What is a manufacturing business plan?

A manufacturing business plan is a formal document that outlines the goals and objectives of your business. It includes detailed information about your:

- Products or services

- Target market

- Marketing strategy

- Financial projections

- Operational details

The purpose of a business plan is to give you a roadmap to follow as you build and grow your business. It forces you to think through every aspect of your venture and identify potential problems or roadblocks before they happen.

Manufacturing business plans can also be used to attract investors or secure funding from lenders. If you are looking for outside financing, your business plan needs to be even more detailed and include information on your management team, financial history, and expected growth.

Ideally, you should update your business plan yearly to ensure that it remains relevant and accurate. As your business grows and changes, so too should your plan.

Why does a manufacturing company need a business plan?

No matter how simple or complex your ideas may be, you need a plan, or they will never become a reality. A business plan will clearly understand your costs, competition, and target market. It will also help you to set realistic goals and track your progress over time.

Let’s look at a manufacturing strategy example. You have a great idea that you think will revolutionize the automotive industry. Your new safety harness will be made from a lightweight, yet incredibly strong, material that cannot be cut or torn. You are confident that your product will be in high demand and generate a lot of revenue.

But before you walk into Ford or Toyota to try and get a purchase order, you need to have a plan. You must know:

- How much will it cost to produce your product

- How many units do you need to sell to break even

- Who is your target market is

- What is your competition selling

- How will you reach your target market

You also need to clearly understand the regulatory landscape and what it takes to bring a new product to market. All of this information (and more) should be included in your business plan.

This is not just a document that you create and forget about. It is a living, breathing tool that should be used to guide your actions as you build and grow your business.

No matter how simple or complex your ideas may be, you need a plan, or they will never become a reality. A business plan will clearly understand your costs, competition, and target market. It will also help you to set realistic goals and track your progress over time.

Let’s look at a manufacturing strategy example. You have a great idea that you think will revolutionize the automotive industry. Your new safety harness will be made from a lightweight, yet incredibly strong, material that cannot be cut or torn. You are confident that your product will be in high demand and generate a lot of revenue.

But before you walk into Ford or Toyota to try and get a purchase order, you need to have a plan. You must know:

- How much will it cost to produce your product

- How many units do you need to sell to break even

- Who is your target market is

- What is your competition selling

- How will you reach your target market

You also need to clearly understand the regulatory landscape and what it takes to bring a new product to market. All of this information (and more) should be included in your business plan.

This is not just a document that you create and forget about. It is a living, breathing tool that should be used to guide your actions as you build and grow your business.

What are the key components of a business plan?

Every manufacturing business plan will be different, but almost always, they will include the same five components:

- Executive summary

- Company description

- Products and services

- Market analysis

- Financial plan

Let’s take a closer look.

Executive summary

The executive summary is the first section of your business plan, but it is typically written last. This is because it should be a concise overview of everything that follows, and you can only do that once you have completed the rest of your plan.

Include the following in your executive summary:

- The problem that your product or service solves

- Your target market

- Your unique selling proposition (what makes you different from your competitors?)

- Your manufacturing business model (how will you make money?)

- Your sales and marketing strategy

- A brief overview of your financial projections

Someone should be able to quickly scan through your executive summary and have a pretty good understanding of what your business is and how it plans to be successful.

Company description

This is where you can get a bit more creative, explaining your company’s history, mission, and values. You will also include information on your team or management structure.

It can be simple but should inspire faith in your ability to execute your business plan.

Products and services

You will need to provide a detailed description of your product or service, as well as any unique features or benefits that it offers. You should also include information on your manufacturing process and quality control procedures.

If you have any patents or proprietary technology, they should be listed here as significant assets for your business.

For example, let’s say you are planning on creating a brand-new line of disposable coffee cups. The dimensions, materials, and other specifications would be listed here, along with any unique benefits (such as being made from recycled materials).

You might also include information on your manufacturing process, such as the fact that the cups will be produced in a certified clean room or that you will employ workers local to where the product is sold.

Automated a Manufacturing Business From A to Z with ODOO AI

using AI technology and machines to perform specific tasks Fundamentals of Manufacturing System Design and Analysis

Market analysis

Chances are, you started down this path because you realized that there was a market opportunity for your product or service. In this section, you will need to provide detailed information on the opening, as well as the analysis that convinced you to pursue it.

This should include:

- Market size (current and projected)

- Key market segments

- Customer needs and wants

- Competitive landscape

This is where you will need to do your homework, as you will be justifying your business decision to enter this particular market. The more data and analysis you can provide, the better.

For our coffee cup example, the market analysis might include:

- Information on how many cups are used every day

- Projected growth

- Key segments (such as office workers or on-the-go consumers)

- Customer needs (such as convenience or sustainability)

It would also examine the competitive landscape, including both direct and indirect competitors.

Financial plan

You’re in this to make money, and so are your potential investors. In this section, you will need to provide detailed information on your manufacturing business model and how it will generate revenue. This should include:

- Initial investment

- Sales forecast

- Carrying costs

- Pricing strategy

- Expense budget

You will also need to provide information on your long-term financial goals, such as profitability or break-even point. Discuss production line details, inventory management strategies, and other factors impacting your bottom line.

How to write a business plan for a manufacturing company

The process of creating a business plan for a manufacturing company is similar to any other type of business. However, there are some key considerations to keep in mind.

First, you need to understand your industry and what it will take to be successful in it. This includes understanding the competitive landscape, the costs of goods sold, and the margins you can expect to achieve.

You also need to have a clear understanding of your target market and what needs or wants your product or service will address. This market analysis should include information on your target customer’s demographics, psychographics, and buying habits.

While there will be many things specific to your company, here are five questions to answer for each of the sections listed above.

Executive summary:

- What is the problem that your company will solve?

- How will your company solve that problem?

- Who are your target customers?

- What are your key competitive advantages?

- What is your business model?

Company description:

- What is the legal structure of your company?

- What are your company’s core values?

- What is your company’s history?

- Who are the key members of your management team?

- Where is your manufacturing facility located?

Products and services:

- What product or service does your company offer?

- How does your product or service solve the problem that your target market has?

- What are the key features and benefits of your product or service?

- How is your product or service unique from your competitors?

- What is the production process for your product or service?

Market analysis:

- Who is your target market?

- What needs or wants does your target market have that your product or service will address?

- What is the size of your target market?

- How do you expect the needs of your target market to change in the future?

- Who are your key competitors, and how do they serve the needs of your target market?

Financial plan:

- What are the start-up costs for your company?

- How will you finance your start-up costs?

- What are your monthly operating expenses?

- What is your sales forecast for the first year, and how does that compare to your industry’s average sales growth rate?

- What are your gross margin and profit targets?

Even if you do nothing but answer these questions, you’ll be well on your way to creating a thorough manufacturing business plan.

Automated a Manufacturing Business From A to Z with ODOO AI

In this course, part of the Principles of Manufacturing , you will learn how to analyze manufacturing systems to optimize performance and control cost. You will develop an understanding of seemingly opaque production lines with a particular emphasis on random disruptive events – their effects and how to deal with them, as well as inventory dynamics and management.

What you should look for in your manufacturing accounting software

Without accurate, timely, and quality information, it won’t be easy to understand what is happening in your business.

As a manufacturer, you must always be on top of materials and other associated costs to correctly price your finished items.

At the same time, you need to consider external market factors affecting your business and industry.

It would help if you had a manufacturing software solution that allows you to deal with the extra complexity of calculating inventory and the cost of your manufacturing goods.

This software can be used to extract data and analyze trends, improve efficiency, and make the best business decisions.

Your manufacturing accounting software should also help you keep compliant with regulations and the tax laws of the countries you have a business in.

Often, manufacturers invest in an all-in-one solution, which handles other tasks away from finances, such as planning and production.

This is known as Enterprise Resource Planning (ERP). Ideally, data should move freely between production lines and the back office, meaning you have accurate real-time data.

Features found in accounting software such as inventory management can help you optimize the way you use inventory, such as providing alerts when your stock needs replenishing.

It is crucial when understanding raw materials, work-in-process, and finished goods.

It will avoid a situation where you have too much inventory (which costs money) or, even worse, not enough inventory, where you cannot fulfill the requirements of your customers.

Unlock the secrets to financial success in manufacturing

Manufacturing

A manufacturing corporation must coordinate an unending amount of work, from putting together the components for manufacturing to shipping the finished product to the market. To ensure the quality of each product, the conversion of raw materials into final goods must be effectively monitored or managed. If all of these processes are managed manually, it will be quite taxing on you and take up a significant portion of your working day. In order to ensure that their consumers are receiving high-quality products, the company will benefit from having an effective system for managing all of these procedures related to manufacturing orders.

A business may effectively manage manufacturing orders, bills of materials, and work centers, and track all manufacturing operations at every level with the use of the Odoo17 ERP system. Odoo 17 is wholly reliable for the efficient management of job orders. With the specialized module, arranging and planning each stage of manufacture is now simpler.

We will examine the Manufacturing module for Odoo 17 in-depth in this chapter.

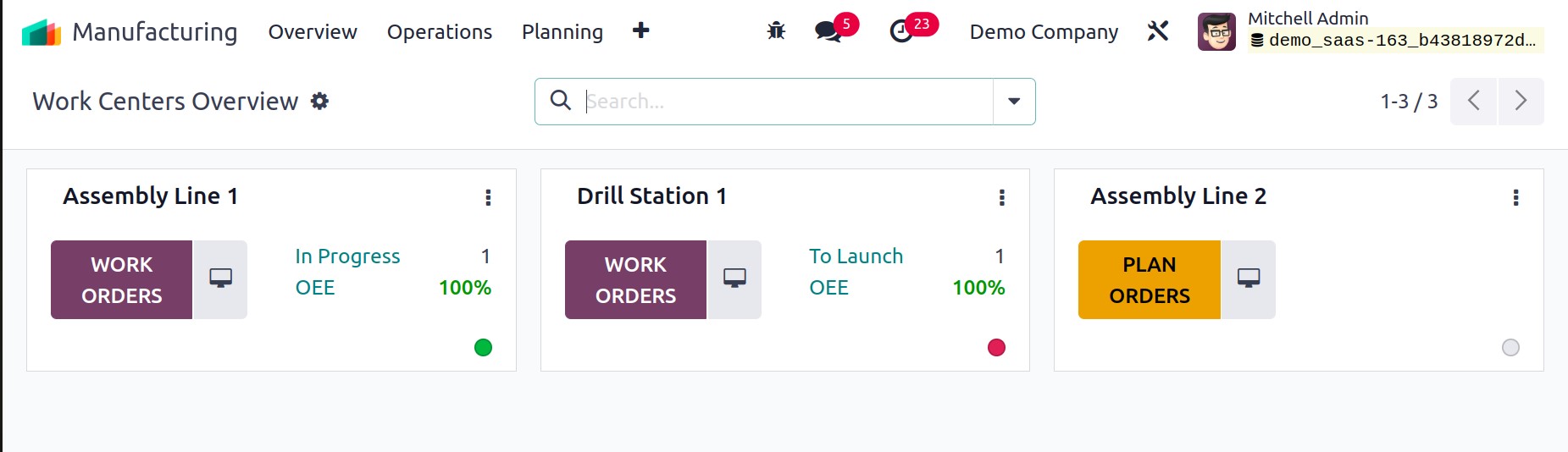

You will arrive at the Overview window of the work centers in Odoo17 when you access the Manufacturing module from the main dashboard of Odoo17. As seen in the image below, this platform will display all configured work centers in your system.

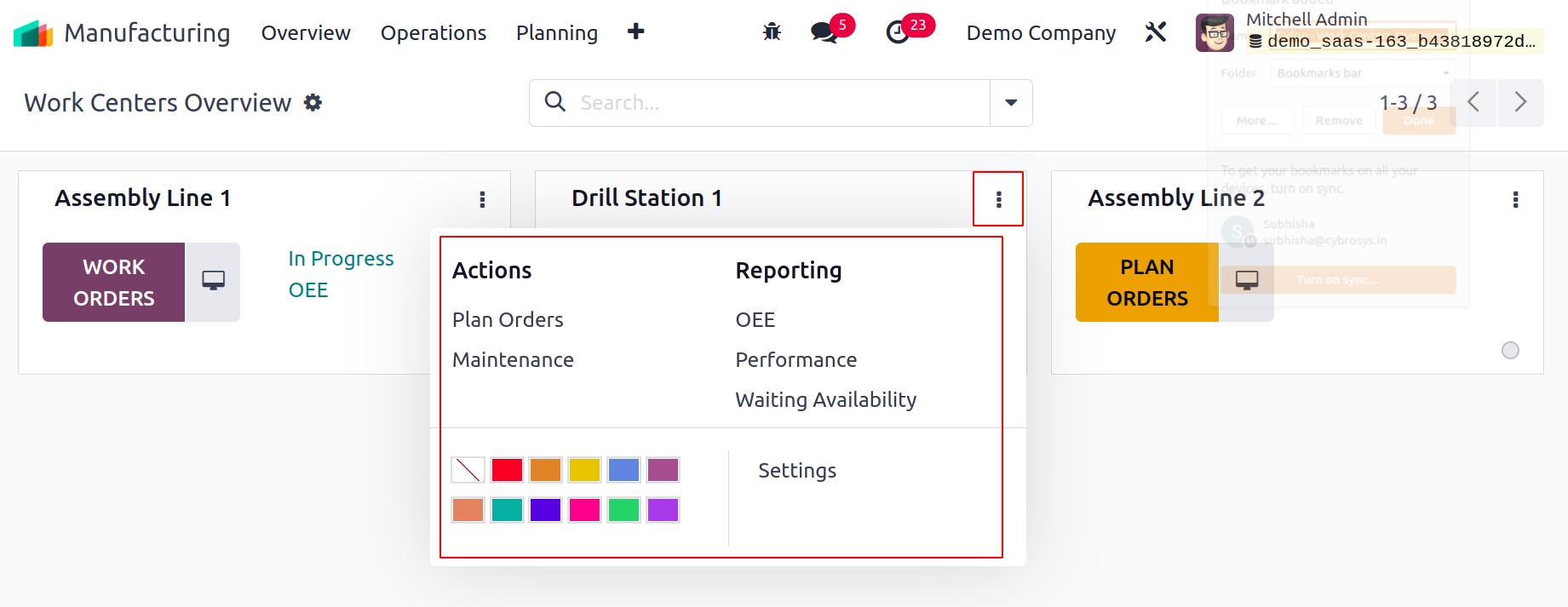

The work centers can be managed directly from this dashboard. You can keep track of all the work orders for the specific work center by using the Work Orders button. You can use the little monitor icon for this. You can access additional operating tools by clicking on the three dots located in the upper right corner of each work center tab, as illustrated below. You can take steps to plan orders and maintenance using this menu.

Additionally, it displays buttons for creating reports on performance, waiting availability, and overall equipment efficiency.

To make the necessary changes to the work center's configuration, use the Settings option. You can see a tiny red dot on the associated work center if the work center is obstructed. There are no active work orders at the specific work center, as indicated by the yellow color of the PLAN ORDERS.

Manufacturing Orders

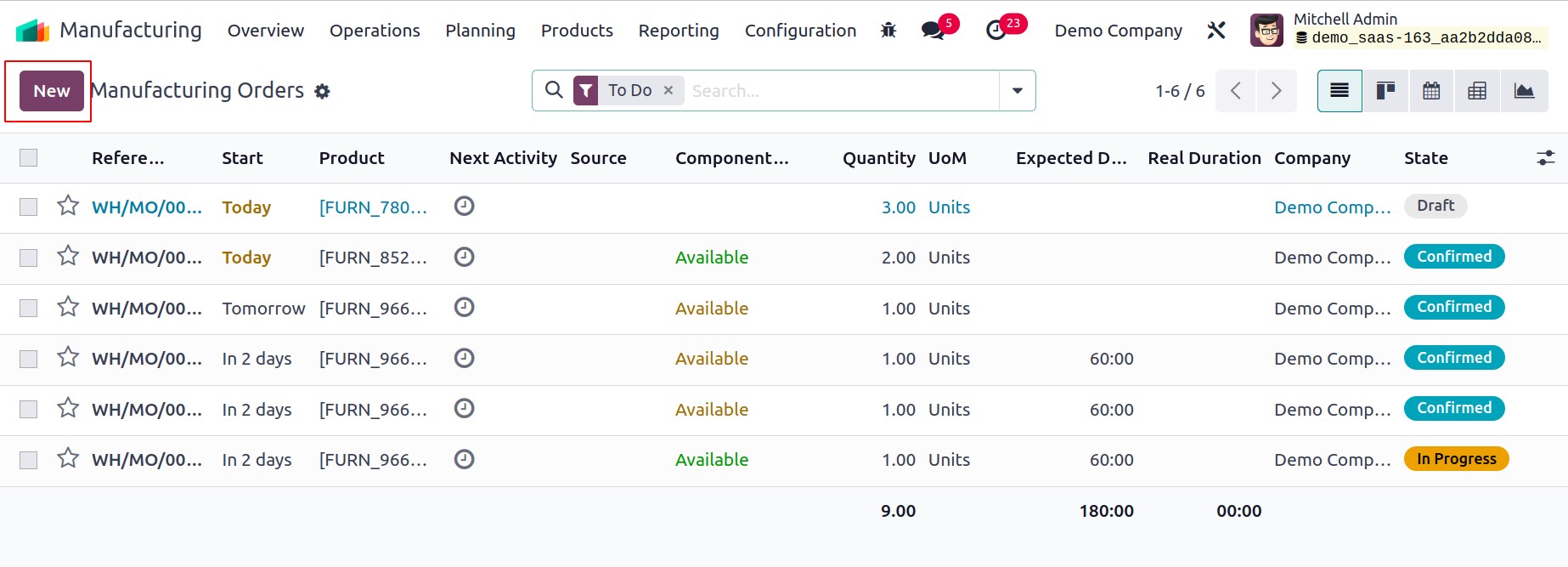

To produce a flawlessly finished product, several activities are included in a production order. All of these procedures can be specified as Work Orders when configuring a manufacturing order in the Odoo17 Manufacturing module. In Odoo17, you may generate production orders to accomplish this. The Manufacturing Orders option may be found in the Manufacturing module's Operations menu. Odoo17 will open the list of manufacturing orders produced in this module when you select this option. For this platform, you can choose from List, Kanban, Calendar, Pivot, and Graphical views.

The list's preview displays information about the manufacturing orders, including the Reference, Scheduled Date, Product, Next Activity Source, Component Status, Quantity, UoM, Expected Duration, Real Duration, Company, and State. Different colors will be used to represent the state.

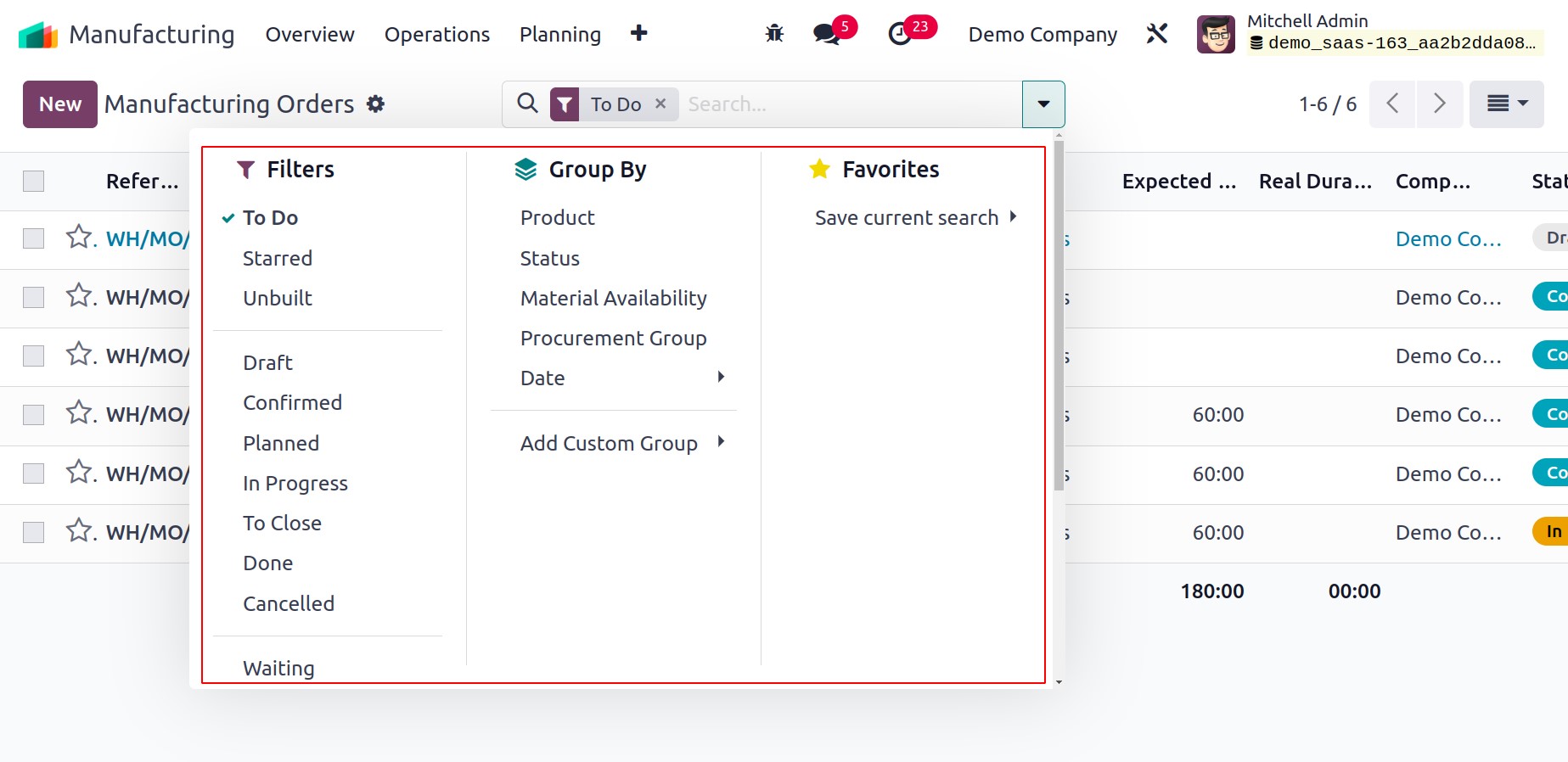

The following filters are available as default selections: To Do, Starred, Unbuilt, Draught, Confirmed, Planned, In Progress, To Close, Done, Canceled, Waiting, Ready, Planning Issues, Scheduled Date, and Warning. Based on Product, Status, Material Availability, Procurement Group, and Scheduled Date, the data is segmentable. Both the Filters and Group By choices come with the customization option.

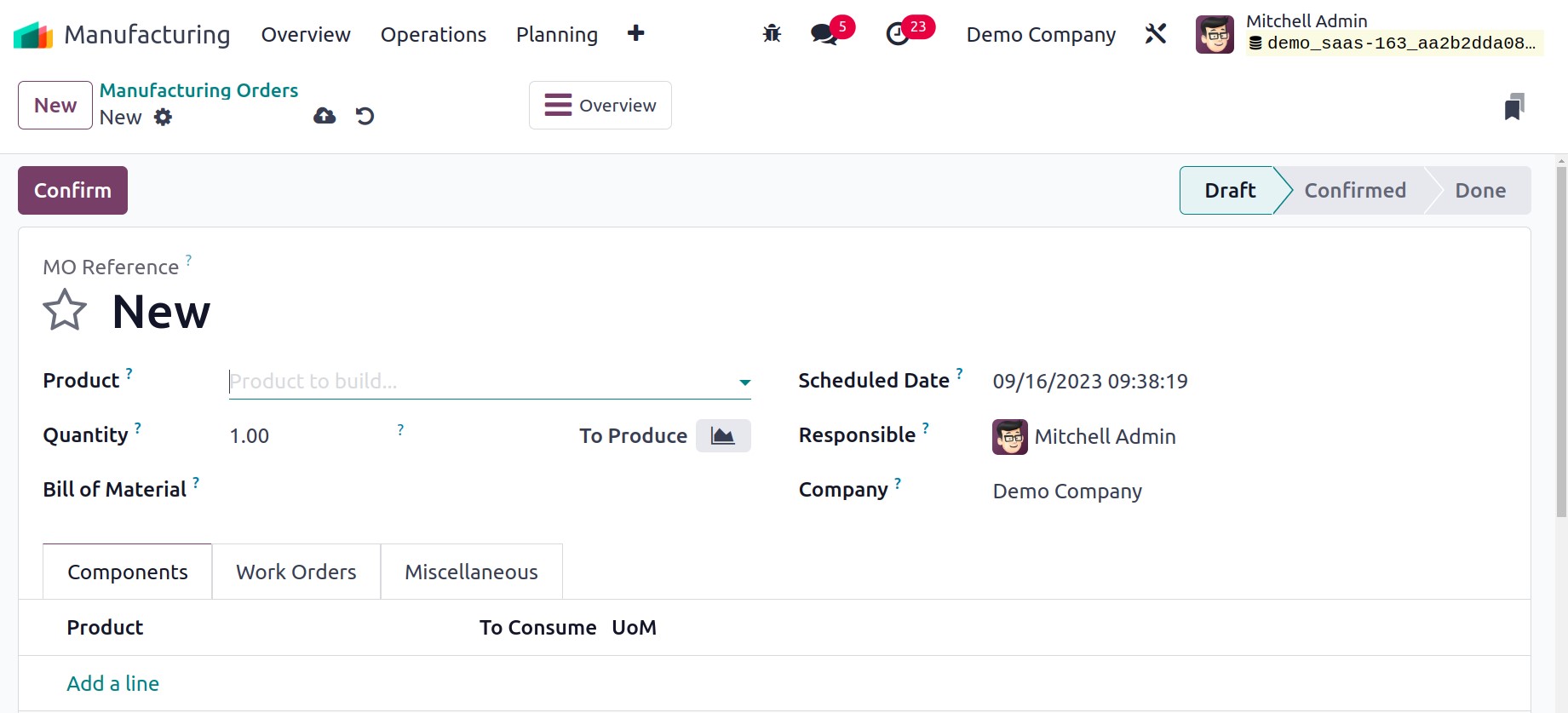

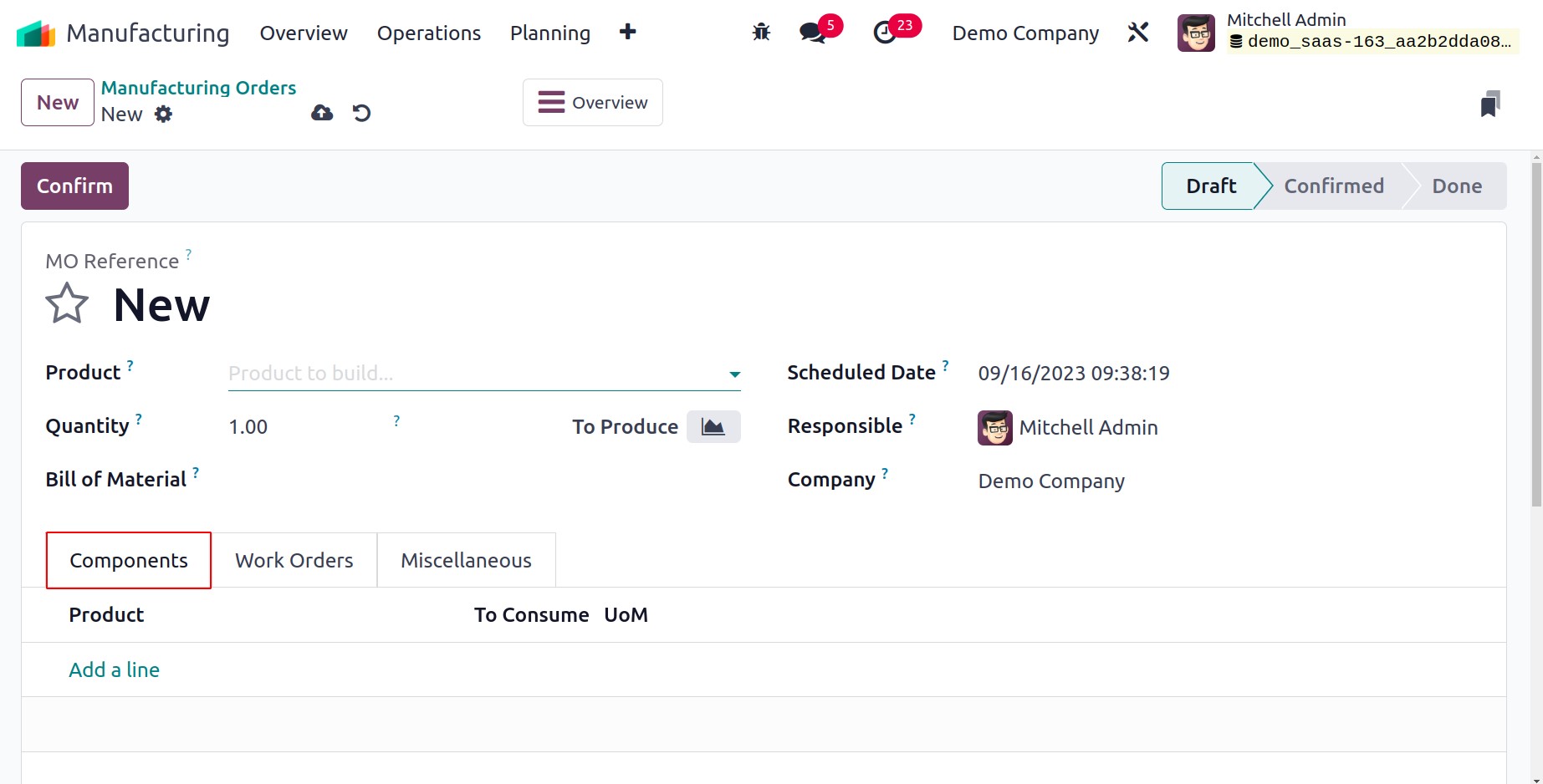

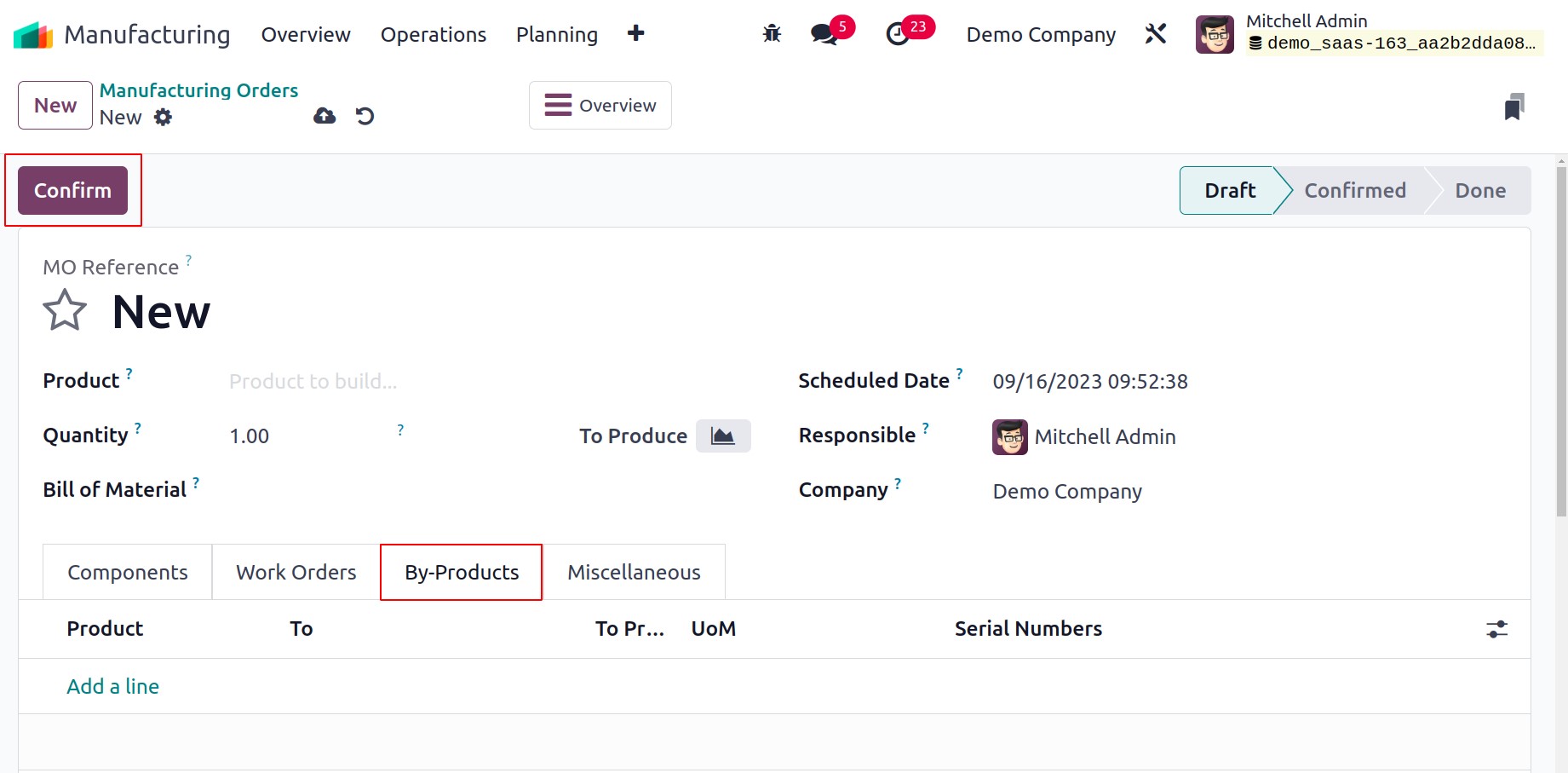

By selecting the New button, a new production order can be created. The following form view will then come up.

You can enter the name of the product you want to make in the Product section. You are able to include the components needed to make a final product in the "Bill of Materials" column. Give the quantity of the product you intend to generate in the Quantity area. The Scheduled Date option allows you to choose the day you intend to begin the product's production. In the Responsible field, designate the Company and an employee who will be responsible for keeping an eye on the progress of this manufacturing order.

You can list each component needed to make this product one at a time in the Components tab by using the Add a Line button. The From field will have access to the components' locations. If you intend to outsource the manufacturing operations, then that location will be a partner location. The number of products from an inventory perspective will be displayed in the To Consume field. Mention the UoM of the individual components along with this.

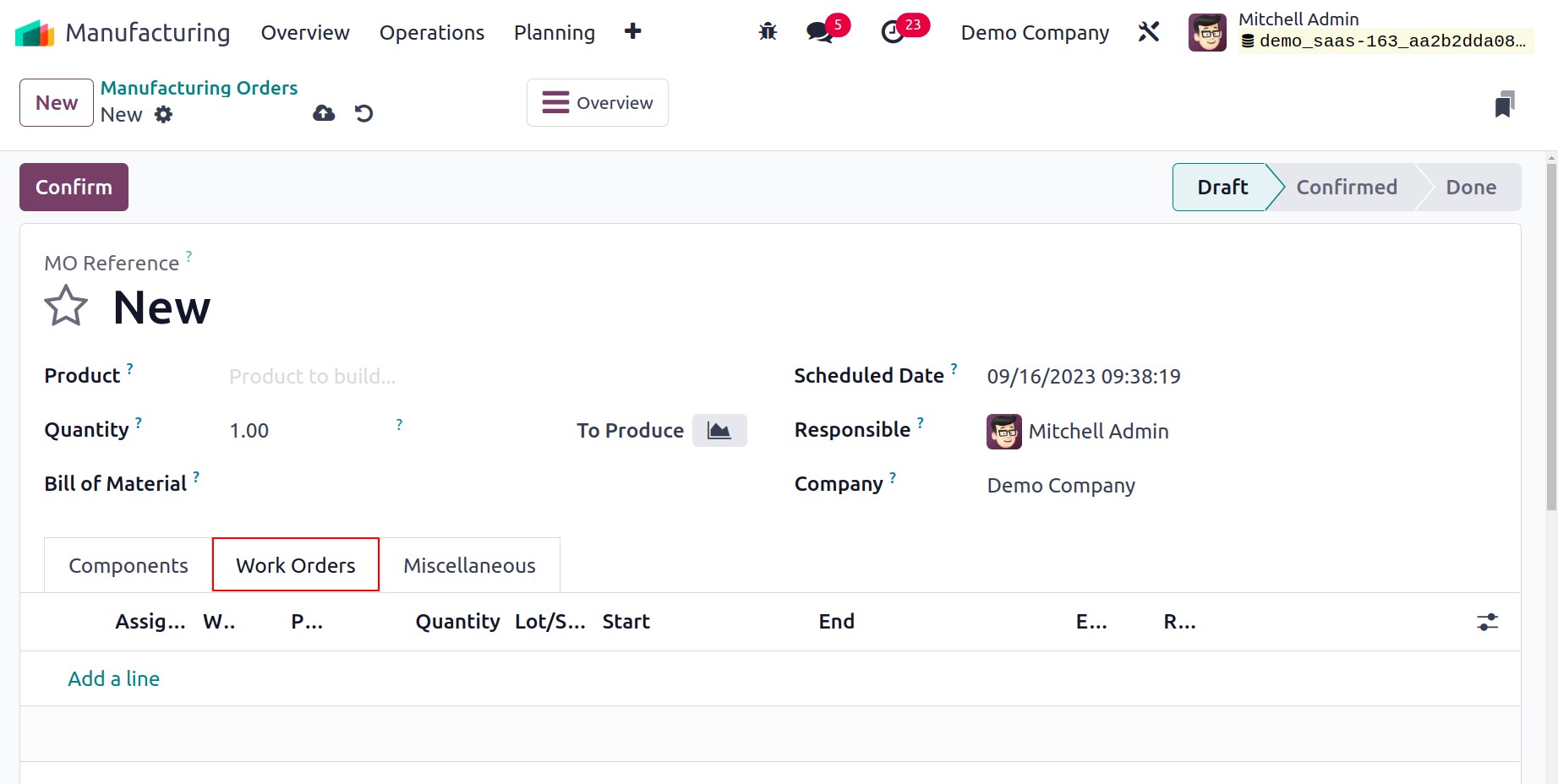

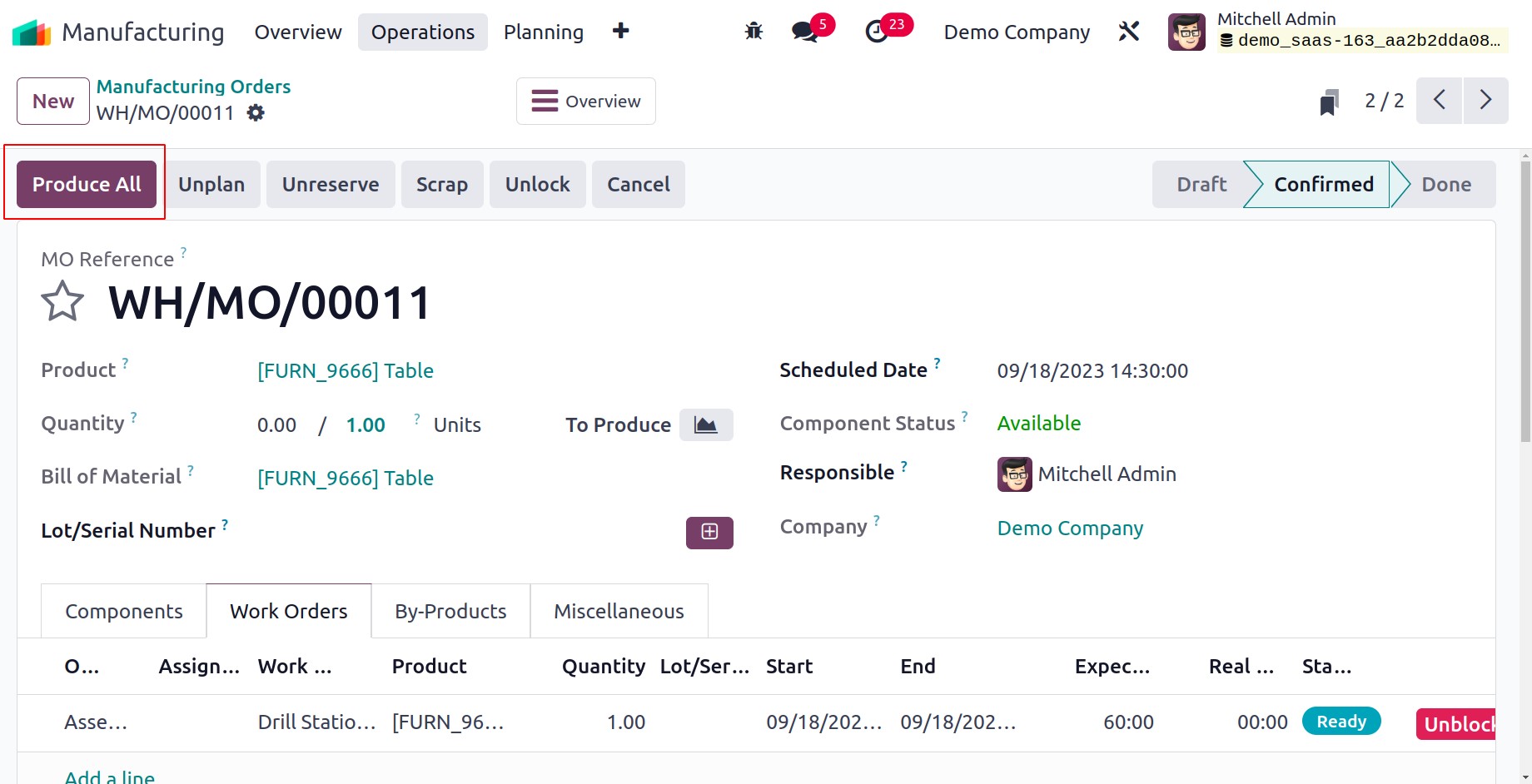

The Work Orders tab can be used to organize the production activities for each work center. You can add the Operation, Work Centre, Product, Quantity, Scheduled Starting Date, and Expected Duration using the Add a Line button. The Real Duration will automatically update after you start the process and confirm the manufacturing order.

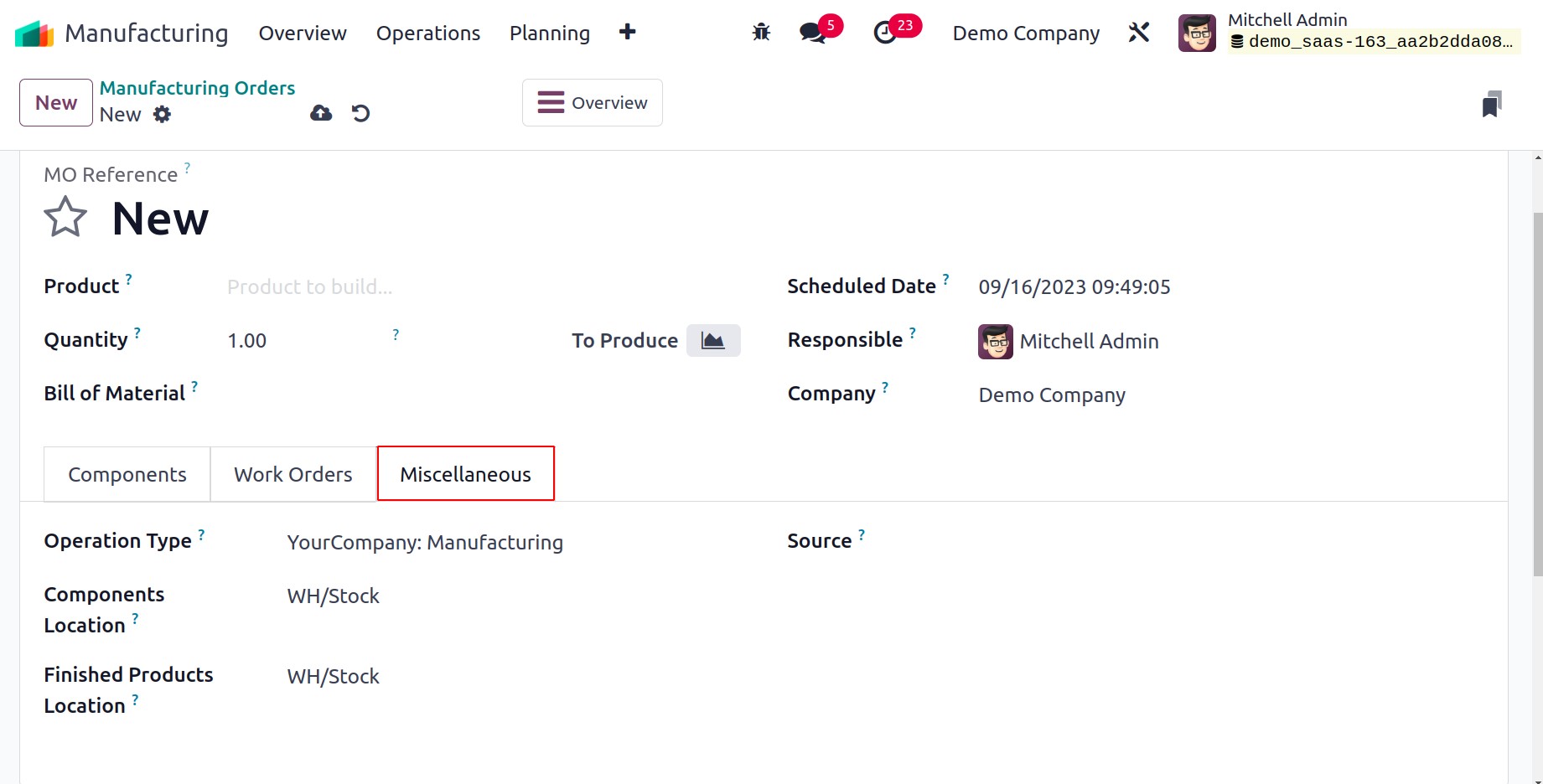

Mention the Operation Type, Components Location (where the product's components are), Finished Product Location (where the system will store the finished product), Source (the document's reference that produced this manufacturing order), and Analytic Account in the Miscellaneous tab. This analytical account will contain the operations cost and consumed items cost entries associated with this manufacturing order.

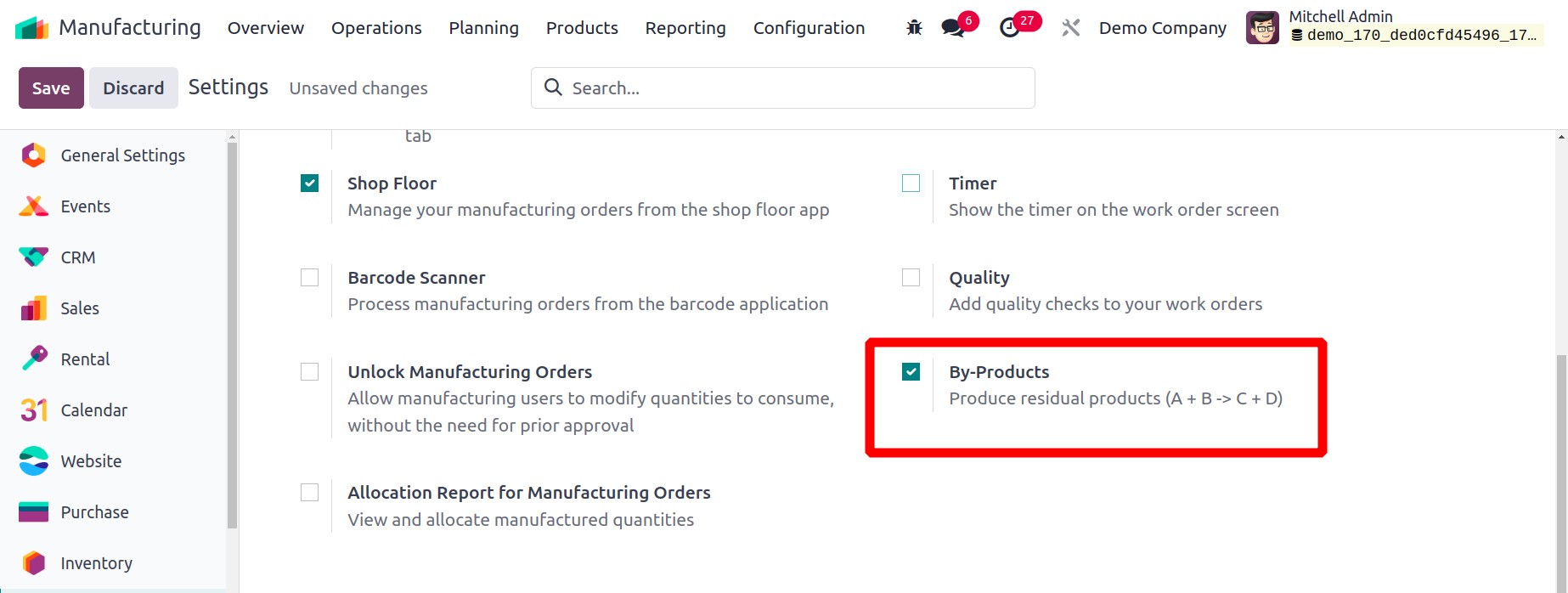

You may occasionally receive some extra products as a result of manufacture. These extra items are regarded as byproducts. You can provide information about the By-products while setting the production order for the primary product. Go to the Settings menu and turn on the By-products option, as seen in the screenshot below, to accomplish this.

You will be able to access an additional tab in the manufacturing order's form view after you activate this feature. Using the Add a Line option, you can individually identify each of the supplementary products that are included with the primary product here.

Click the Confirm button after providing all the information required for the manufacturing order.

You can mark the manufacturing order as done by clicking the Plan All option after the manufacture is finished.

Manufacturing Sustainability A to Z | with ODOO Systems AI

Production Schedule measure effectiveness PLM;Quality ChecksEquipment Maintenance;calculate manufacturing costs

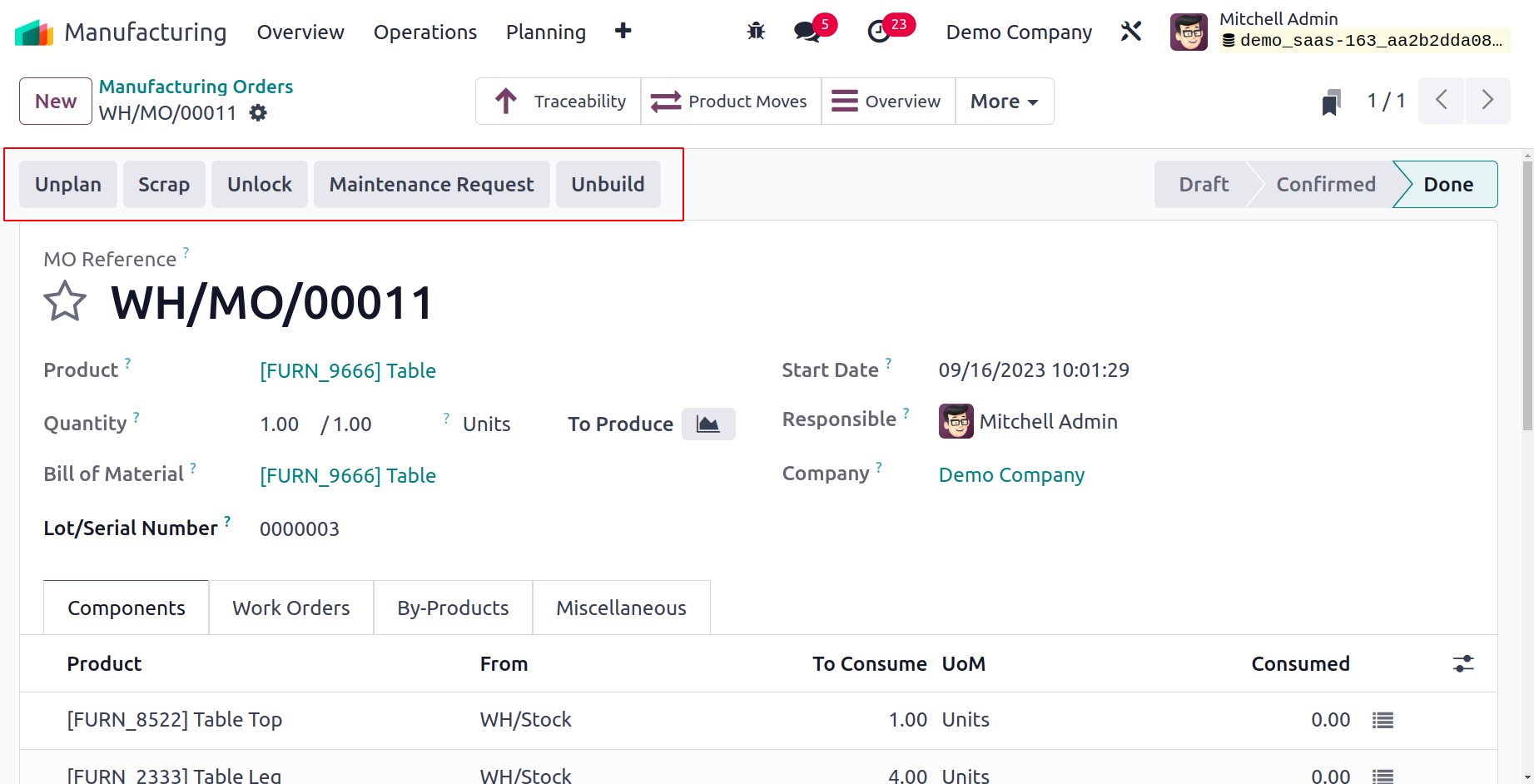

By creating a Maintenance Request, you can send the created goods to maintenance if you discover any defects. You can create a new maintenance request in a new window by clicking this button. While describing the Maintenance module, we will go through how Odoo17 handles maintenance requests.

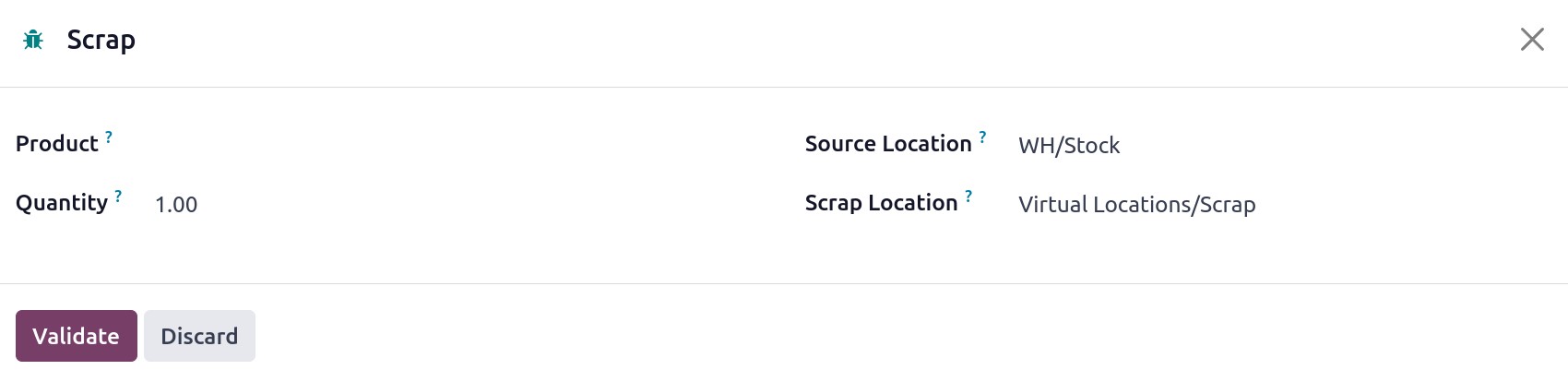

By selecting the Scrap button, you can send the product to the scrap pile if it is wholly ruined. The product, quantity, source location, and scrap location must all be mentioned in the pop-up box that appears. The damaged item will be transferred to the designated scrap location once you click the Validate button.

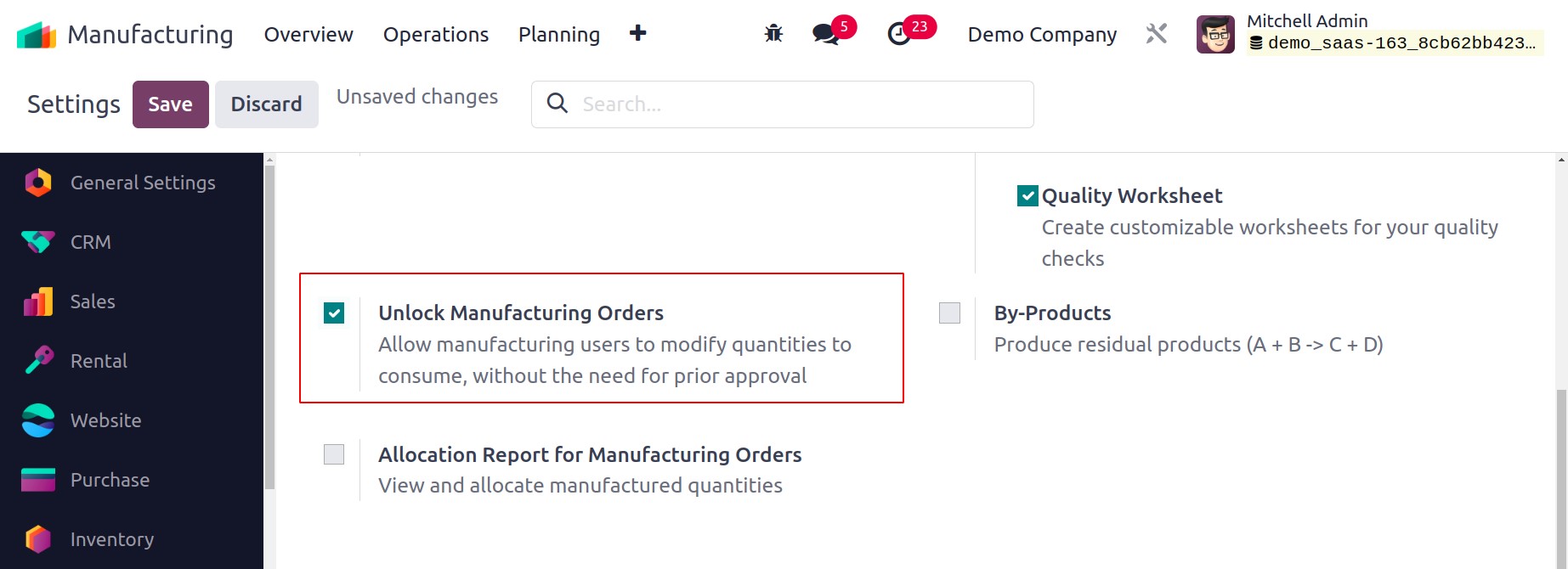

You may activate the Unlock Manufacturing Orders option in the module's Settings menu. By turning on this option, you can alter your consumption amounts without obtaining previous consent.

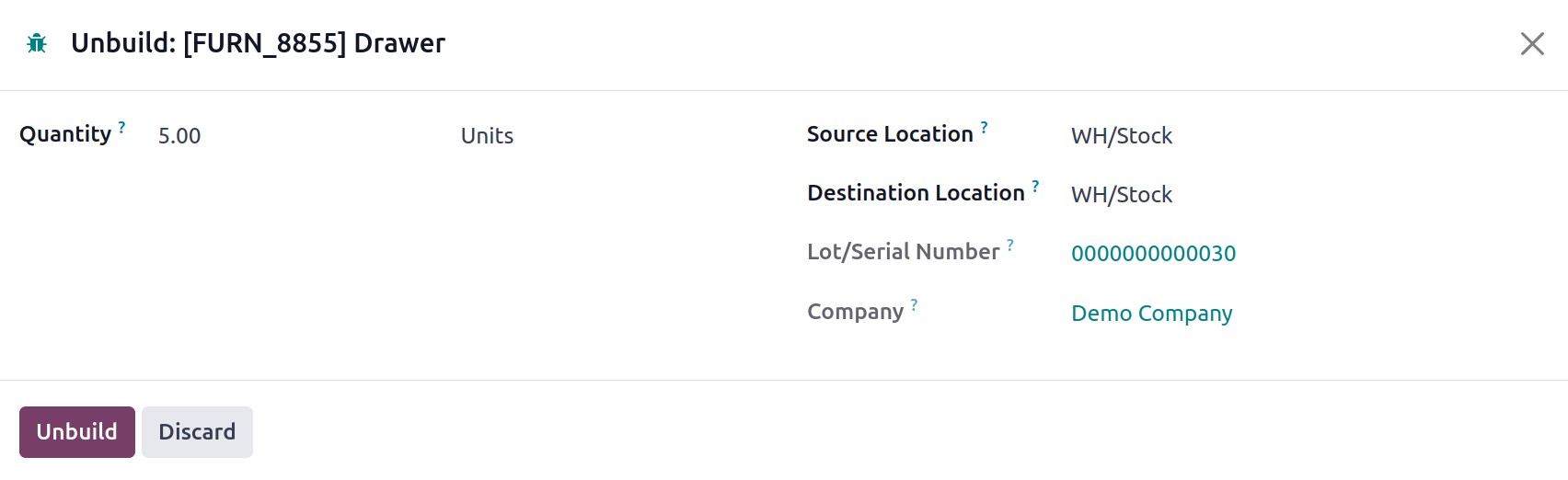

You can adjust the quantities as necessary by clicking the Unlock button. You can unbuild the produced good and log its data by using the Unbuild button.

Here, you must include the quantity of the product to be disassembled. The Source Location field allows you to specify the location of the product you wish to unbuild. You'll decide where to send the components that arise from the unbuild order based on the destination location. Select "Unbuild" from the menu.

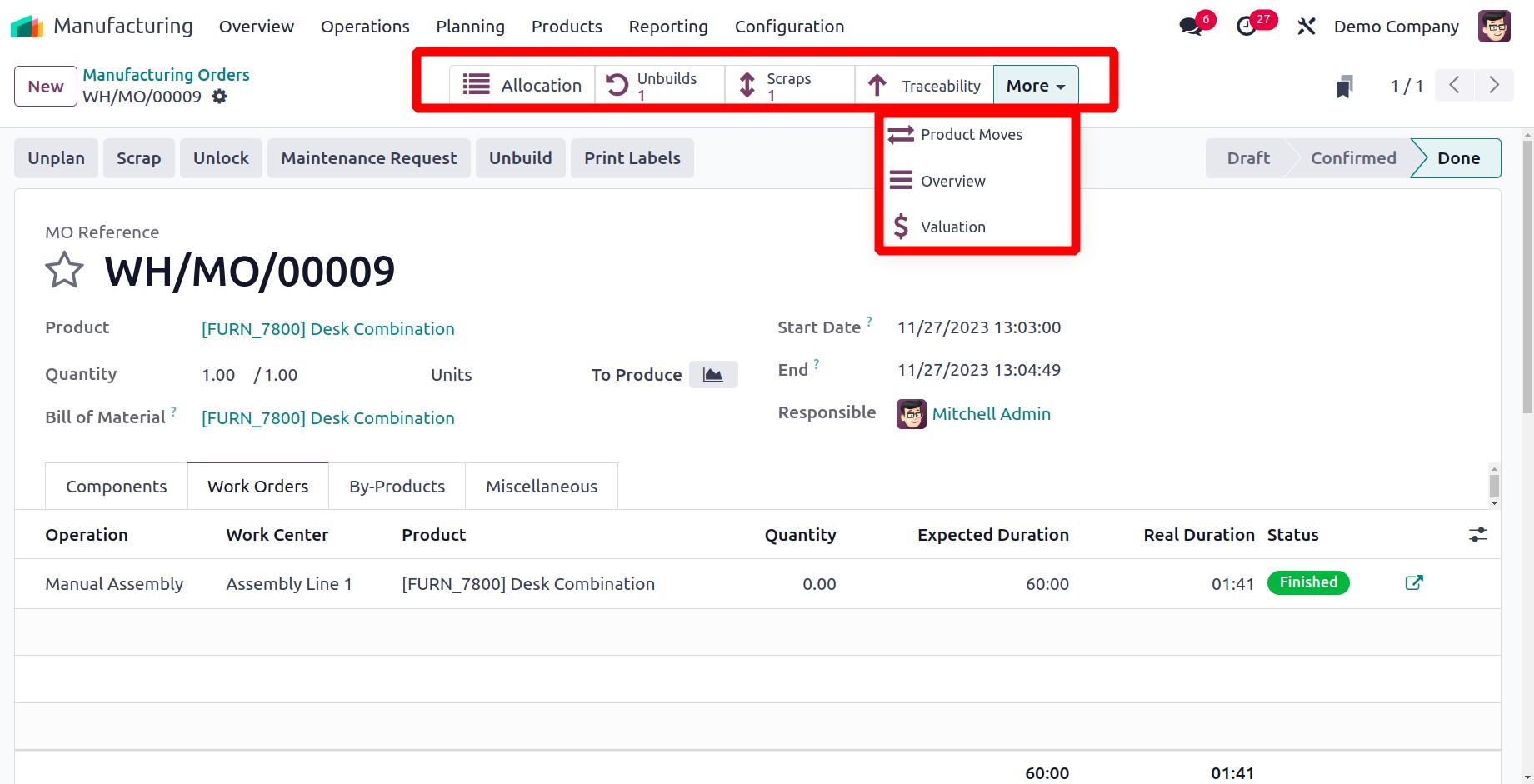

In the manufacturing order's form view, there are sophisticated smart buttons that you may use to track different procedures.

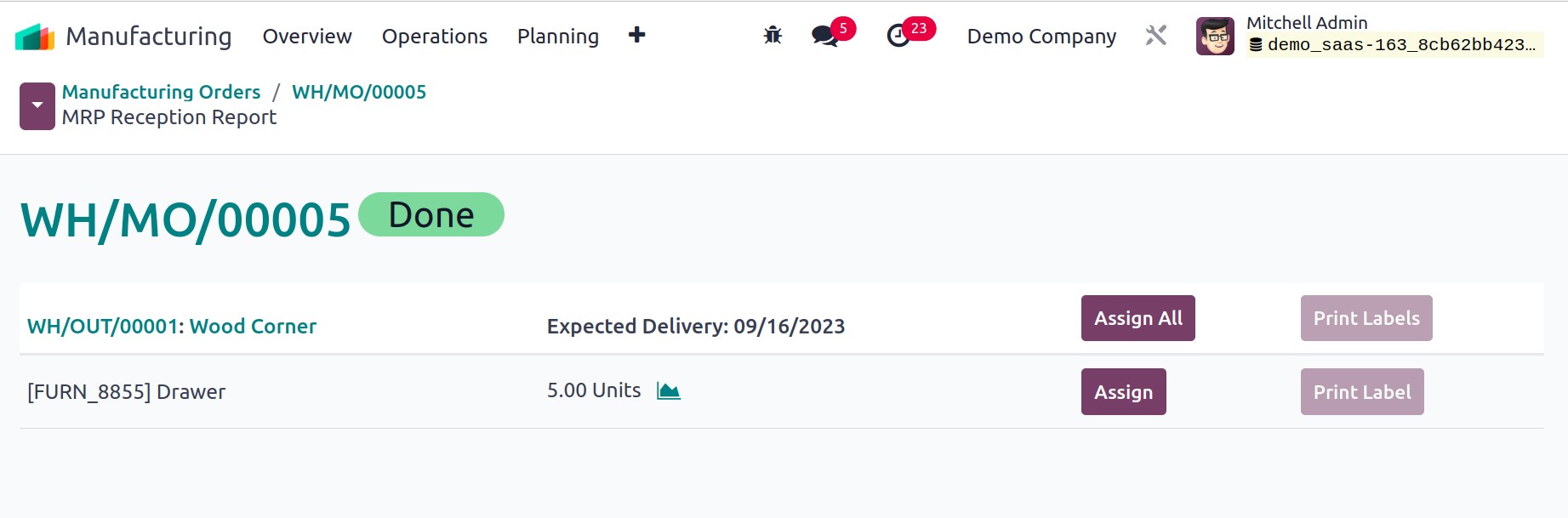

The Allocation button, when clicked, displays the product's Reception Report. You can assign the product to orders using the Assign button.

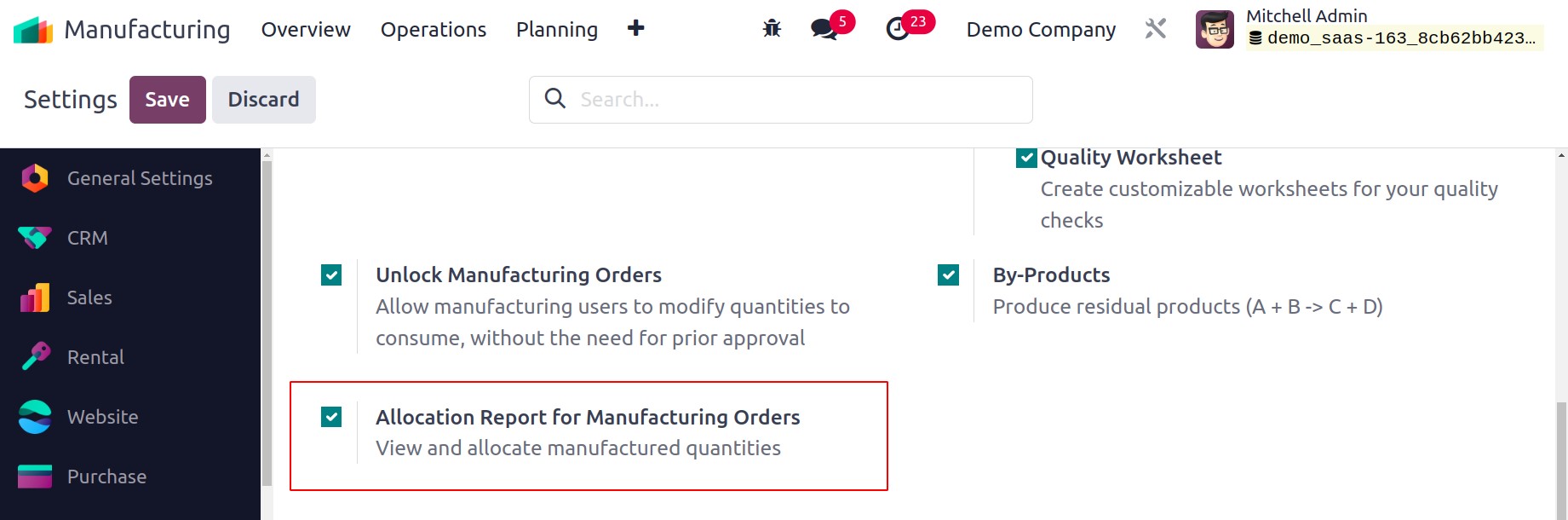

You can activate the Allocation Report for Manufacturing Orders from the module's Settings menu to receive the Allocation Report for the manufactured amounts. You'll be able to see and assign manufactured goods thanks to this.

The Child MO button allows you to view the manufacturing orders for the main product's constituent parts. Referencing, Scheduled Date, Product, Next Activity, Source, Component Status, Quantity, UoM, Expected Duration, Real Duration, Company, and State are all displayed.

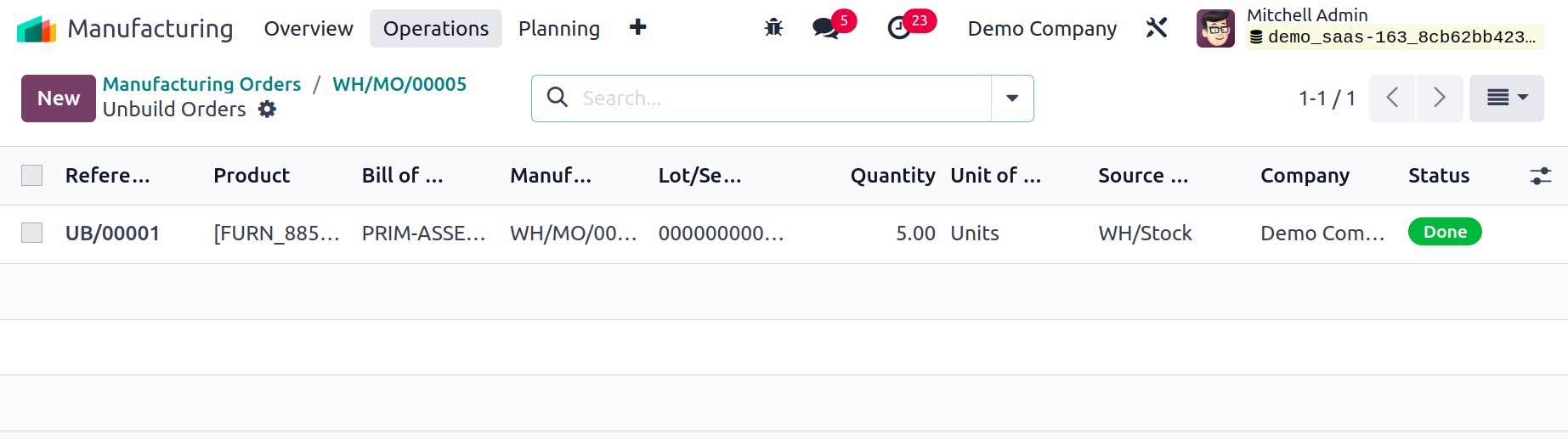

To view the Unbuild Orders, click the Unbuilds button. The reference, product, bill of materials, manufacturing order, lot/serial number, quantity, unit of measurement, source location, company, and status are all displayed in the list of unbuilt orders.

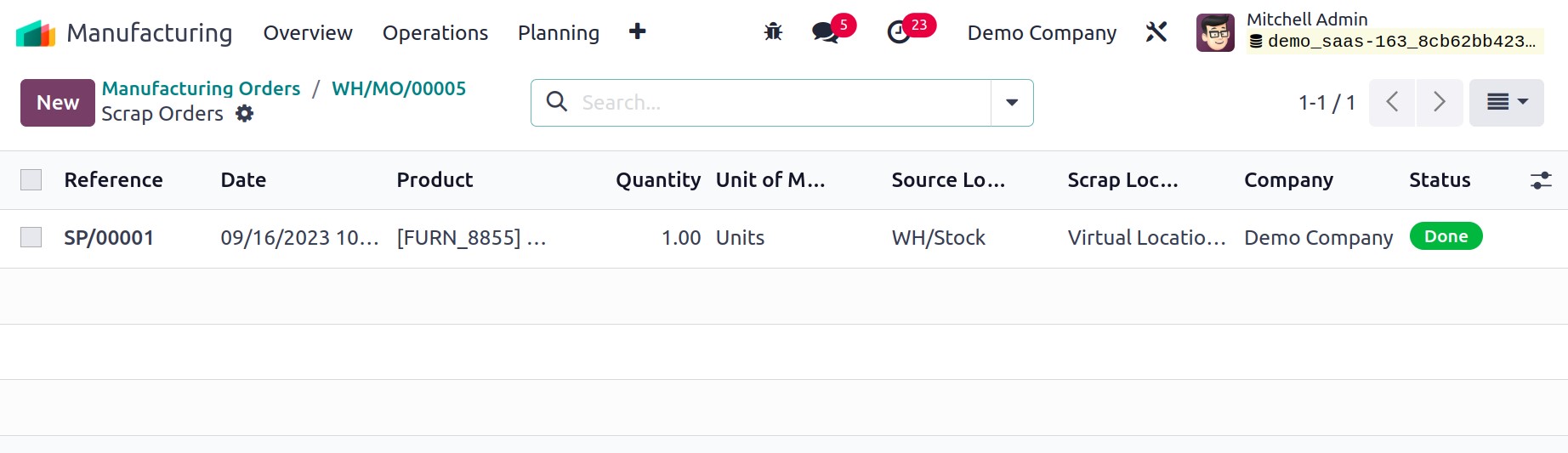

By selecting the Scrap option, you may view the orders for scrap. The pane displays the Reference, Date, Product, Quantity, Unit of Measure, Source Location, Scrap Location, Company, and Status, as seen in the illustration below.

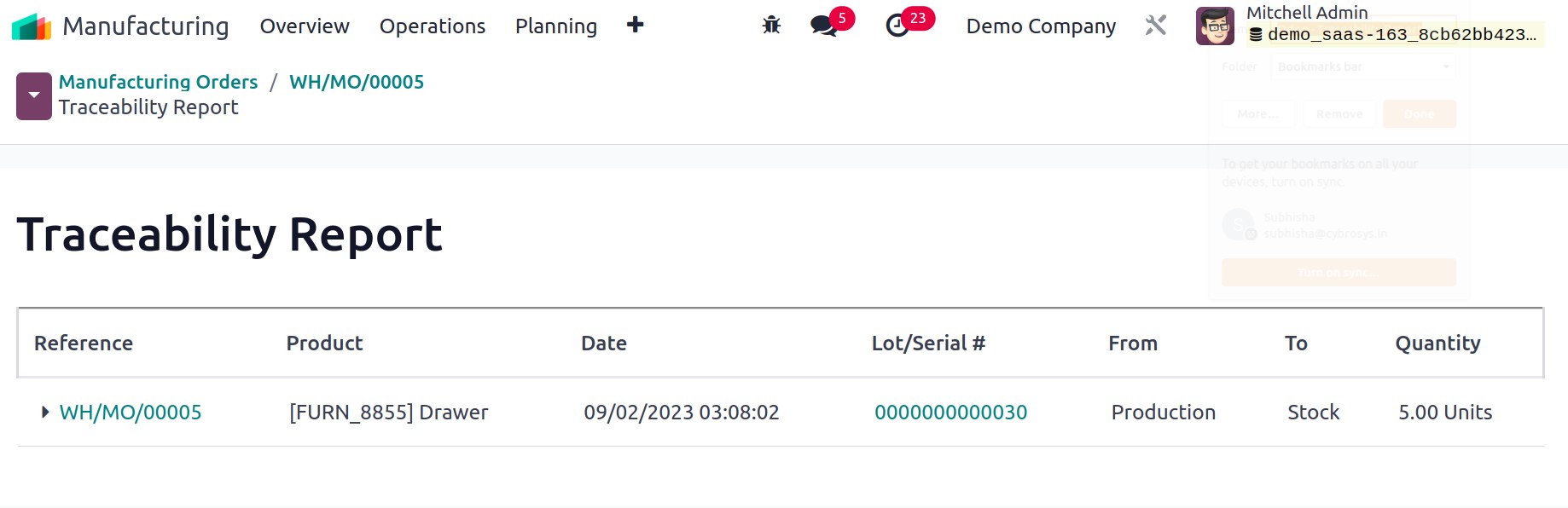

Using the Traceability button, you can create a report detailing the product's traceability. The report displays information on the product's Reference, Product, Date, Lot/Serial, From, To, and Quantity.

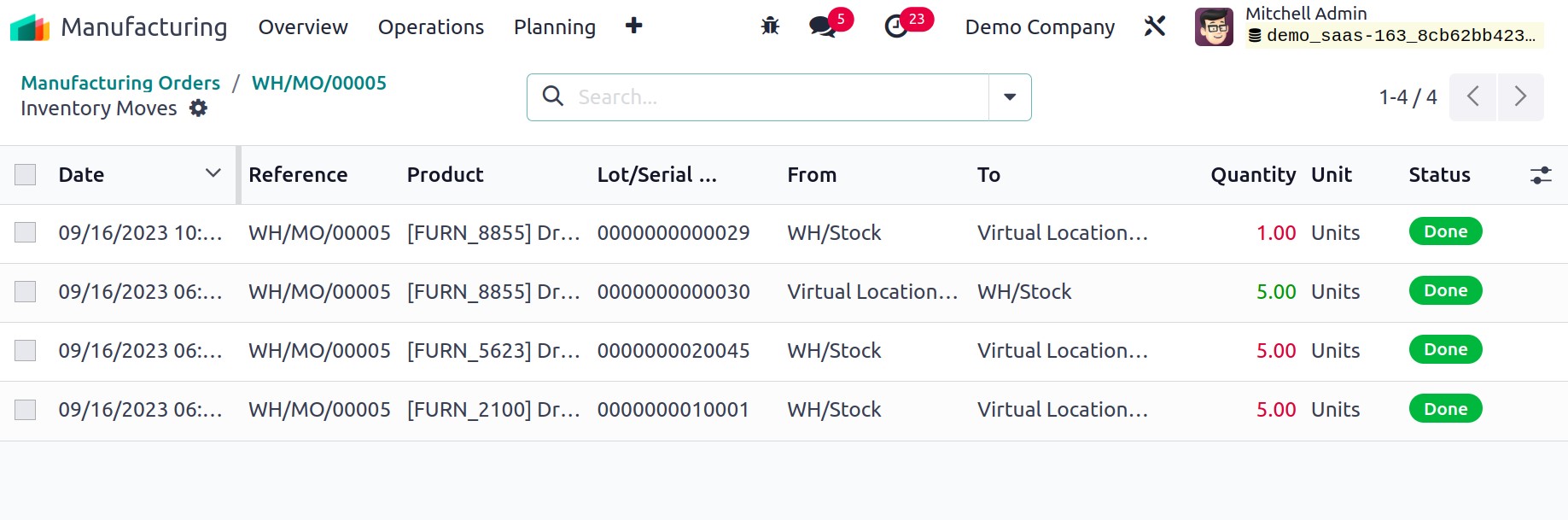

The Product Moves button can be used to examine the product's inventory moves. The window displays information about the product and its parts, including the Date, Reference, Product, Lot/Serial Number, From, To, Quantity, Unit, and Status.

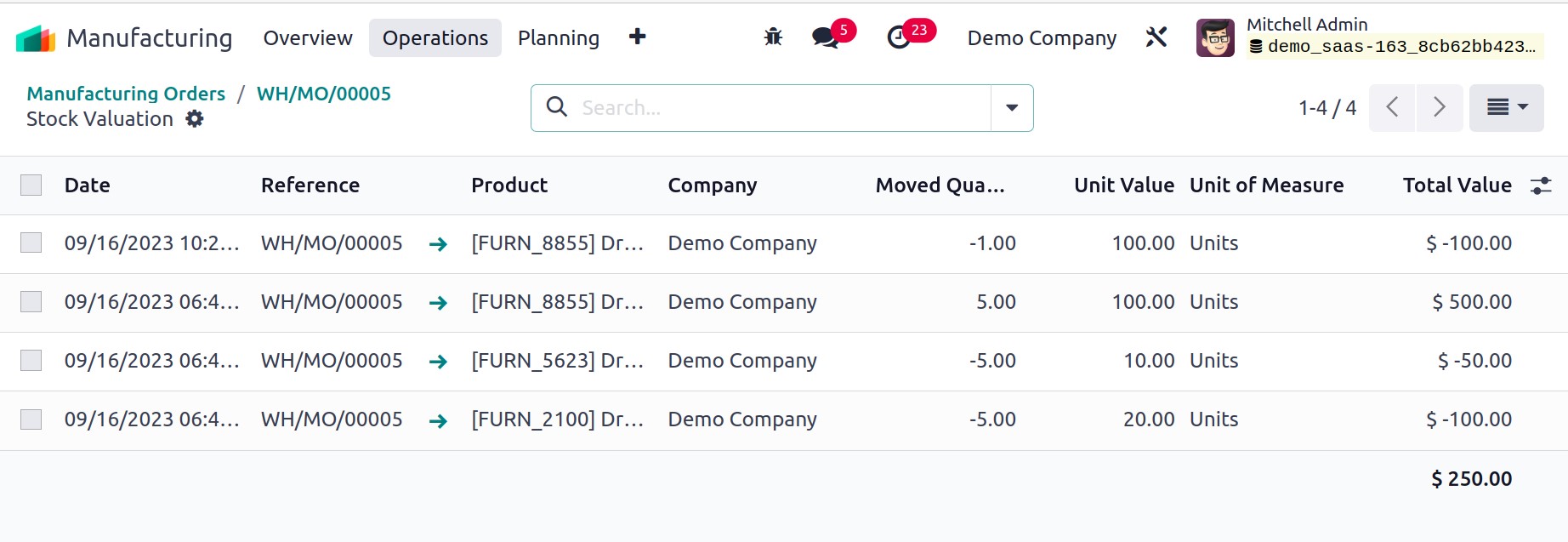

By selecting the Valuation button, you may carry out a stock value of the product and its parts. Details about the Date, Reference, Product, Company, Moved Quantity, Unit Value, UoM, and Total Value are provided in the Stock Valuation window.

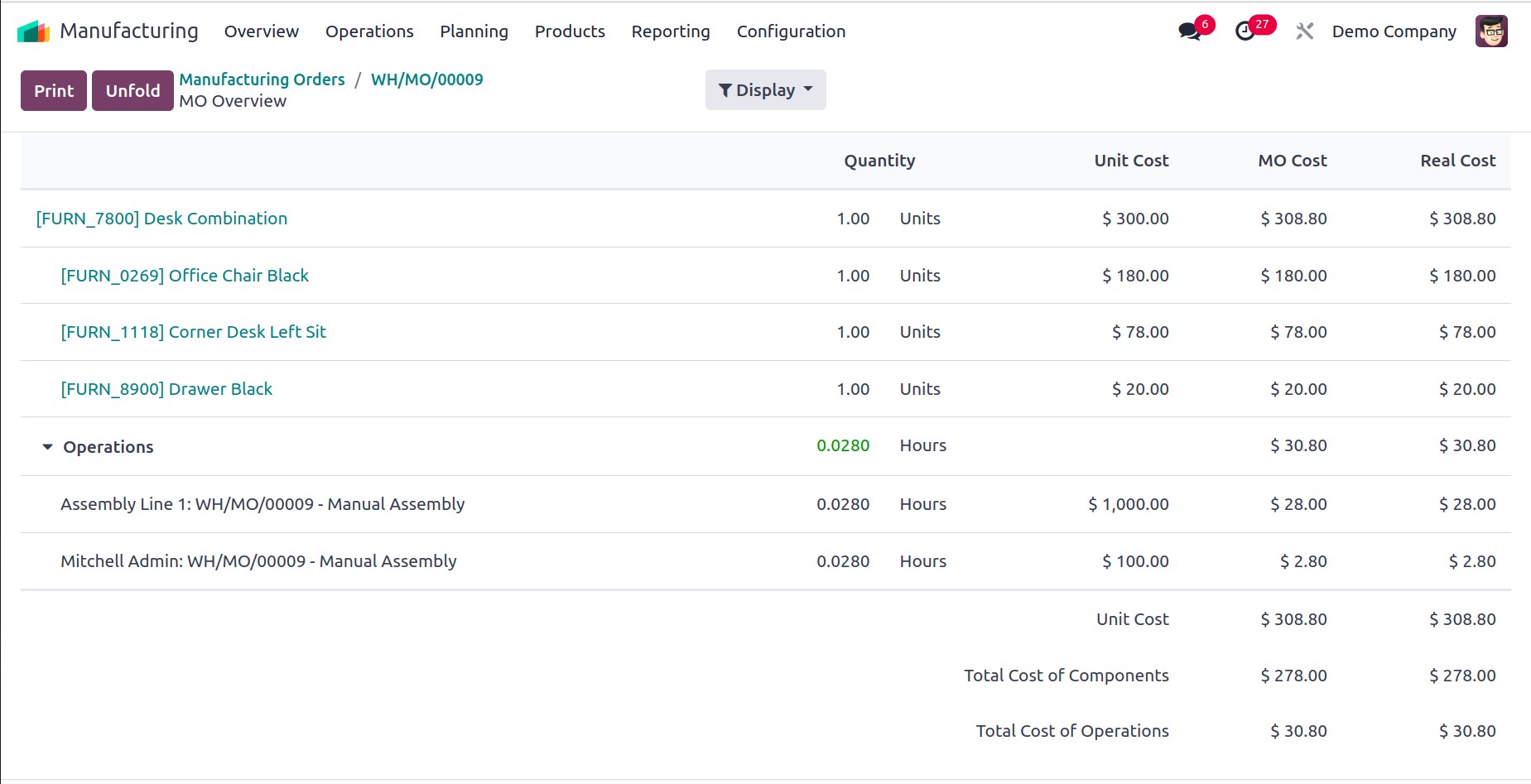

An Overview report will be produced when you click the Overview button, as illustrated below. In this report, you may see the cost of the components and cost of the Operations separately.

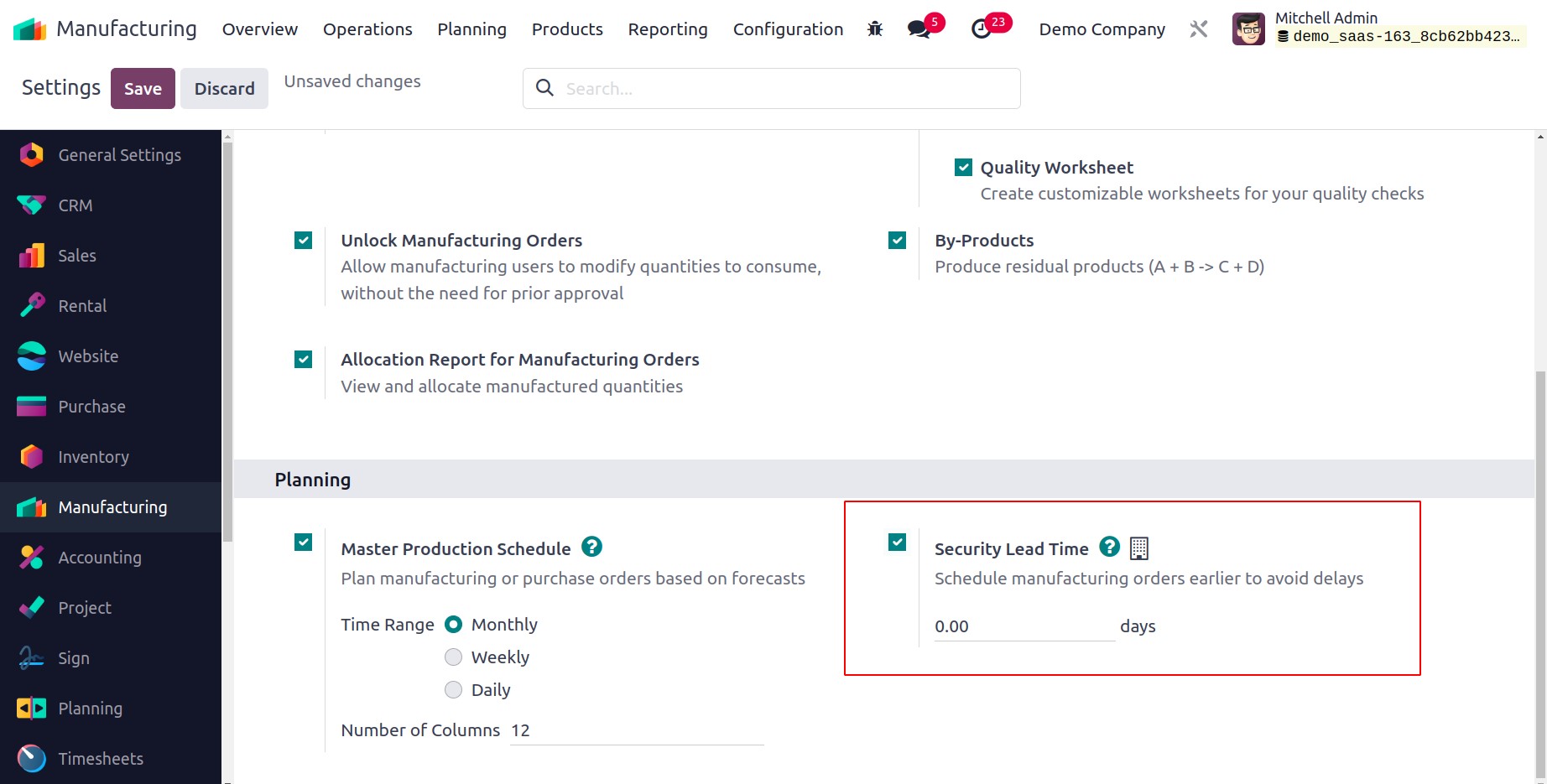

You can find the Security Lead Time function in the Manufacturing module's Settings menu.

This function can be turned on to arrange production orders for a particular day in advance. In order to avoid delays, the number of days can be specified here, and the manufacturing deadline will be set early.

Manufacturing Sustainability A to Z | with ODOO Systems AI

It doesn’t matter what industry you work in or what types of finished products or goods you produce: you always want to maximize your efficiency in a manufacturing setting. But finding the areas that can help you increase your efficiency isn’t always easy, especially if you think you’re already working at your highest level of efficiency.

Common mistakes to avoid

However, new manufacturing entrepreneurs often fall into a handful of traps when creating their business plans.

- Not doing enough research – You can’t know everything about your industry, but you should do your best to understand as much as you can before writing your business plan. This means talking to experts, reading trade publications, and studying the competition

- Not being realistic – It’s important to be optimistic when starting a new business, but you also need to be realistic. This is especially true when it comes to financial projections. Don’t overestimate the amount of revenue you will generate or underestimate the costs of goods sold

- Not having a clear understanding of your target market – You need to know who you are selling to and what needs or wants your product or service will address. This market analysis should include information on your target customer’s demographics, psychographics, and buying habits

- Failing to understand your competition – You need to know who your competitors are, what they are offering, and how you can differentiate yourself. This information will be critical in developing your marketing strategy

- Not having a clear vision for the future – Your manufacturing business plan should include a section on your long-term goals and objectives. What does your company hope to achieve in the next five years? Ten years? Twenty years?

Creating a business plan for manufacturing can be simple. It can be quite simple if you break it down into smaller pieces.

Once you have it in place, staying on track can be quite a bit more difficult. By using ERP software like odoo , you can track all of your key metrics in real time, avoid any potential issues, and make course corrections as needed.

To start following your plan and creating a successful manufacturing company, get a odoo demo today.

Manufacturing Accounting Explained

Manufacturing accounting deals with all the expenses encountered in making physical goods, which, in any sizable manufacturing business, means an extraordinarily high volume of individual transactions. The accounting process begins by accumulating the costs to buy, hold and use raw materials. It goes on to encompass the costs of direct labor and the production activities that convert raw materials into finished goods. Finally, manufacturing accounting aggregates all of a company’s manufacturing overhead costs and develops a reasonable and systematic way to allocate them to the various products the company makes. All of these component costs are used to value finished goods inventory, which are the products considered ready for immediate sale or stored for future sales.

What’s Different About Manufacturing Accounting?

Unlike the broader discipline of financial accounting, which is charged with reporting all of a business’s activity in financial statements, manufacturing accounting takes a narrower view — it’s limited to the costs incurred during the production process. But that narrow scope does not mean it’s simple. Not only must manufacturing accounting track a high volume of transactions, but it also requires accountants to have a solid understanding of manufacturing operations. Eight other hallmarks of manufacturing accounting are explored here.

Cost Classifications

One of the most fundamental characteristics of manufacturing accounting is proper cost classification. This means identifying and recording, in many separate categories, all of the different costs for direct materials, direct labor and the manufacturing overhead expenses that arise from the production process. Cost classifications are typically embodied by a specialized chart of accounts, so that transactions are categorized appropriately.

Matching Principle

The matching principle is a primary tenet of U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). The matching principle states that an expense should be reflected in the same fiscal period as the revenue it supports. This is a key principle for all GAAP- and IFRS-compliant businesses. But it’s even more important for manufacturers, because they incur significant costs to make a product in advance of selling that product. Without the matching principle, manufacturers would report misleading swings in net income because expenses would be reflected in one fiscal period and revenue in another.

Cost Allocation

Cost allocation is the process of assigning expenses to a particular project or activity. For manufacturers, this involves attributing the various cost categories, like raw materials, to the right finished product. Allocating all manufacturing expenses to the appropriate products helps a business understand its costs, which is the first crucial step in setting sales prices that cover costs and achieve a desired profit.

Inventory Valuation

Inventory is a significant asset on a manufacturer’s balance sheet, so it’s important to value it properly. Manufacturers have three types of inventories: raw materials, finished goods and works in progress. For each type of inventory, there are two factors that impact inventory valuation: the physical count of items and the value of each item. Determining the volume of items involves physically tracking those items through periodic counts and using inventory management software. The inventory valuation process assigns a fully allocated cost to the items, using one of the common valuation methods — first in, first out (FIFO), last in, first out (LIFO), weighted average cost (WAC) or specific identification (SI).

Overhead Allocation

Overhead is a catchall term for all the indirect costs involved in the manufacturing process, such as rent, insurance and taxes for the factory; supporting labor, like factory security personnel; and supplies (and other small components) used to make products. While overhead isn’t as clearly connected to the manufacture of each product as are raw materials, for instance, it can be as significant a cost. Overhead costs are aggregated and then allocated to products for inclusion in the product’s total costs. There are many methods for allocating overhead. In general, manufacturing accountants develop a rate using an appropriate allocation base, such as machine hours or labor hours, to allocate overhead costs.

Work-In-Progress (WIP) Accounting

WIP inventory is one of the three types of inventories included on a company’s balance sheet. WIP covers products that are partially complete — they are no longer just raw materials, yet they aren’t finished goods. This type of inventory presents a unique valuation challenge. Manufacturing accountants typically estimate the value of WIP inventory using the percentage of completion method, which applies an average or standard cost based on the stage of completion. Valuing WIP requires intimate knowledge of the production cycle and can become especially complex when there are multiple batches of many different products.

Variance Analysis

One of the objectives of manufacturing accounting is to provide useful information to measure and monitor the costs of production. Variance analysis, which is the comparison of two data points followed by a qualitative investigation into the difference between them, is one way manufacturing accountants deliver on that objective. It’s common for cost accountants to regularly prepare a package of several variance analyses to give managers a detailed account of how the production process is going. Some examples include comparing planned (budgeted) costs to actual costs, or standard labor hours per unit to actual, or overhead rates in the current period to those incurred in the previous year. Automated reports help save preparation effort, so that more time can be spent probing the variances.

Industry Regulations

Like businesses in other industries, manufacturers must deal with differing sets of regulations from various agencies. The accounting team must stay current on GAAP rules and IRS regulations, both of which are always changing. Many manufacturing companies must comply with GAAP (or IFRS, if outside the U.S.) to satisfy requirements of lenders and investors, or if they are public companies. That requires using accrual-basis accounting for financial statements and adhering to uniform capitalization (UNICAP) rules from the IRS, which, like accrual-basis accounting, requires that overhead costs be capitalized into inventory. Though these rules change fairly often in small ways, significant changes do occur from time to time, such as when UNICAP thresholds were raised as part of the 2017 Tax Cuts and Jobs Act (TCJA). That change gave many more small, private companies the option to use cash-basis accounting, which does not adhere to the matching principle — it simply records revenue and expenses at the time cash is exchanged. That streamlines manufacturing accounting — but also reduces the accuracy of financial reporting.

What Type of Accounting Is Used in Manufacturing?

Manufacturing accounting primarily uses cost accounting to measure and analyze production activity to help managers make decisions. Because cost accounting is intended for an internal company audience, it doesn’t need to adhere strictly to GAAP, so is usually tailored to the unique needs of the business. Cost accounting information is often used in budgets, constraint analysis and margin analysis.

Budgeting [h3]

A budget, of course, is a set of financial documents that shows what a company plans to do in an upcoming fiscal period. It’s the financial manifestation of the company’s strategic plans, so it is built using estimates that are based on historical data, trends, business strategy and predicted demand. Cost accounting provides the data to make reasonable estimates for materials, labor and overhead, which are key components in a manufacturer’s budget.

Constraint Analysis

Just as cost accounting helps manufacturers identify potential issues in their manufacturing process, constraint analysis aims to increase a manufacturer’s output or profitability by analyzing and rectifying any process bottlenecks and limitations. Manufacturing accounting provides data that can help uncover points of rising costs within the production cycle.

Margin Analysis

A manufacturer’s gross margin is one of its most important metrics. Gross margin is the percentage of revenue left over after subtracting COGS. It shows whether the manufacturer is making or losing money, on a direct basis, on every unit it sells. Manufacturing accounting is keenly focused on all elements of COGS, including raw materials, direct labor, supplies, factory overhead and freight-in costs.

Types of Manufacturing Cost

Manufacturing accounting uses a long list of special terms to describe the various types of costs. It can get confusing, but bear in mind that they all reflect different combinations of the three costs of production: raw materials, labor and overhead. Here’s the breakdown.

Total Manufacturing Cost

Total manufacturing cost (TMC) is an inclusive term representing all the costs of producing an item. It is the sum of all the direct and indirect costs inherent in making a finished product.

- Direct costs: Direct costs are those that are tied to producing a specific product, and they fall into two categories: direct materials and direct labor. Direct materials are the components or raw materials that go into the product, such as fabric for clothing, silica for computer chips or lumber for furniture. Direct labor comprises all payroll costs for personnel involved in production of a product, such as a seamstress, carpenter or assembly-line workers. Payroll costs include all compensation for those workers, from wages and overtime to payroll taxes and the employer portions of benefit costs.

- Indirect costs: Also known as manufacturing overhead, indirect costs are all the costs involved in the manufacturing process that aren’t directly traceable to a particular product. Overhead includes supporting manufacturing costs, such as rent, depreciation of production equipment and buildings, real estate taxes for the factory, equipment repairs and factory security. There can be many different indirect manufacturing costs, and their classification can sometimes get fuzzy, such as with supplies that are considered de minimis, or lacking importance, like screws for a furniture manufacturer. In these situations, it’s important to handle them consistently. Indirect costs are aggregated and then allocated to each unit of production, using a standard allocation methodology, since they cannot be directly attributed.

Factory Profit/Loss

Unlike the other metrics discussed in this section, factory profit/loss is a key performance indicator (KPI), not a value used in financial reporting. It helps management assess whether it is more profitable to manufacture a product or purchase it from wholesalers, in whole or in part. The factory profit/loss KPI reflects the difference between an item’s TMC and the market value that a manufacturer would have to pay to buy the item (usually considered its wholesale price). For example, consider a manufacturer that makes a table with a TMC of $10. Alternatively, the company could purchase the table legs for $4 and a tabletop for $8 from a supplier that would preassemble those components. The factory profit would be $2 ([$8 + $4] – $10), because it costs less to manufacture than to buy. Calculating and analyzing factory profit can become much more involved when considering various combinations of building versus purchasing subassemblies.

Manufacturing Sustainability A to Z | with ODOO Systems AI

Production Schedule measure effectiveness PLM;Quality ChecksEquipment Maintenance;calculate manufacturing costs

Cost of Goods Manufactured (COGM)

COGM is the total cost of manufacturing the products that are finished during a certain fiscal period, such as a month, quarter or year (although manufacturers can choose to measure it more frequently). It consists of the TMC incurred during the period to produce fully finished goods, plus the net change in WIP inventory, which is the period’s beginning WIP inventory minus its ending WIP inventory. This KPI helps manufacturers identify any anomalies in costs for the period, such as rising materials costs or unusual direct labor overtime. The formula for COGM is:

COGM = TMC for the period + (Beginning WIP – Ending WIP)

OGM = TMC for the period + (Beginning WIP - Ending WIP)

Cost of Goods Sold (COGS)

COGS is a key component of a manufacturer’s income statement that shows the total costs of producing the products that the company sold during the period, including direct materials, direct labor and manufacturing overhead. The key difference between COGS and COGM is that COGS relates to the products sold during a period, using the company’s cost flow assumption, such as FIFO or WAC, while COGM relates to all the products finished during the period. COGS is a critical metric because when deducted from the matching revenue for the period, it shows whether a product has positive gross margins and also influences net income on the income statement.

Variable Costs

Manufacturing costs that fluctuate with production volume are called variable costs. These costs increase as the number of products produced goes up, and they go down when volume decreases. Most direct costs, such as those for materials and hourly labor, tend to be variable costs. Some indirect costs are also variable, like factory utilities that increase as machine hours increase. Understanding variable costs is essential when preparing budgets, forecasts and scenario analyses. Analyzing direct variable costs can help a business squeeze more gross profit from their sales.

Fixed Costs

Fixed costs stay the same, regardless of manufacturing volume. They tend to correlate with the passage of time, rather than activity. Common examples of fixed costs are rent, salaries, insurance and depreciation. A common misconception is that all fixed costs are indirect costs, like factory rent, but there are many examples of fixed costs that are direct costs, such as payment to a salaried seamstress. Manufacturers need to understand fixed costs, because they are obligations that must be met, even if no products are produced.

Costing Methods in Manufacturing Accounting

Manufacturers determine the cost of the products they produce in two steps. First, they accumulate all the production costs, including materials, labor and overhead. Second, they assign those costs to the specific products. There are two approaches to assigning costs — product costing and process costing. A simplified way to contrast these two approaches is to note that product costing tracks specific costs related to a particular product, while process costing aggregates costs incurred at different stages of production. Within these approaches lie several different methods, which are described here.

Standard Costing

Standard costing is a unique type of product costing that uses estimated costs, rather than actual costs, to determine production costs. The estimates, or standards, are based on planned (or budgeted) costs that are then applied to the actual volume of items produced. Using standardized costs reduces tracking effort and, along with it, the cost of bookkeeping. The differences between actual costs and standard costs are captured in variance accounts in the general ledger, which are part of the inventory and COGS balances. Though imprecise at a granular level, standard costing enables business leaders to manage by exception — in other words, to identify significant outliers worthy of deeper investigation.

Job Costing

Job costing is a form of product costing that precisely tracks the cost of making a particular product. This method is used for specific, identifiable jobs, typically those that are customized, one-offs or unique. For example, a custom piece of jewelry might have a “job sheet” that tallies the exact costs of the metals, gems and labor that were used to make it. An amount of factory overhead would be added to calculate the piece’s TMC. Job costing is a very accurate way of costing, but it has limited practical application.

- Job-Order Costing: This is an offshoot of job costing that is typically used when similar goods are produced in batches, rather than as one-offs. The goods within the batch are homogenous, but there may be differences between the batches. A good example is mass-produced furniture, where one batch might include 50,000 lower-cost pine and cotton sofas, while another batch contains 30,000 mahogany and silk sofas. The product costs are tracked by batch, with an average cost assigned to each of the individual products within the batch.

Process Costing

Process costing is an approach that accumulates costs grouped by stage of the production process, rather than by product. It is often used by manufacturers that produce a large volume of identical products, with no significant differences among batches and no need to trace costs by product or batch. Examples of such products include glass, timber, processed food and chemicals. In process costing, department managers are responsible for capturing all the costs and volume that flows through their area, with a focus on calculating the COGM in their section of the process.

Activity-Based Costing (ABC)

ABC costing is a hybrid costing approach. It uses product costing for direct materials and labor, and process costing to allocate indirect costs to products. ABC costing looks at the indirect costs through yet another lens, grouping a company’s overhead costs by activity, rather than by product or department. Some examples of common manufacturing activities are material receiving and inspection, quality assurance, engineering, packing and shipping. Manufacturers can define activities as they see fit for their unique production processes, then collect the costs of each activity in separate “cost pools.” The cost pools are allocated to products based on predetermined metrics that indicate how much of each activity is used to build each product (called cost drivers). The appropriate portion of each activity’s costs is added to the direct materials and labor costs of the product to calculate its TMC. ABC is considered a very precise method of costing, but it is complex to administer.

Inventory Valuation Methods

Once products have been assigned costs, manufacturers select a cost flow assumption for how they will report inventory and COGS. A cost flow assumption is a method of determining which products have been sold during a period and which products remain in inventory at the end of a period. It is an accounting tool to calculate COGS for the period and the value of ending inventory. As such, cost flow assumptions are also called inventory valuation methods. The four main inventory valuation methods are discussed below. It’s important to note that any given company’s cost flow assumption may or may not be aligned with how it picks, packs and ships products to customers — cost flow assumptions are purely accounting tools.

The different methods explained in the following sections can yield very different values for COGS, thereby affecting the manufacturer’s profitability. This is why changing inventory valuation methods from period to period is discouraged by GAAP (and requires additional disclosures) and is prohibited by the IRS without prior approval (to reduce manipulation of taxable income). Therefore, it’s important to understand how each inventory valuation method works and the pros and cons of each, because once a manufacturer selects a method, it is difficult to change.

First-In, First-Out (FIFO)

The FIFO method is an order-of-production approach that assumes the oldest units in inventory are sold first. As such, it also means that the ending inventory on hand would be the units that were most recently manufactured. During inflationary periods, when the cost of raw materials or labor is increasing, the FIFO method yields a higher per-unit value of inventory for those items still on hand, compared with those that were sold earlier in the period. In this case, FIFO would cause COGS to be lower than other methods, which increases profitability.

Last-In, First-Out (LIFO)

LIFO inventory valuation is the reverse of FIFO. It assumes that the newest units produced are sold first and that the inventory on hand at the end of a period consists of the oldest units produced. During periods when costs for raw materials or labor are increasing, LIFO yields a lower per-unit valuation of inventory for those items still on hand, because they were produced earlier in the period. In this case, LIFO would cause COGS to be higher, which causes profits to be lower.

Weighted-Average Cost (WAC)

This method values inventory using an average cost for the period. WAC is calculated by aggregating all the costs incurred and dividing them by total units created over the entire period. The average cost is assigned to every item. This approach is simple to administer and smooths out price fluctuations, usually resulting in COGS that falls between the outcomes from FIFO and LIFO methods.

Specific Identification (SI)

Specific identification is the most accurate inventory valuation method but has limited application. This method tallies the specific costs incurred for each individual item produced. In many ways, it is similar to job-costing. In practice, manufacturers use SI for unique, distinguishable products, such as automobiles, jewelry and construction projects.

Cost-Volume-Profit Analysis (CVP)

Manufacturers need to understand the potential impact that changes in one variable of a product’s business model might have on their overall revenue and profit. As its name implies, CVP is an analytical technique that aims to provide such understanding by combining multiple formulas as needed to perform different “what-if” analyses. For example, CVP analysis can show the effect of changes in a product’s sales volume on the business’s total costs, revenue and income. Manufacturing accountants use CVP to help inform operating decisions, such as whether to increase production, change prices or adjust the product mix.

While there are volumes written about how to perform CVP, understanding a few basics, such as break-even, contribution and margin of safety, can help frame its use for pricing and production decisions.

Break-Even Analysis

A break-even analysis is a common first step in CVP because it helps businesses understand the level at which the revenue from an activity covers its cost. By calculating the break-even point, businesses identify the exact volume of activity that yields no profit and no loss — it is profit neutral. That’s helpful information when deciding whether to launch a new product or business or add additional costs, like hiring more staff. Doing a break-even analysis requires knowing — or estimating — the company’s fixed costs, the variable costs of the activity, the sales price of the resulting product and the volume of expected product sales. The formula for a break-even analysis is:

Break-even point (units) = Fixed costs / (Price per unit - Variable costs per unit)

Contribution Margin

A product’s contribution margin is essential for CVP and break-even analysis. Contribution margin is the amount of revenue that is left over after deducting all the variable costs of an item or activity. It is called the contribution because it’s the amount of funds available to “contribute” to covering fixed expenses. When contribution margin is greater than fixed expenses, the residual is profit. Contribution margin is equal to fixed costs at the break-even point. The formula is, simply:

Contribution margin = Sales - Variable costs

Safety Margin

The margin of safety is the company’s “wiggle room” — the difference between actual sales of a product and its break-even point: in other words, the degree to which sales of a product can fall without the company losing money. The formula is:

Safety margin = Actual sales - Sales at the break-even point

Importance in Pricing and Production Decisions

CVP, break-even and contribution margin are critical metrics that help inform many operating decisions, especially around pricing and production. Financial analysts can use CVP to model what changes in sales prices might do to a company’s profitability, assuming that volume remains the same. Looking at a product’s contribution margin is a quick and direct way of understanding whether a product’s sales price is adequate to cover its variable costs. For example, if a product’s contribution margin is negative, a company is effectively losing money on every item it produces, alerting management that changes are necessary (such as increasing the price or cutting variable costs). Many companies choose a target contribution margin and then reverse-engineer to get to the sales price required to achieve their desired level of profitability. Manufacturers often use CVP to determine whether to increase or decrease production levels. For example, a weak contribution margin may lead to a decision to discontinue a product or to reduce its prominence in the overall product mix. Or, CVP may help indicate whether increasing production could counterbalance a weak contribution margin, assuming there is untapped market demand.

Manufacturing Accounting Challenges

Manufacturing accounting is tedious. It involves a high volume of transactions and tracking — of costs, of products, of inventory — and correlating it all with sales. It also involves aggregating and allocating costs, like factory overhead, in reasonable and consistent ways. And it involves creating and analyzing data to help management keep the factories humming in the most efficient and profitable way possible. Beyond these day-to-day challenges, manufacturing accountants face other overarching challenges from globalization, regulation and advancing technology.

Complexities in Global Operations

Tracking costs for inventory valuation and calculating COGS are high-transaction-volume, painstaking tasks. As manufacturers extend their supply chains and operations internationally, the challenge increases and becomes more complex. Simply getting complete documentation of transactions can become more difficult when dealing with multiple time zones, languages and currencies. Legacy systems often aren’t up to the task of collecting and integrating the necessary data. Timely, accurate information is necessary to stay on top of these tasks, which provide vital support for management decisions.

Changes in Regulations and Standards

Manufacturing accountants need to stay current with accounting and tax guidelines, as well as changing industry regulations and laws. For example, changing accounting rules for leases and recognition of contract revenue are likely to have significant impact on manufacturers’ financial results. A shortage of accountants, especially cost accountants, adds to the challenge. Additionally, regulatory changes from the federal government create more challenges, because they add additional reporting and compliance requirements. In fact, these regulations are such a significant challenge that the National Association of Manufacturers (NAM) tracks the costs of complying with them. A recent NAM study found that the majority of manufacturing companies surveyed spend more than 2,000 labor hours per year complying with various federal regulations. Even small manufacturers incur about $50,000 in expenses per year, per employee, for compliance.

Rapid Technological Advancements

Changing technology is both a challenge and an opportunity for manufacturing accountants. The opportunity derived from additional automation is that tracking manufacturing accounting transactions can become less labor-intensive, allowing for more and better analyses to support decision-making. Additionally, evolving accounting software can make the financial-close process easier and faster, and it can also assist with compliance. However, the current reality for many accounting departments in the manufacturing sector is one of dealing with disconnected legacy systems. Until the infrastructure becomes aligned, manufacturers will be challenged to adopt the latest innovations such as real-time analytics, robotic process automation and artificial intelligence (AI).

Manufacturing Accounting Best Practices

The following seven best practices can help manufacturing accountants as they fulfill their missions to accurately value inventory, determine COGM, calculate COGS and provide custom reports and analyses to help keep the manufacturing processes running as efficiently as possible.

- Choose between cash-basis or accrual accounting ASAP. Select one of the two methods of accounting — if the business qualifies for cash-basis — based on the needs and resources of the organization. Cash-basis accounting is significantly easier to administer and may be an option for businesses that come in under the TCJA 2023 threshold of $29 million in annual revenue for the prior three years (the threshold is adjusted for inflation every year). However, it isn’t GAAP-compliant, which may be a requirement for investors, lenders and partners. For most manufacturers, the default selection will be accrual-basis accounting.

- Create a realistic budget. A thoughtfully constructed budget is more than a blueprint for planned activities and resource allocations — it’s the foundation for comparative analyses that lead to healthier businesses and greater profitability. Comparing actual manufacturing costs to budgeted costs is a useful way to flag variances for further investigation, which can then lead to operational improvements. Budgets also help keep department managers on track for delivering their stages in the production process.

- Keep track of production costs. Establish a system for capturing all production costs by product or batch, as appropriate. This likely means expanding and customizing the chart of accounts, so that all the direct materials, direct labor and manufacturing overhead costs are classified in ways that reflect the reality of a business’s operations.

- Monitor and analyze overhead costs. The indirect costs that make up manufacturing overhead can add up quickly, so it’s a best practice to stay on top of them. This is especially important because overhead costs are usually a diverse mix, from utilities to cleaning supplies to insurance, with many different responsible parties who may not always be aware of the big picture.

- Align accounting with lean manufacturing operations. “Lean” thinking is a management approach that concentrates on improving quality, eliminating waste and increasing customer value, and one that can be applied to any industry. In manufacturing, lean thinking tends to center on maximizing productivity and increasing efficiency. It’s a good idea to rally the accounting team around those goals. That way, they can tailor the information in reports toward lean analyses, ensure that data is updated as frequently as possible and make sure that KPIs and other analyses aim to identify potential inefficiencies and corresponding improvements.

- Implement inventory control. Inventory valuation and control is central to manufacturing accounting. Maintaining real-time counts of physical inventory improves the accuracy of inventory balances, reduces the potential for shrinkage and also helps ensure that stock is available to fill customer orders. Inventory management software preserves the accuracy of quantity data and can be integrated with demand forecasting and accounting software for better and more efficient inventory control.

- Invest in manufacturing software. Handling manufacturing accounting with manual logs and spreadsheets gets unwieldy very quickly, raising the potential for costly errors and misleading financial reports. Modern manufacturing software can make the entire accounting process more accurate and less time-consuming, while providing accountants with better data and the time to do more value-added analysis.

Trends in Manufacturing Accounting

There are several noteworthy trends at the intersection of manufacturing and accounting, but the shortage of accountants is generally cited as a top concern. In 2023, manufacturers face challenges overcoming such talent gaps and labor shortages, even as they wrestle with improving supply chain management and new-technology adoption. Given a backdrop of economic uncertainty following post-pandemic expansion, many manufacturers are more fixated on efficiency than ever before. Three examples of this are the role of technology, lean manufacturing and just-in-time systems.

Role of Technology

For many manufacturers, technology is the tool of choice for doing more with less. Automating repetitive and tedious tasks, whether in the accounting department or on the factory floor, is one way to help fill any labor gaps. For example, tools like enterprise resource planning (ERP) systems can help streamline the manufacturing process from end to end — from order processing through inventory management, production, supply chain, warehouse operations and accounting. At the same time, new technologies, such as artificial intelligence and machine learning, are expected to increase the quality and quantity of data analytics for deeper business insights, leading to higher efficiency.

Lean Manufacturing

Lean manufacturing is a management approach based on five underlying principles: value, value stream, flow, pull and perfection. The value and value stream principles focus on a trio of goals: understanding a product’s import from the customer’s perspective, creating value for the customer and eliminating any waste in the processes that create customer value. The flow and pull principles go hand in hand, as flow is the creation of a smooth process from order to delivery, and pull is the customer demand that triggers the flow. The perfection principle represents the relentless pursuit of increased quality and eradication of defects. Lean manufacturing theory has been around for decades, but today’s advanced technology generates better results than previously possible.

Just-In-Time (JIT) Systems

JIT is an inventory management approach that produces only enough inventory to meet customer demand, eliminating reserve stock. The goal of JIT is to reduce the production costs that come from manufacturing inventory that exceeds immediate levels of demand. Other benefits of JIT are lower carrying costs for inventory, such as storage, security, insurance and shrinkage from theft, damage or obsolescence. Switching to JIT from a “just in case” approach that stockpiles inventory can increase efficiency and profitability. However, JIT comes with risks — it requires precise customer demand forecasting and a highly reliable supply chain.

Simplify and Streamline Manufacturing Accounting Processes With odoo

Manufacturers must understand their costs of production in order to stay in business — it’s table stakes. The nuts and bolts of manufacturing accounting include detailed tracking of costs, ensuring that expenses are properly classified so that inventory and COGS are accurately valued. Sounds simple, but this exercise quickly becomes overwhelming if attempted manually because of the high volume of transactions and all the moving parts. That’s why accounting software is also table stakes, and why it’s so important to choose wisely.

odoo financial management solutions are well suited to manufacturing accounting because they seamlessly integrate all the financial pieces of the production process as part of odoo ERP. From order management to inventory management, accounts payable and accounting, all data is in one central database, reducing the time and risk of duplicated data entry and data inconsistency. With the tedium simplified and streamlined, cost accountants can spend more time analyzing the costs, supported by role-based dashboards and customizable reports, to help drive efficiency and raise profitability.

Manufacturing accounting is a type of managerial accounting that is focused on tracking and analyzing product costs for proper inventory valuation and for optimizing production processes. It uses various costing methods and valuation approaches to capture and allocate all of the various concomitant direct and indirect manufacturing costs. These cost accounting activities and analyses help manufacturing companies maximize profitability and overcome industry challenges. Manufacturing accounting is a big job, in a big industry, and it requires accounting expertise supported by robust technology.

Automated a Manufacturing Business From A to Z with ODOO AI

In this course, part of the Principles of Manufacturing , you will learn how to analyze manufacturing systems to optimize performance and control cost. You will develop an understanding of seemingly opaque production lines with a particular emphasis on random disruptive events – their effects and how to deal with them, as well as inventory dynamics and management.