | ||

| Registering Payment | Accounts Receivable | XX | |

| Outstanding Receipts | XX | ||

| Reconciling | Outstanding Receipts | XX | |

| Bank Account | XX |

Finally, using the double-entry bookkeeping method, the total of the credits will equal the total of the debits.

Accounting and auditing with artificial intelligence-Odoo 17

Is your accounting team still spending hours on tedious data entry tasks? Are you wondering how financial professionals can predict cash flows, detect fraud, and ensure regulatory compliance in real-time? In a world where numbers rule, the accounting and auditing industry is experiencing an innovative transformation powered by Artificial Intelligence (AI).

Anglo-Saxon Accounting

For tiny areas, such as those found in the United States, United Kingdom, Ireland, Canada, Australia, and many other nations, Anglo-Saxon Accounting is applicable. Odoo17 only offers Anglo-Saxon accounting in the enterprise edition. There are numerous contrasts between the two accounting systems, Continental and Anglo-Saxon. We talked about how a purchase affects the expense account in Continental Accounting. However, in Anglo-Saxon accounting, after executing a sale order has an impact on the expense account.

You must enable Anglosaxon accounting from the Odoo Accounting Configuration Settings if you wish to use all of its features, and you should activate the developer mode. The cost distinctions between Account and Stock account properties when the inventory valuation is automated is another important aspect of the Anglo-Saxon accounting system. To track the price difference between the vendor bill and the purchase cost, use the price difference account.

Transactions in Anglo-Saxon Accounting

1. Purchase Process

In some cases, the expense won't register when it is made. The purchases could be made in bulk and consumed over a lengthy period of time. Therefore, including them as an expense in financial entries will have a bigger effect on the company's profit and loss. It is, therefore, common practice to record acquired products as assets and costs at the moment of use in order to handle those scenarios. Ledgers contain the cost of spent assets.

We will start by making a product purchase.

Purchase Order: Purchase orders do not impact any accounting ledgers; they just produce a valid document for receiving products or services from the vendor.

Purchase Receipt: After the goods' receipt has been acknowledged, the arriving assets must be added to stock. As a result, both stock input accounts and stock valuation accounts are impacted by stock.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock valuation account | Asset | Increasing | Debit |

| Stock Input account | Asset | Decreasing | Credit |

When stock is received and recorded in the "Stock input account," it is thought of as an asset until it is sold or consumed at which point it becomes a liability. So, it might be either assets or liabilities. [Liability = -Assets] as either the liability or the asset changes.

Purchase Return: There is occasionally a chance that the purchased item can be returned because of a quality problem or product damage. As a result, stock accounts are reversed, and the stock move is exactly the opposite of the incoming.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock Valuation Account | Asset | Decreasing | Credit |

| Stock Input Account | Asset | Increasing | Debit |

Purchase Bill:Posting the purchase bill follows completion of the purchase receipt. As was already indicated, in Anglo-Saxon, the direct expense will be recorded as an asset rather than at the time of purchase. As a result, once a bill is generated, "Account Payable" and "Stock interim accounts" are impacted. The amount to be paid to the vendor is noted in Account Payable. As a result, when a bill is generated, the amount owed to the vendor rises, increasing the company's liability and crediting the Account Payable.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Account Payable | Liability | Increasing | Credit |

| Tax Account | Asset | Increasing | Debit |

| Stock Input account | Asset | Increasing | Credit Or Debit |

Register Payment: Making a payment or sending money to the vendor is known as registering it. 'Account Payable' and 'Outstanding Payment Accounts' are impacted by this process. The company's liability decreases as a result of payments made to the vendor. The company's payable liabilities are recorded in account payable. As a result, Account Payable, which by definition is a liability, is debited when the liability diminishes.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Accounts Payable | Liability | Decreasing | Debit |

| Outstanding Payments | Liability | Increasing | Credit |

The Outstanding Payment account serves as a middleman for holding unreconciled outbound payments alongside cash and bank journals. Rather than using the Account Payable, these outstanding payment accounts are used to reconcile with the bank statement. As a result, whenever a payment is registered, the "Outstanding Payments" account is credited.

Reconciliation: The bank statement and vendor payment must match because that is the next step. The 'Outstanding Payment' and 'Bank' accounts are thus impacted by reconciliation.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Outstanding Payments | Liability | Decreasing | Debit |

| Bank Account | Asset | Decreasing | Credit |

During this procedure, it will be noted that the vendor has finally received payment from the bank account. As a result, the asset in "Bank" decreases, which credits "Bank," and the liability in "Outstanding Payment" reduces, which debits "Outstanding Payment."

The table below displays the total journal entries made during the buying process.

| Operation | Accounts Affected | Debit | Credit |

|---|---|---|---|

| Purchase order | No Accounts Affected | ||

| Material Receipt | Stock Valuation Account | XX | |

| Stock Valuation Account | XX | ||

| Purchase Bill | Stock Valuation Account | XX | |

| Account Payable | XX | ||

| Tax Account | XX | ||

| Registering Payment | Account Payable | ||

| Outstanding Payments | XX | ||

| Reconciling | Outstanding Payments | XX | |

| Bank Account | XX |

2. Sales Process

The sales transaction entails a number of procedures, including the establishment of the order, the handling of the product delivery to the customer, the generation of the invoice, as well as its payment and reconciliation.

Sale Order: A sales order is made when a customer specifies the goods and services they need, the quantity they need, the confirmed pricing, etc. There is no impact on any accounts.

Delivery Note: After an order is accepted, the items must be delivered to the consumer. The attributes of the stock account will change once delivery has been authenticated. The stock that was supplied to the customer is tracked in the "Stock Output Account." A "Stock Output Account" is an expense by nature, and in this case, the expense value rises and is debited. Additionally, the value of all the stock or assets in the warehouse declines and is recorded in the "Stock Valuation Account." So, a credit is made to the stock valuation account.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock Valuation Account | Asset | Decreasing | Credit |

| Stock Output Account | Expenses | Increasing | Debit |

Sales Return:Sales Return: Take into account a customer returning goods for any reason. In this manner, the stock is likewise inverted.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Stock Valuation Account | Asset | Increasing | Debit |

| Stock Output Account | Expenses | Decreasing | Credit |

Sales Invoice: The 'Income Account' and 'Account Receivable' are impacted when creating a sales invoice for a customer. While "Account Receivable" refers to assets, "Income Account" refers to income. Thus, as assets grow and income rises, the "Income Account" is credited, and the "Account Receivable" is debited. Additionally, two other ledgers—the "Stock Output Account" and the "Expense" Account—are also impacted because, according to Anglo-Saxon accounting, the expense is impacted as soon as the acquired item is used up or sold out.

| Accounts | Nature | Increasing Or Decreasing | Credit Or Debit |

|---|---|---|---|

| Income Account | Income | Increasing | Credit |

| Account Receivable | Asset | Increasing | Debit |

| Tax Account | Liability | Increasing | Credit |

| Stock Output Account | Expenses | Decreasing | Credit |

| Expense Account | Expenses | Increasing | Debit |

Payment Registering: The 'Account Receivable' and 'Outstanding Receipts' accounts are impacted once payment has been received from the customer and has been registered in Odoo17.

Audit Reports

When it comes to business accounting, auditing is a critical component of finance management tasks. This unavoidable component is recognized as a priority throughout the fiscal periods that are now being formed. Furthermore, in compliance with requirements, the entire fiscal year's financial operations are checked, recorded, filed, and audited. This is normally done once every fiscal year. The Accounting module in Odoo provides you with specialized Audit Reporting features to help you manage your company's finances and oversee its accounting operations.

There is a distinct category of Audit Reporting tools available, including General Ledger, Trial Balance, Consolidated Journals, Tax Report, Intrastat Report, EC Sales List, and Journal Audits, all of which are accessible via the Odoo Accounting module's reporting page. Let us now go over each of the Audit reports separately in the next section.

General Ledger

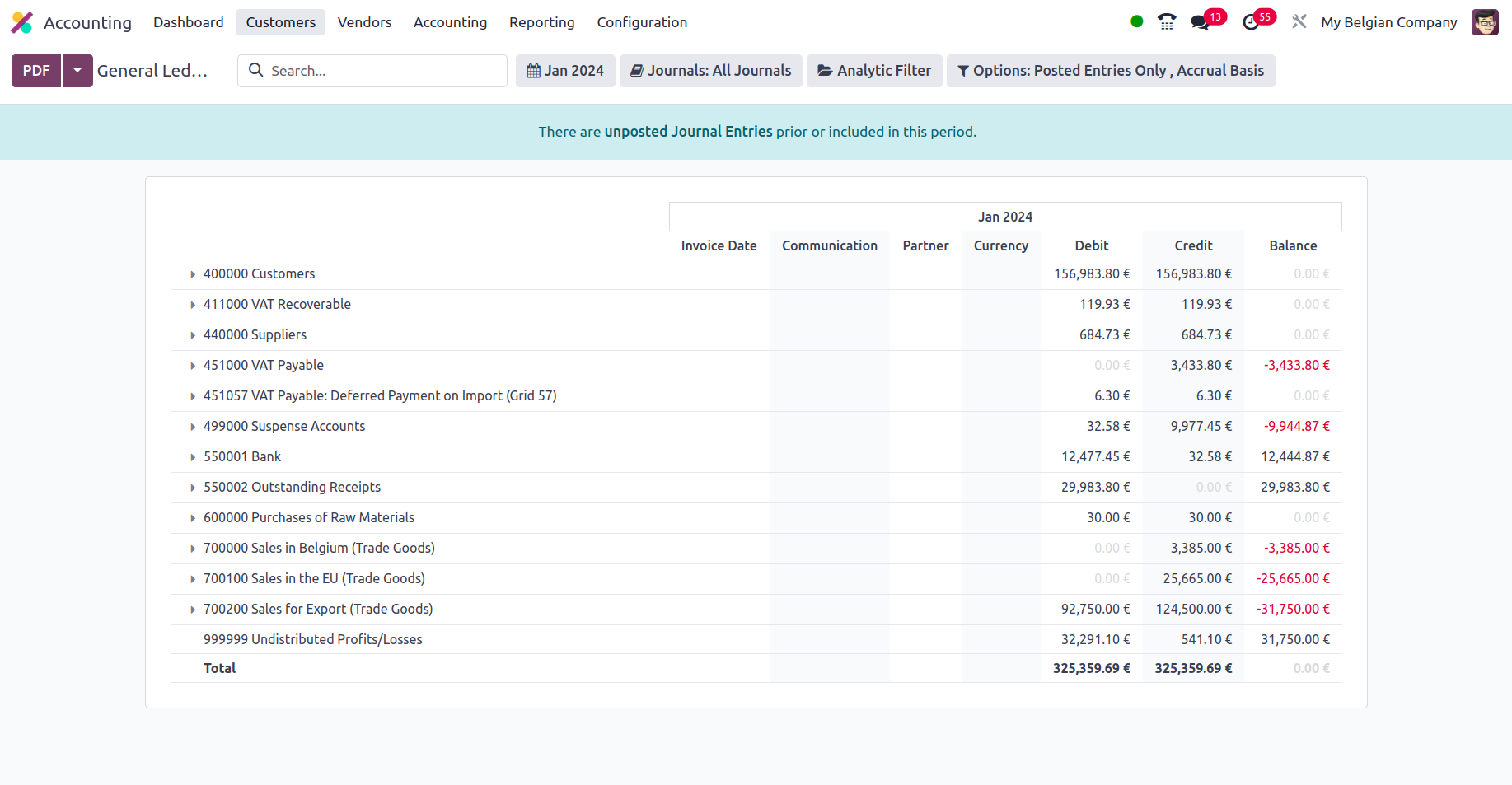

All accounting data related to business operations will be defined in the company's general ledger. Furthermore, filters may be applied to Dynamic reports, and the General ledger displays all business transactions from all Account Ledgers used in the firm. All financial transactions connected to the company's sales, purchases, and other activities will be defined in a unique way here to help the viewer understand those transactions immediately. Furthermore, the well-organized menu may be utilized to study and identify specific information relevant to the company's financial management methods.

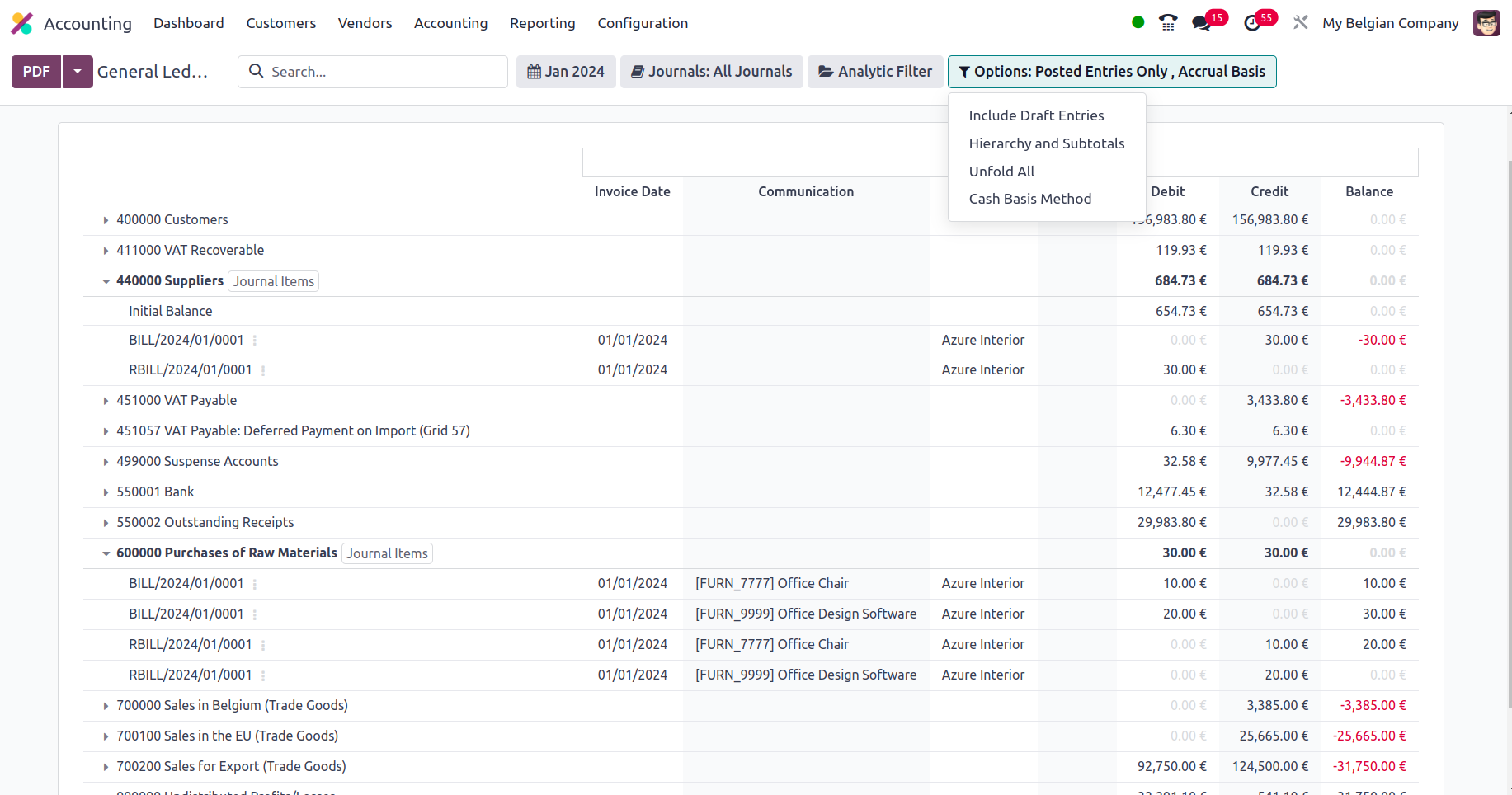

You may examine the company's general ledger by selecting the Reporting option in the Accounting module, as illustrated in the following screenshot. All of the financial operations items that have been filtered to appear for the given time will be displayed here. Every journal that has been posted will be explained, along with the invoice and bill details for that journal.

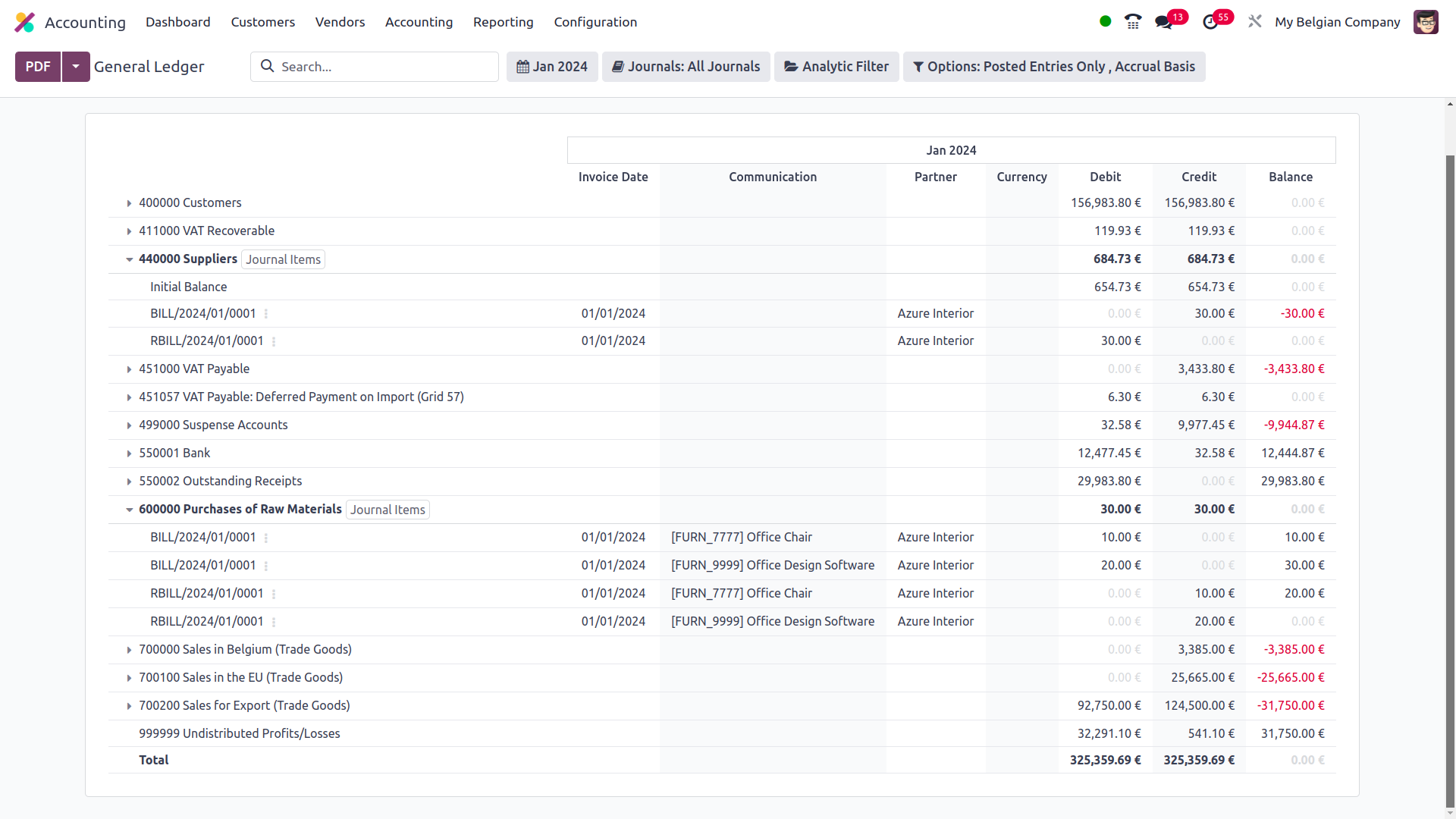

Additionally, you have the option to Print Preview, which will provide a General Ledger Report preview before printing. In addition to exporting General Ledger data, you may export the report in XLSX format for use in other corporate activities by selecting the Export (XLSX) option. The Save option ensures that the set details and filtering parameters are saved in the reporting menu. You may opt to enlarge a Journal, which will display all linked bills and invoices. The Ledger entries in the image below have been filtered to the month of January in the year 2024, and Sample has also been selected as the Journal filter. Furthermore, only the entries that have been uploaded are screened.

When an account is opened, the impacted journal entries are displayed together with the date, partner information, currency, debit/credit amount, and balance. Additionally, a right-click allows you to see and comment on the Journal Entries (add notes on each entry). The remarks made to the journal entries can be viewed and updated at the bottom of the General Ledger. You may filter the date or month of operations as This Month, This Quarter, This Financial Year, Last Month, Last Quarter, or Last Financial Year if you need to define a custom filter date of operations. The Filtration menu in the General Ledger menu is shown in the screenshot below.

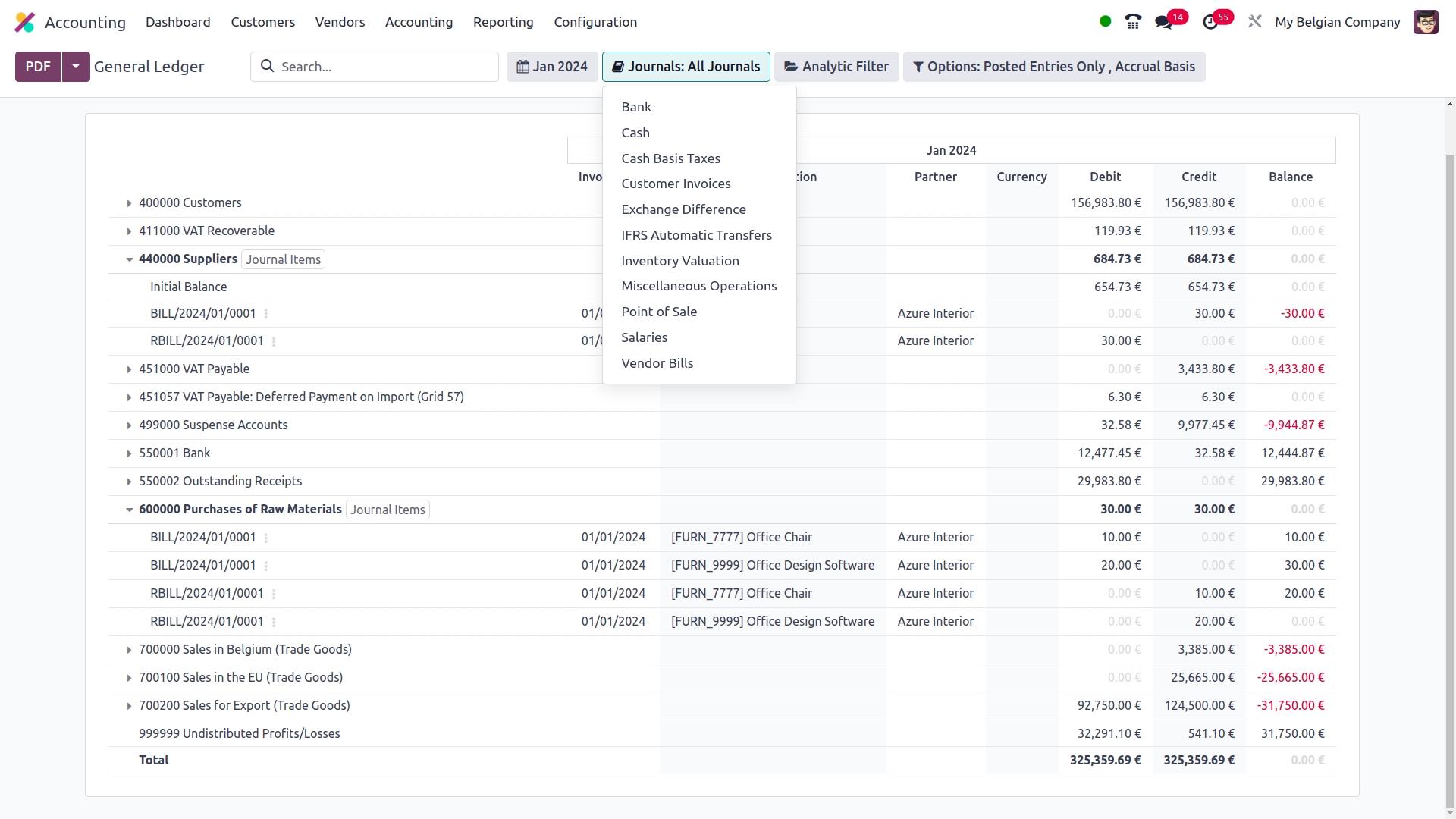

You have a different option to filter the journals where you can pick the particular journals to be filtered as well as the defined journal groupings that may also be selected as the filter.

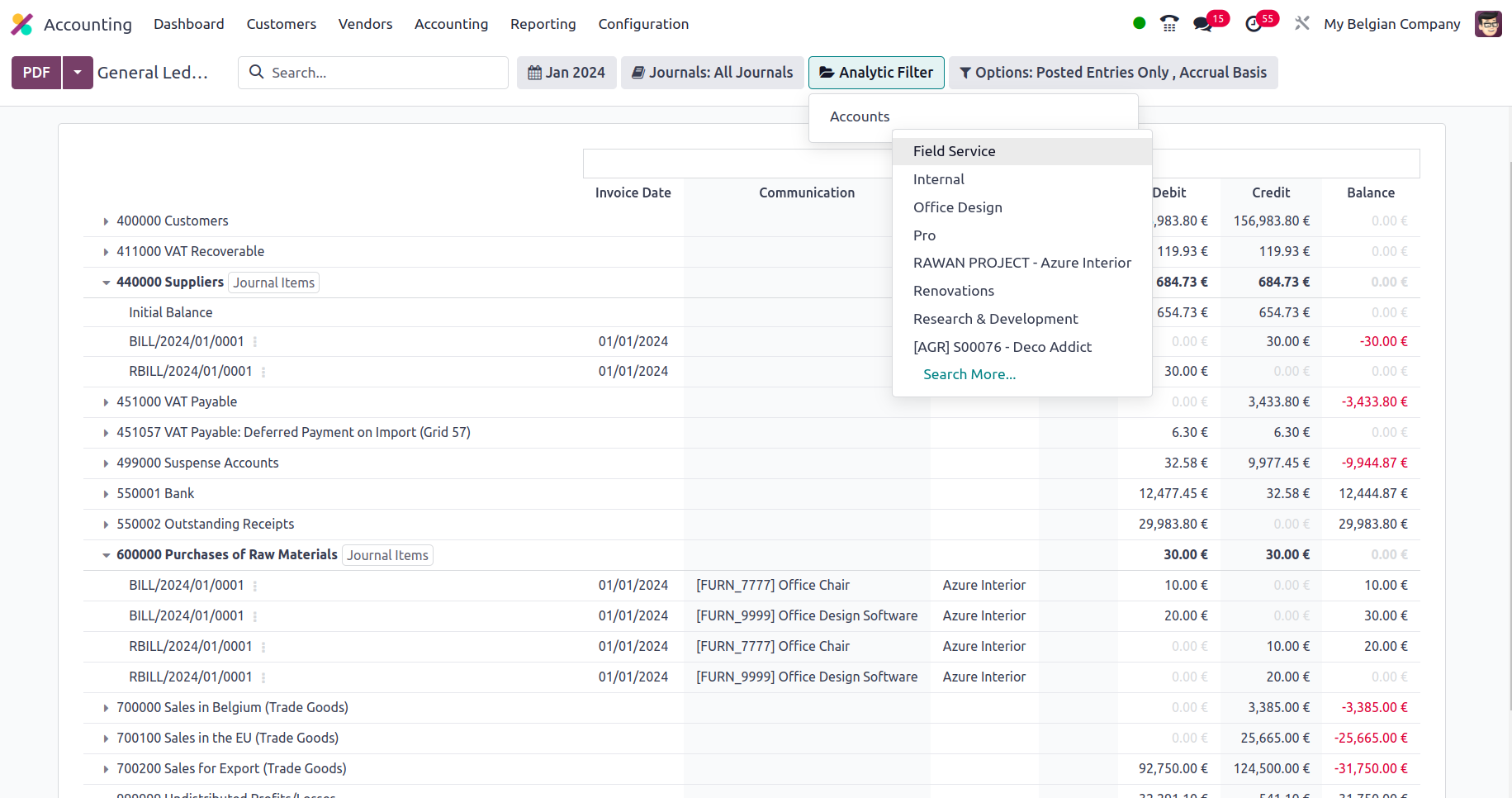

Additionally, using the available Analytic option, the filtration may be done in relation to the Analytical Accounting sections of the firm's financial management. Define the Analytical Accounts and Tags here to filter out General Ledger entries.

In addition, there is a particular filtering tool provided. This filter contains just Posted Entries by default, but it also offers the choices to Include Unposted Entries, Use Accrual Basis, Unfold All, and Use Cash Basis Method. Using this option, the required General Ledger entries can be defined in operation. There are also buttons that allow you to print reports in PDF and XLSX formats. The Store button saves reports to the proper place in the Documents modules, allowing you to keep financial information.

The general ledger is a report that initiates all posted and unposted accounting operations connected to the operation of the firm. In the early days of business, a specialized book known as General Ledger was kept, but with the Odoo Accounting module, all entries will be automatically displayed with regard to the corporate activities of the different Journals. Now that we've covered the Odoo Accounting module's General Ledger reporting menu, let's move on to the next section, which defines the Odoo Accounting module's Trial Balance Report.

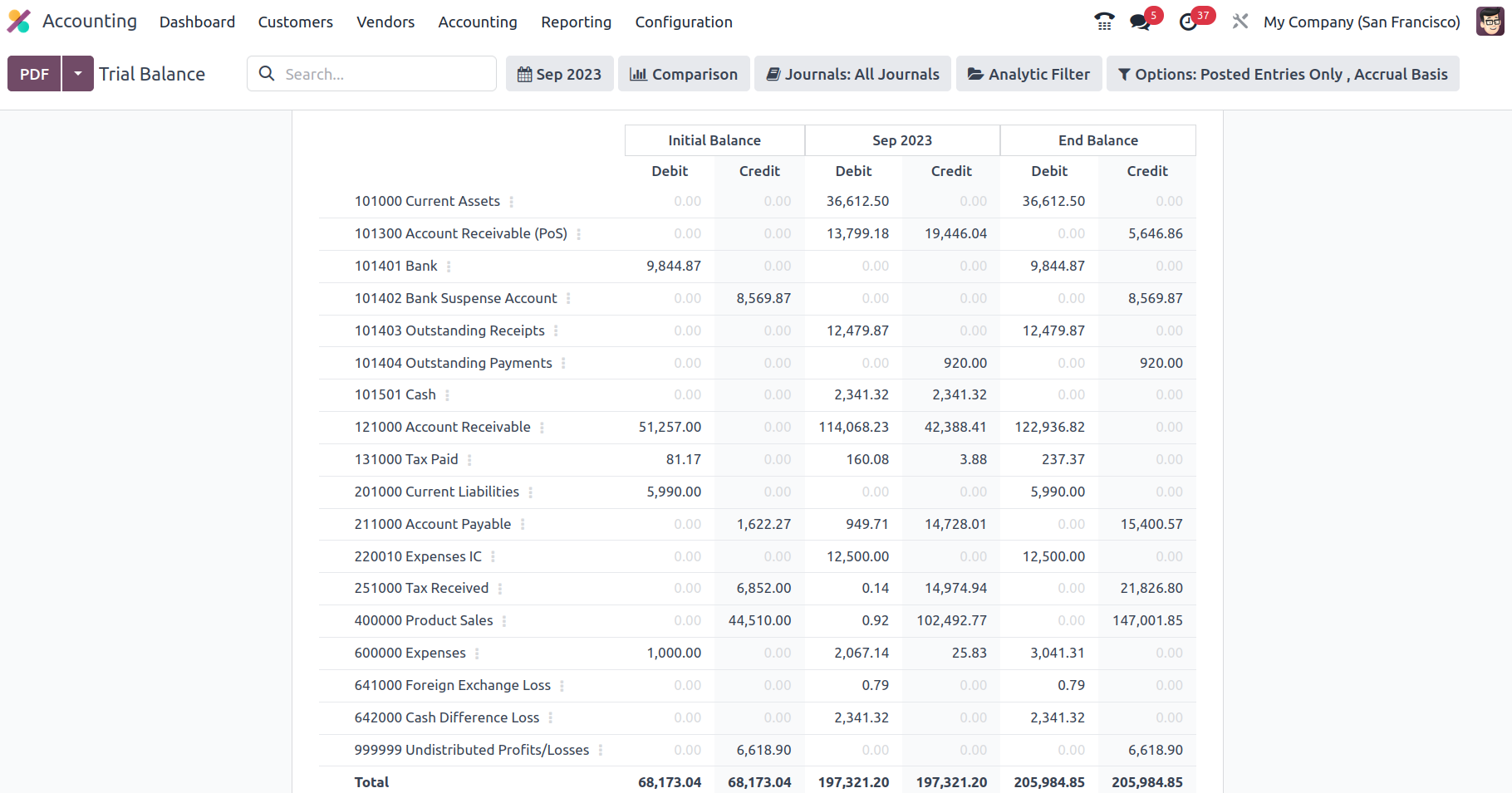

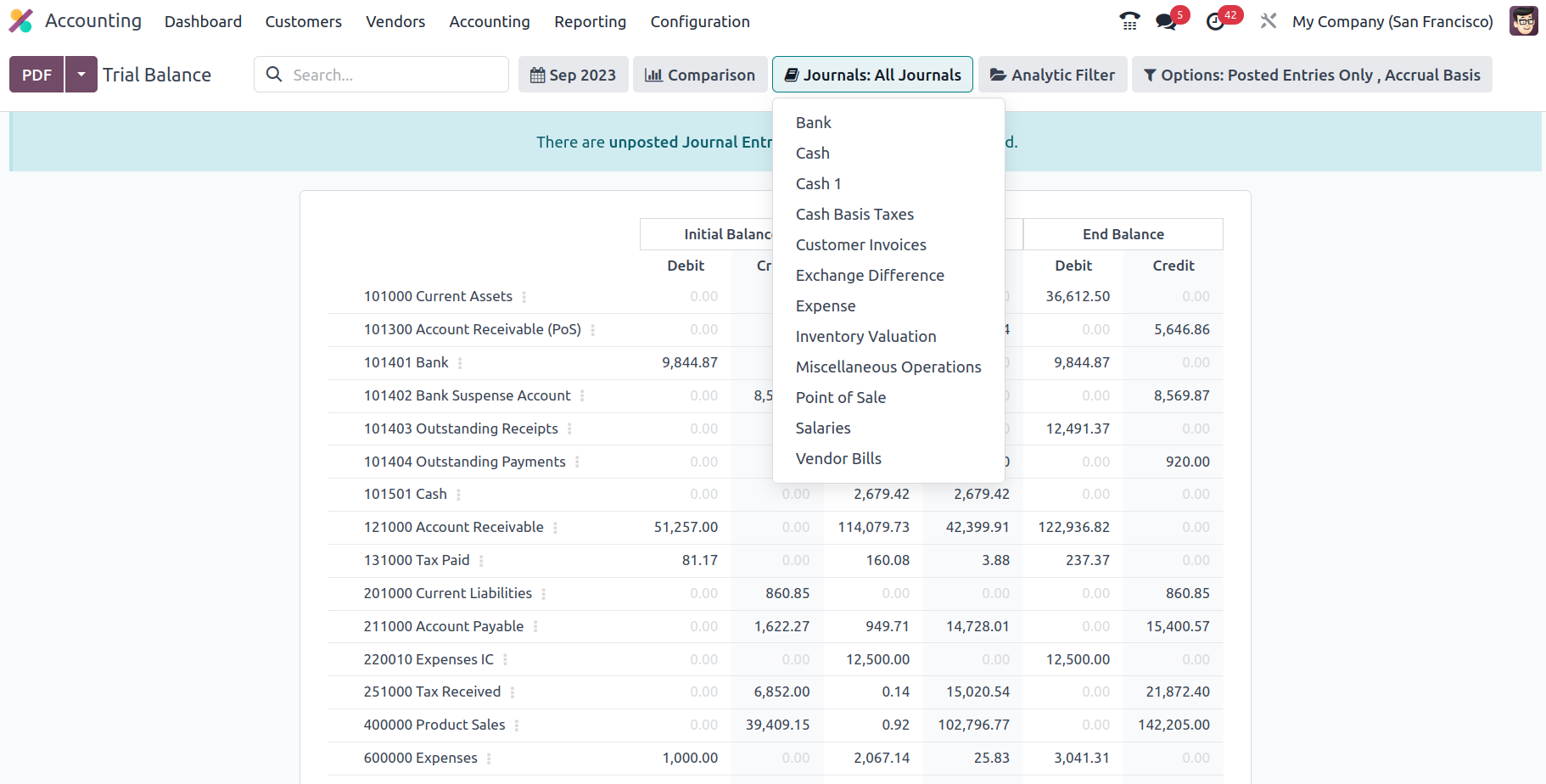

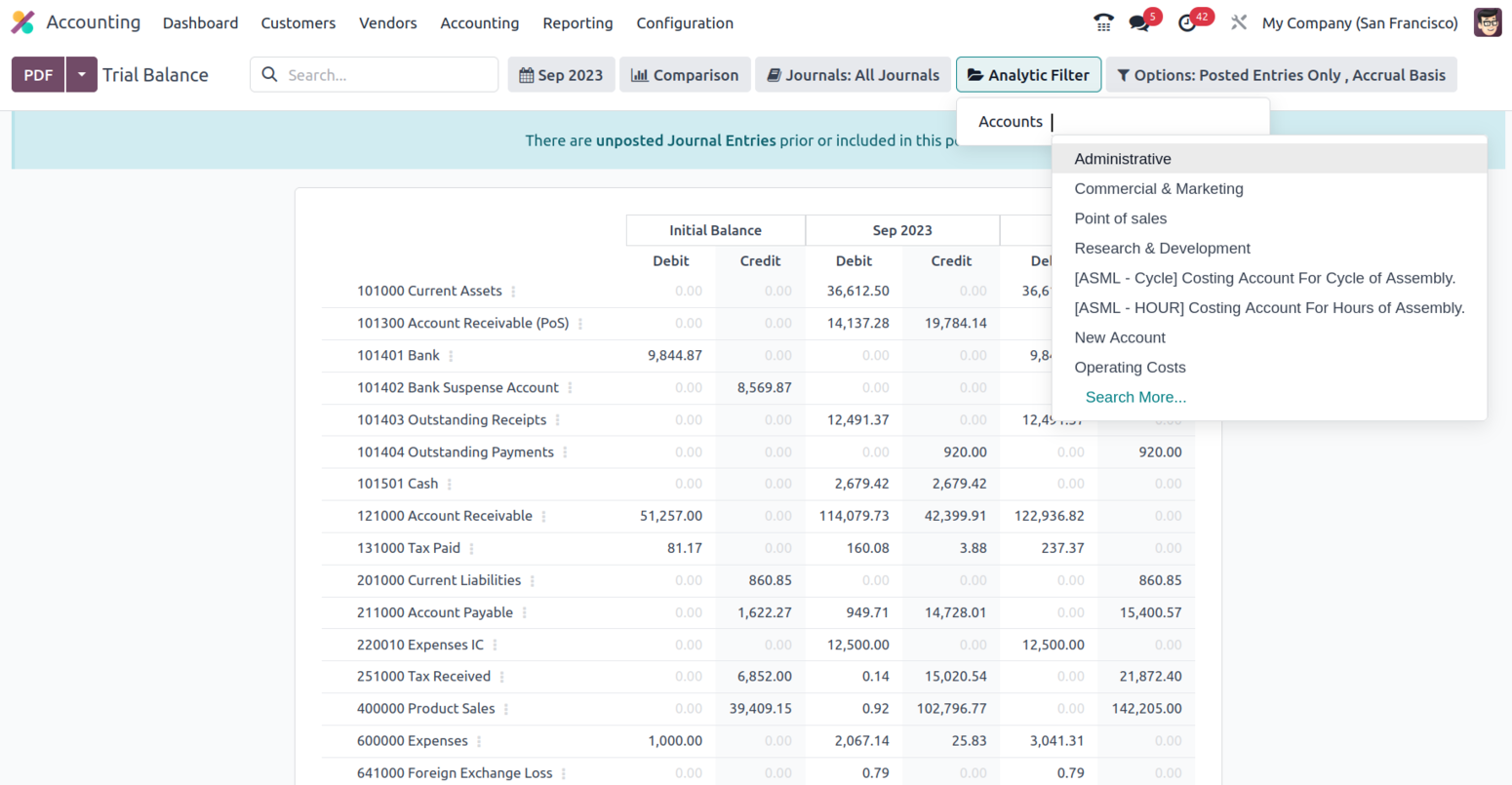

Trial Balance

A trial balance is a sort of bookkeeping instrument that describes the balance of each account in credits and debits in terms of the organization's accounting activities. The Odoo Accounting module's specific Trial Balance reporting tool is specified in the module and available via the module's Reporting page. All filtered journals will be displayed in the Trial Balance report option, together with the operations' beginning balance information in the form of a debit and a credit. The Debits for the appropriate time will then be displayed, together with the Credit amounts of the entries, with the Total Debit and Credit Amount stated. You will also be able to search for a certain Account in the Trial Balance report.

There is also a Print Preview option, which displays a preview of the Trial Balance Report before it is printed. In addition to exporting the Trial Balance details, you may export the report in XLSX format for use in other business operations by selecting the Export (XLSX) option. The Save option saves the set details and filtering options in the reporting panel.

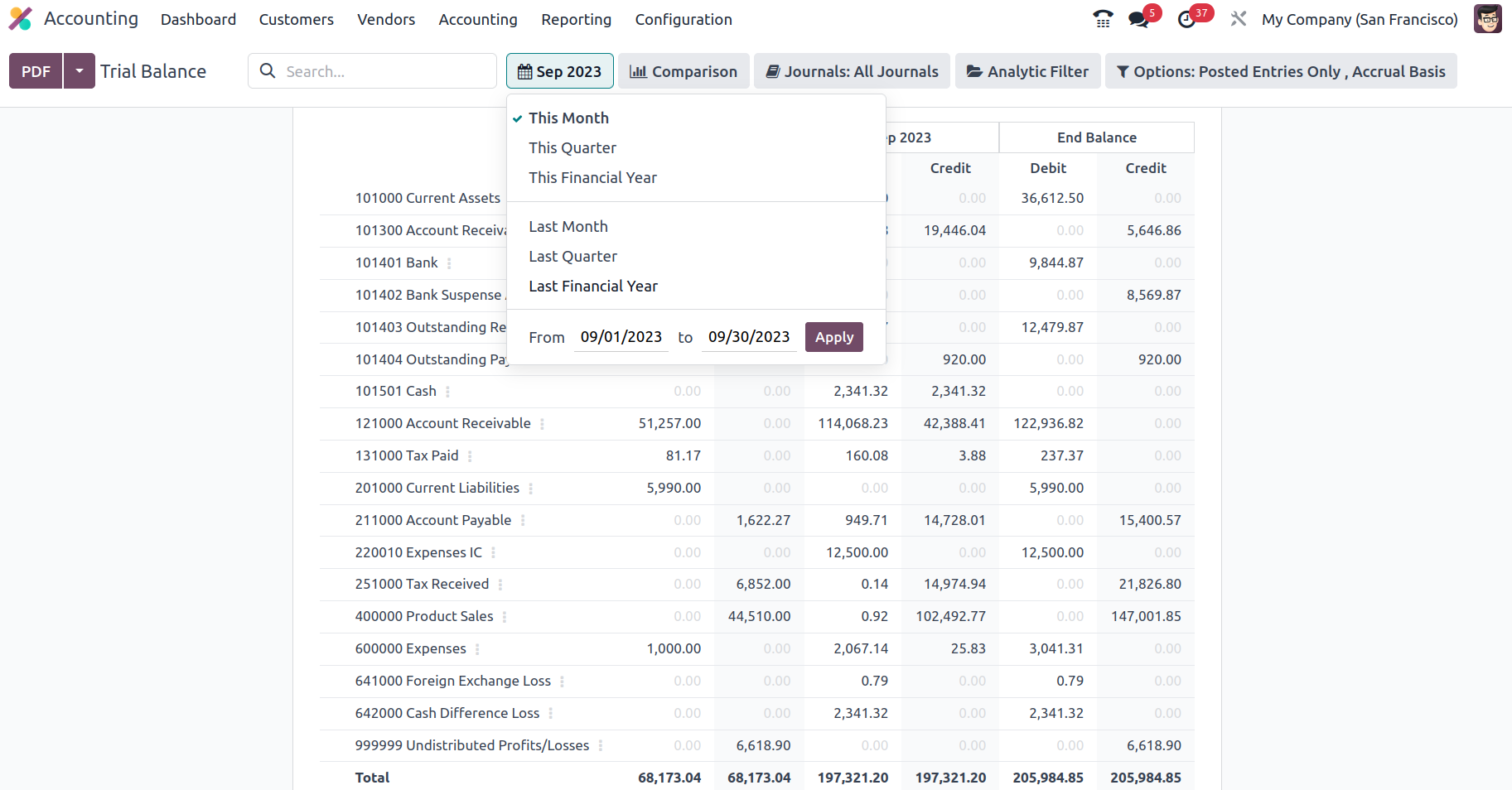

In terms of the Group by feature, you may define the Trial Balance for This Month, This Quarter, This Financial Year, Last Month, Last Quarter, and Last Financial Year, or add Custom filters as needed. The Group by choice is displayed in the accompanying snapshot, and they may be used to filter the Accounts depending on how long the firm has been in existence.

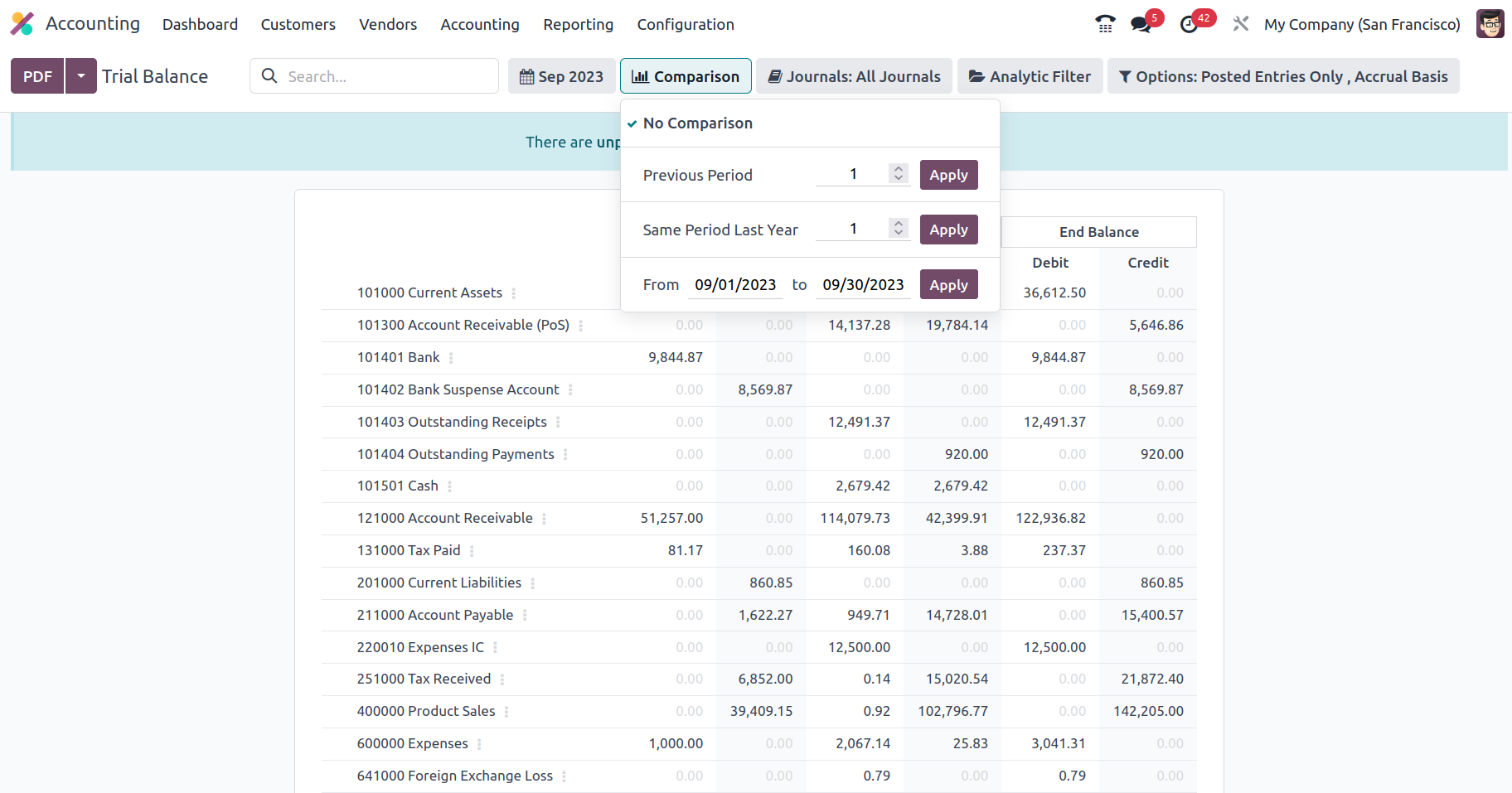

There is also an extra Comparison option that you may use to establish the comparison between the company's Journal entries. The comparison might be with the preceding period, the same period from the previous year, or a bespoke comparison set by the needs. Once the Comparison is created, the Trial Balance Report will specify the two Periods, the current one and the one you need to compare, as seen in the accompanying picture.

The Journal Groups and particular Journals given can also be used to group the Journals. If you employ this grouping approach, you will have a better understanding of the Trial Balance elements in relation to each of the operational Journals.

Additionally, the filtration may be done in reference to the Analytical Accounting sections of the company's financial management utilizing the available Analytic option. Define the Analytical Accounts and Tags below to filter the items in the Trial Balance report.

In addition, there is a particular filtering tool provided. This filter contains just Posted Entries by default, but it also offers the choices to Include Unposted Entries, Use Accrual Basis, Unfold All, and Use Cash Basis Method. Using this option, the necessary Trial Balance entries can be defined in operation. There are also buttons that allow you to print reports in PDF and XLSX formats. The Store button saves reports to the proper place in the Documents modules, allowing you to keep financial information.

The Trial Balance report of the company's financial activities will provide detailed information on the Credit and Debit amounts relevant to the organization's operations. The Trial Balance report will also be useful in grasping and gaining an overview of the company's financial activity. Let's move on to the part that defines Journal Reports in Odoo as they relate to the accounting process of the organization.

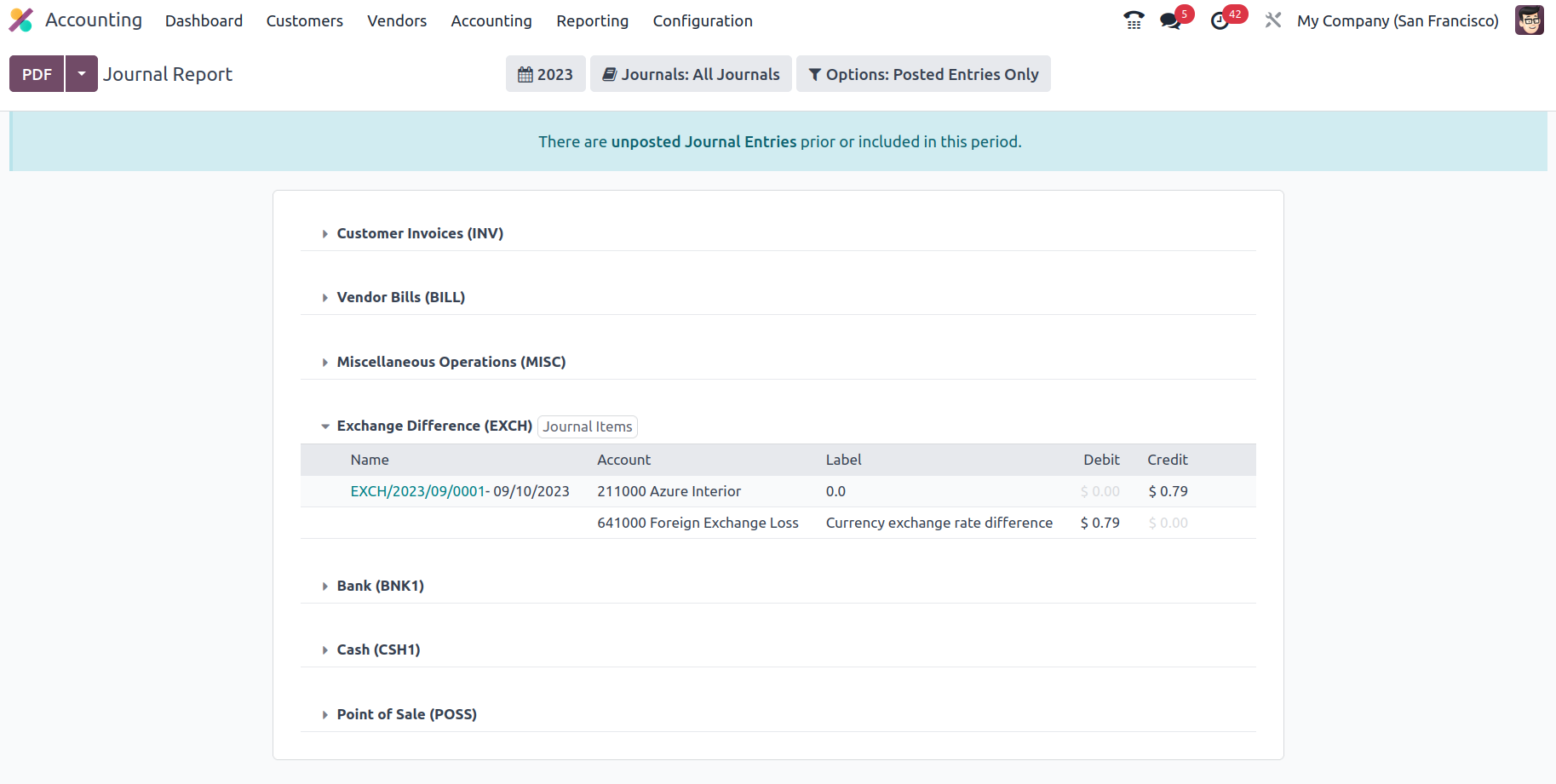

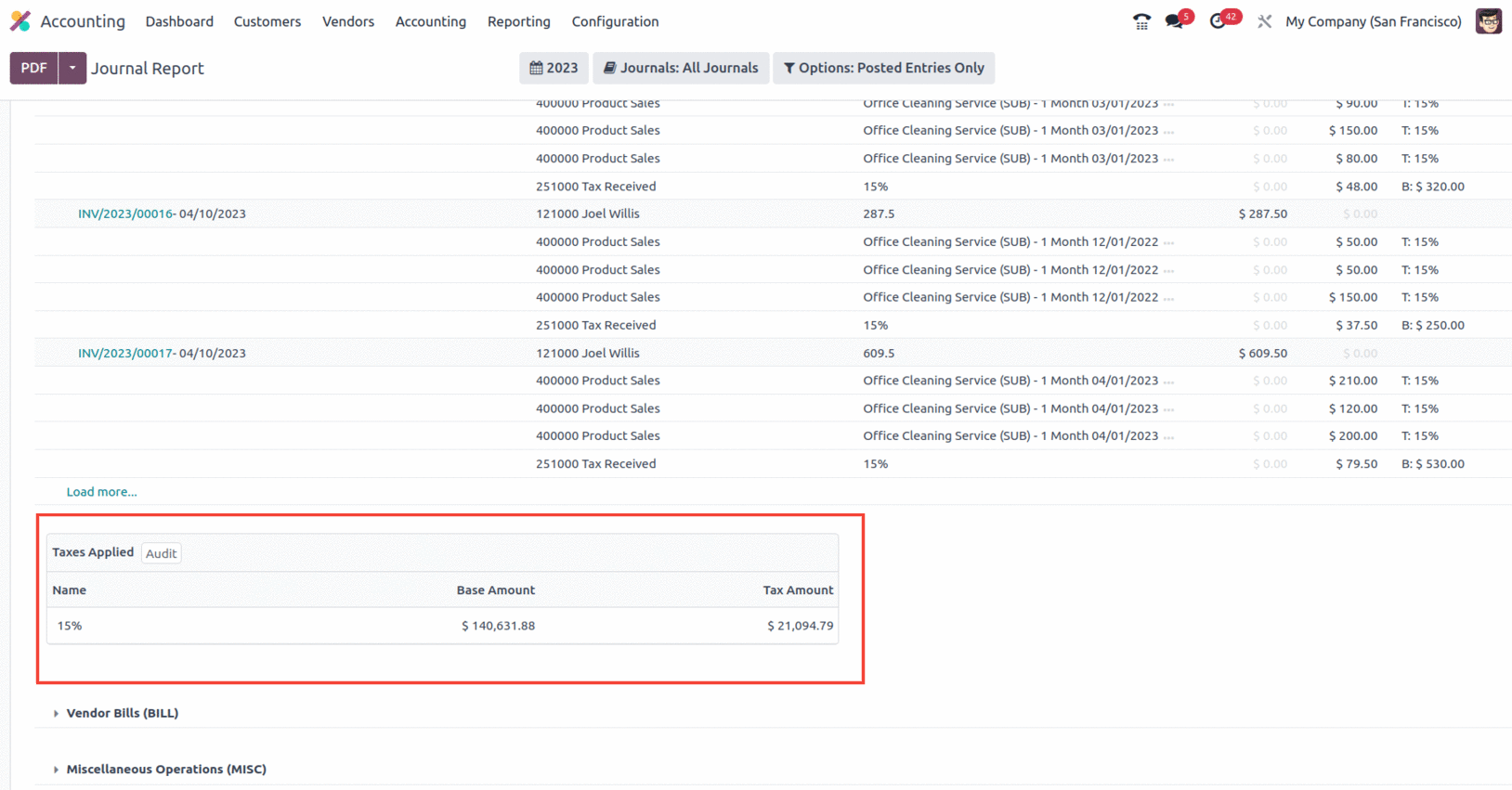

Journal Report

The journals of your accounting operations that are marked as Consolidated for the operations are defined in the Odoo Accounting module's Journal report menu. All operational Journals and their respective operating months will be presented in the menu. The Consolidated Journals report may also be produced as a preview by selecting Print Preview. Additionally, by selecting the Export (XSLX) option, the Consolidated Journals in the XLSX report may be exported. After filtering and aggregating the Consolidated Journals according to another setting element, you may store them to report using the Store option.

A tax declaration will also be added at the conclusion of the entries for sales and buy journals, as seen in the screenshot.

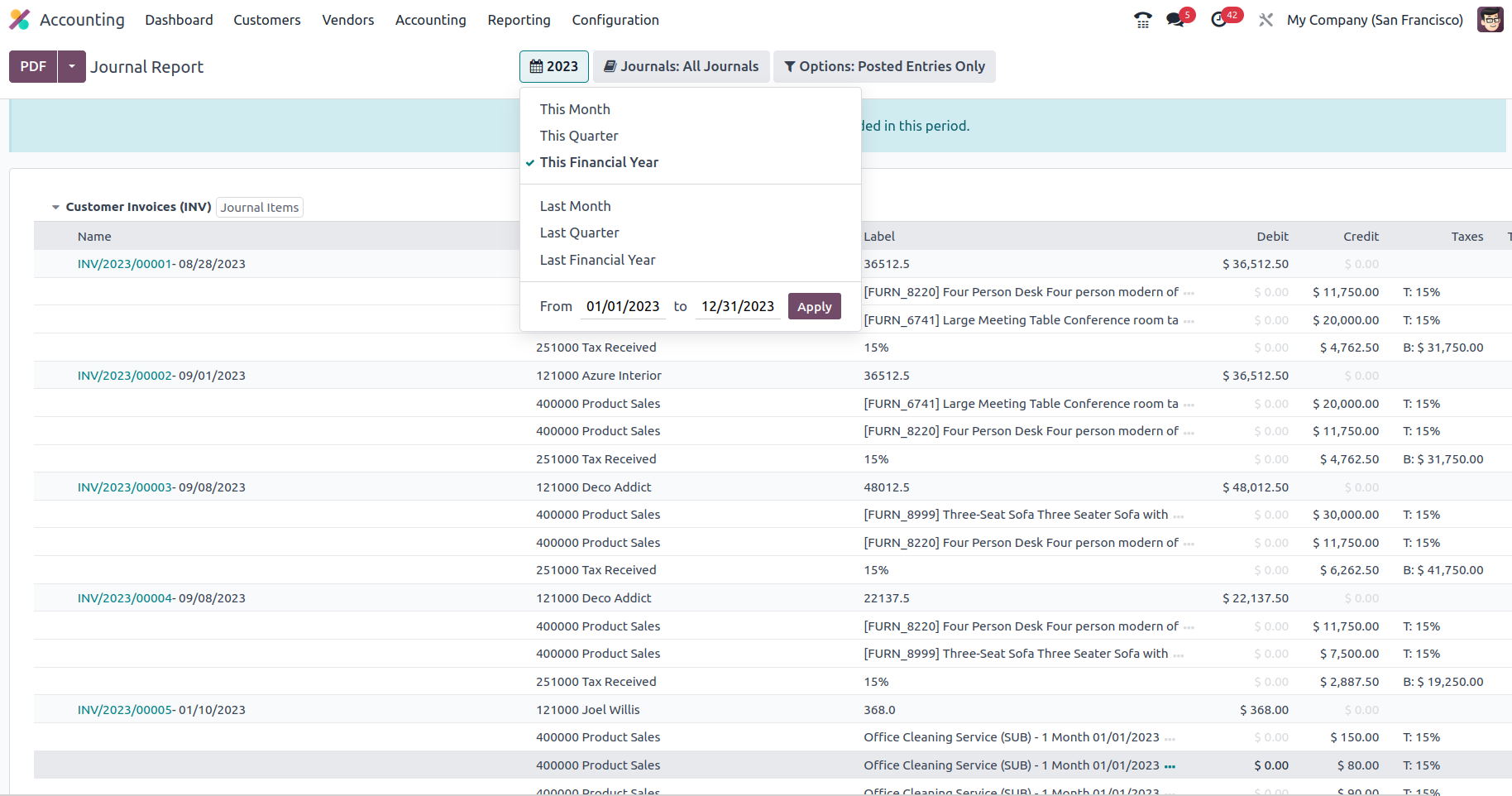

When it comes to sorting the entire depicted in the Consolidated Journals, you have the option to Group by options based on the period of the operation, as well as filtration options like This Month, This Quarter, This Financial Year, Last Month, Last Quarter, Last Financial Year, or add Custom filters of operations as needed. The Group by options available to you to filter the Accounts based on how long the business has been in operation are given in the screenshot below.

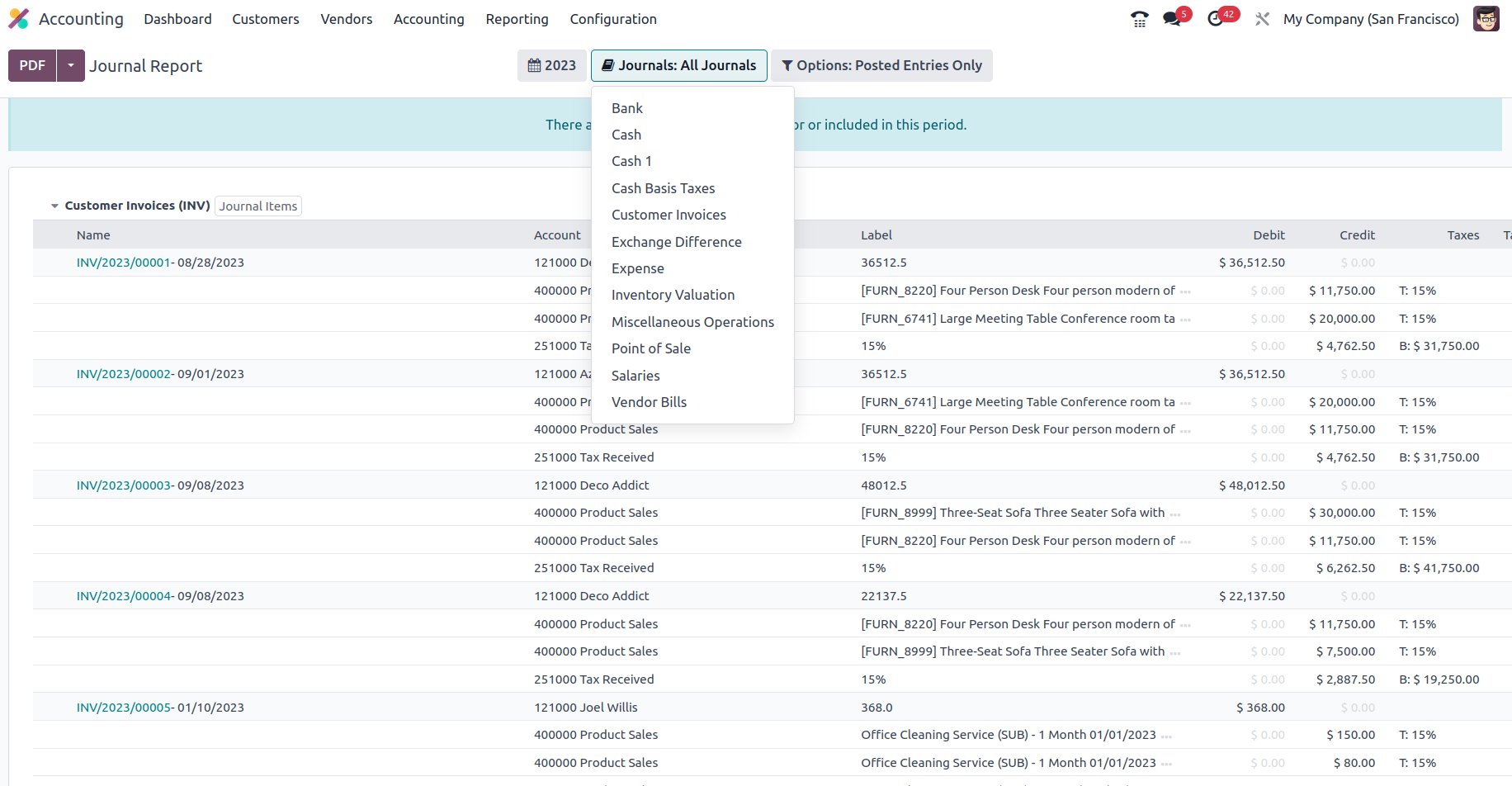

The Journal Groups and particular Journals given can also be used to group the Journals. Using this process of grouping by Journals, you may better understand the Consolidated Journals aspects in connection to each of the operational Journals being built.

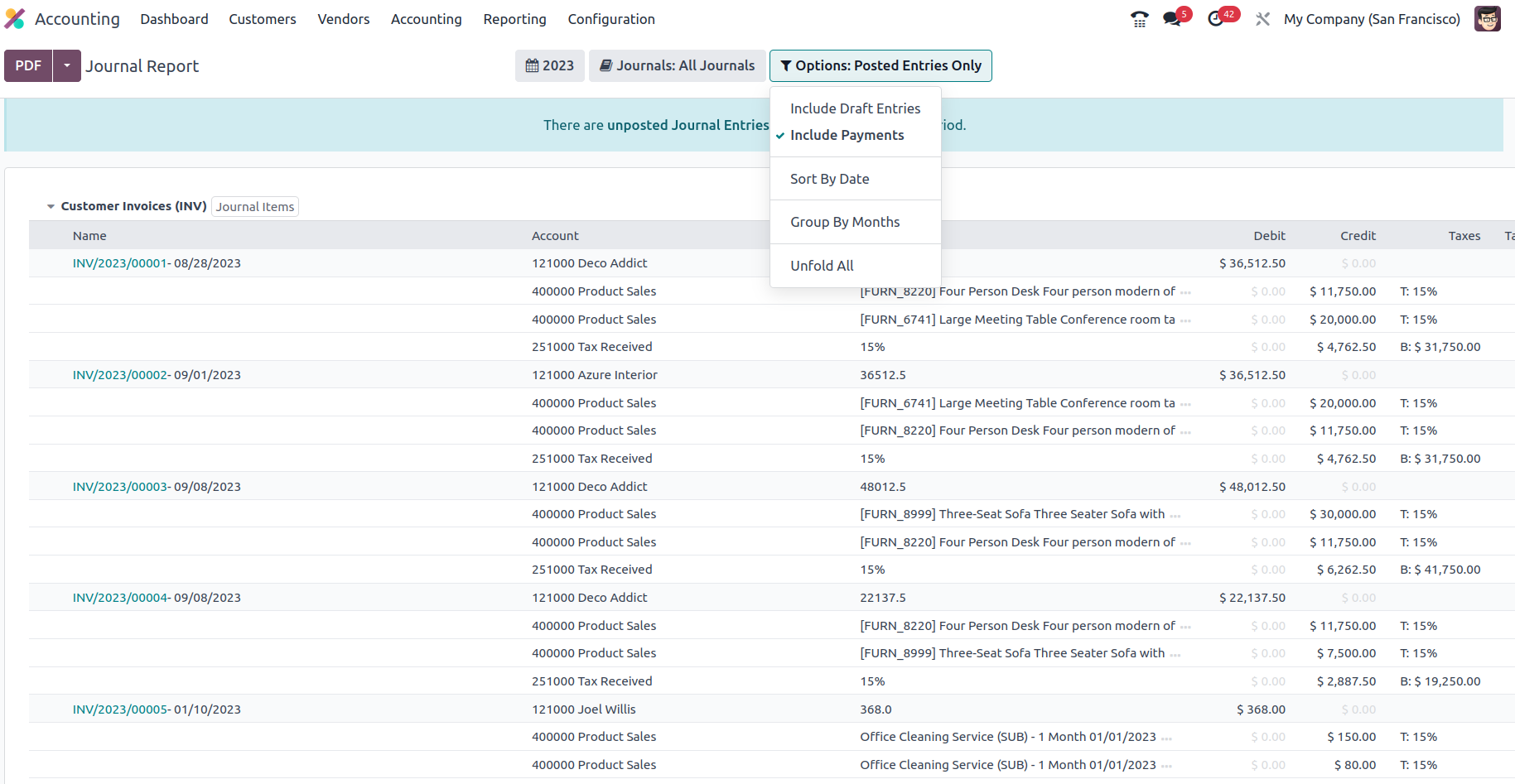

Additionally, the settings tool allows you to filter entries by utilising the Posted Entries Only, Include Unposted Entries, and Unfold All choices. Thanks to these filtering tools and selections, you will have clearly defined options for excluding and sorting the Consolidated Journals items.

The Consolidated Journals reporting window ensures that the viewer understands all of the financial entries and their allocated components of the company's accounting activities. The Intrastat report, the next reporting tool in the Odoo Accounting module, will be discussed in the following portion of this chapter.

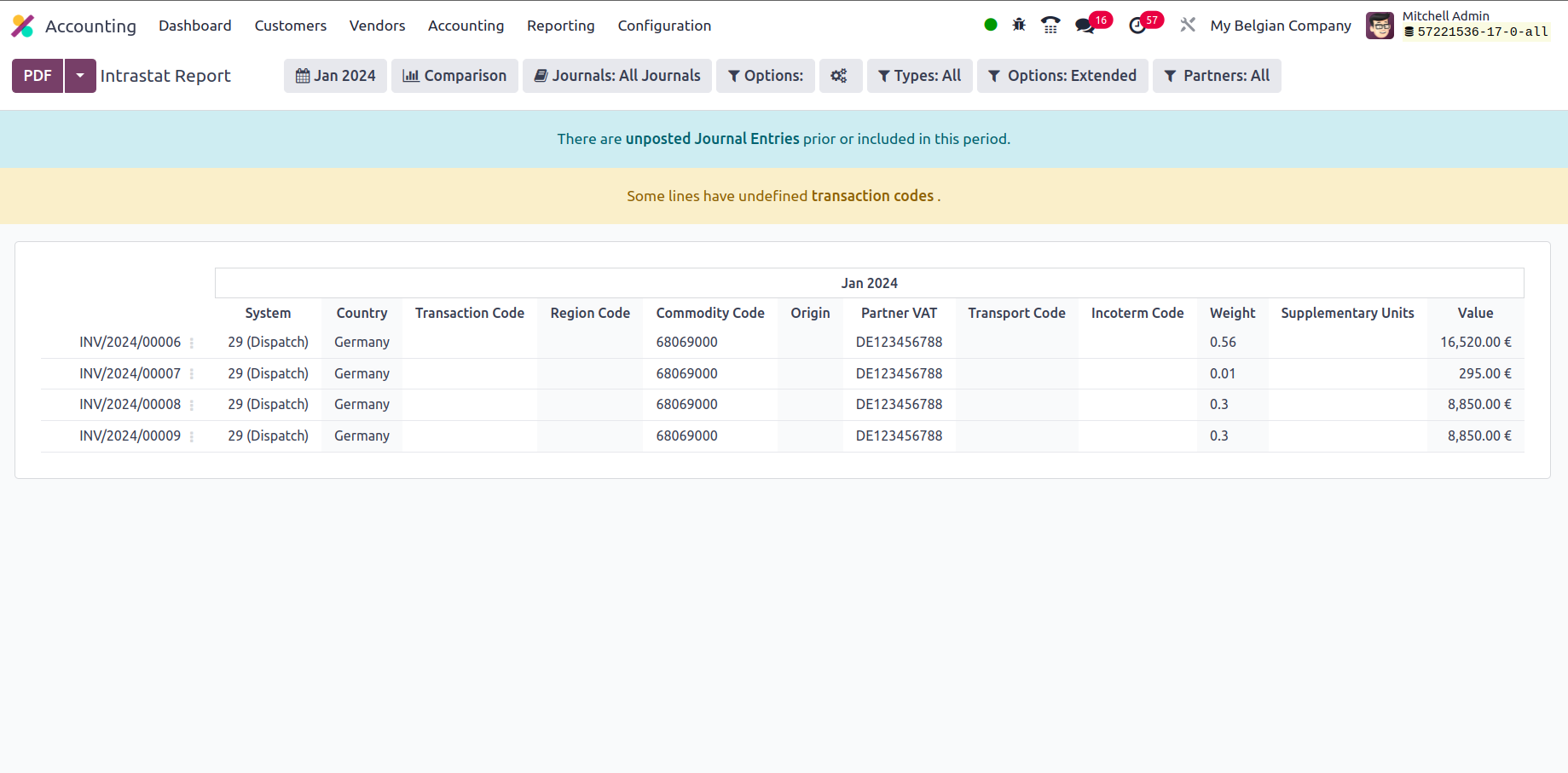

Intrastat Report

The Intrastat Report is one of the more comprehensive reporting options provided by Odoo's Accounting module. The European Union and its member states may track trade and business in a statistical manner owing to the Intrastat reporting mechanism. The Odoo Accounting module's Reporting tab leads to the Intrastat Report menu. This page will display all of the Intrastat Reporting components relating to business operations. There are further options in the menu for Group by and specialized Filtering that can aid in the sorting process.

Filtering tools will aid the Filtering component of the Intrastat Reports in the Odoo platform in relation to the Fiscal Periods of Operations, Journals that have been defined, Types of Journal Entries, and Filtrations depending on the Option as well as the Company in which Business is performed either as Partners, Vendors, or Customers.

If you want to learn more about the filtration features of the entries mentioned in the report, you may refer to the reporting aspects provided in the preceding sections. There are also buttons that allow you to print reports in PDF and XLSX formats. The Store button saves reports to the proper place in the Documents modules, allowing you to keep financial information. Let us go to the next phase, where we will define the Odoo platform's EC Sales List reporting option.

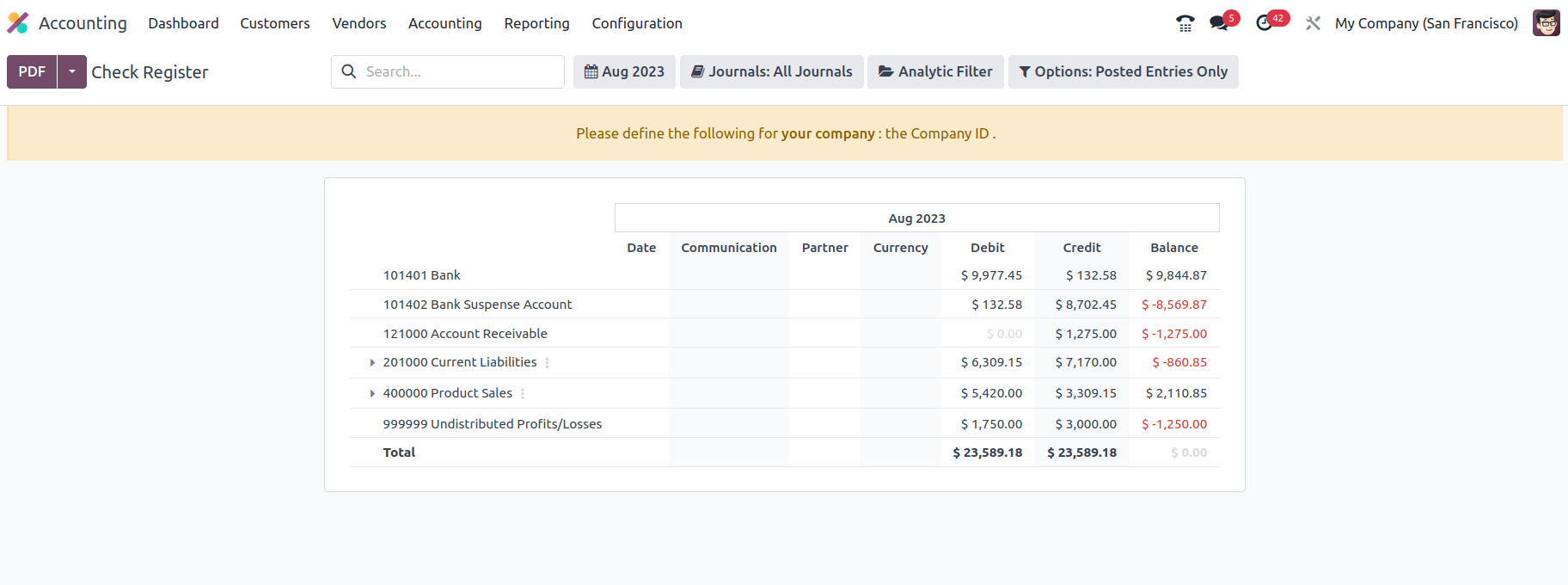

Check Register

The Check Register option is the last one under the Audit Reporting tools in the Odoo Accounting module, and it will provide you with information about your company's Check Register. A check register will describe every financial transaction linked to the firm's functioning, and the check register report will do so analytically, providing you with a full insight into how everything works.

The Accounts Register report will be illustrated using the numerous working Charts of Accounts that have been established in the platform. Each operational Chart of Accounts, as well as the date of operation, communication information, partner, and currency utilized, will be noted here. Furthermore, the Debit and Credit amounts, as well as the Balance of each of the Charts of Accounts, will be described as shown in the following screenshot.

Filtering and grouping possibilities are accessible, much like any other reporting choices in the Odoo Accounting module. You may use the criteria below to narrow down the information in the cheque register based on fiscal periods, journals, analytical accounting features, and posted and unposted entries. There is also a serving tool that you may use to search the Bill Register entries depending on the data you have. There are also buttons for printing reports in PDF and XLSX formats. The Store button saves reports to the proper location in the Documents modules, allowing you to keep your financial information.

The Check Register reporting menu in Odoo will play an important part in carrying out each operation's elements in terms of the company's financial management and will be a valuable accounting tool. The Bill Register completes the reporting functions of the Odoo Accounting module.

Become an Odoo Consultant Odoo Sales Machine [V17 / 2024]

Perfect Odoo Consultant Business Plan is a complete guide that explains the process of business goals.

The topic of artificial intelligence (AI) is everywhere these days and it will forever change how businesses operate. This is especially true for the sales world. Selling in today’s dynamic landscape is difficult — it requires a wealth of knowledge, skills, agility, and perseverance.